For the majority of people living in the developing world, it is easier to buy a pair of Nike shoes than it is to buy a share of Nike stock.

DriveWealth is changing this dynamic through its retail investing platform, designed to give consumers around the globe access to the U.S. stock market. DriveWealth calls its full-stack platform, “Brokerage-As-A-Service” because it can handle the entire customer lifecycle from onboarding to trade execution. “No middle men, no friction,” explained Michael Fitzgerald, DriveWealth’s head of corporate strategy, during the week of FinovateSpring 2015. Among other things, lack of a middle man enables DriveWealth to provide B2C pricing of $2.99 per trade.

At Finovate, DriveWealth demonstrated its BaaS platform, reminding attendees that with most of the retail wealth coming from developing markets, the opportunity is wide open to provide investors in emerging markets with the ability to trade in stocks of some of the best-known—and most successful—companies in the world.

Company facts:

- founded in May 2012

- headquartered in Chatham, New Jersey

- raised more than $10 million in funding

- serves more customers in more than 140 countries

- Robert Cortright is CEO

How it works

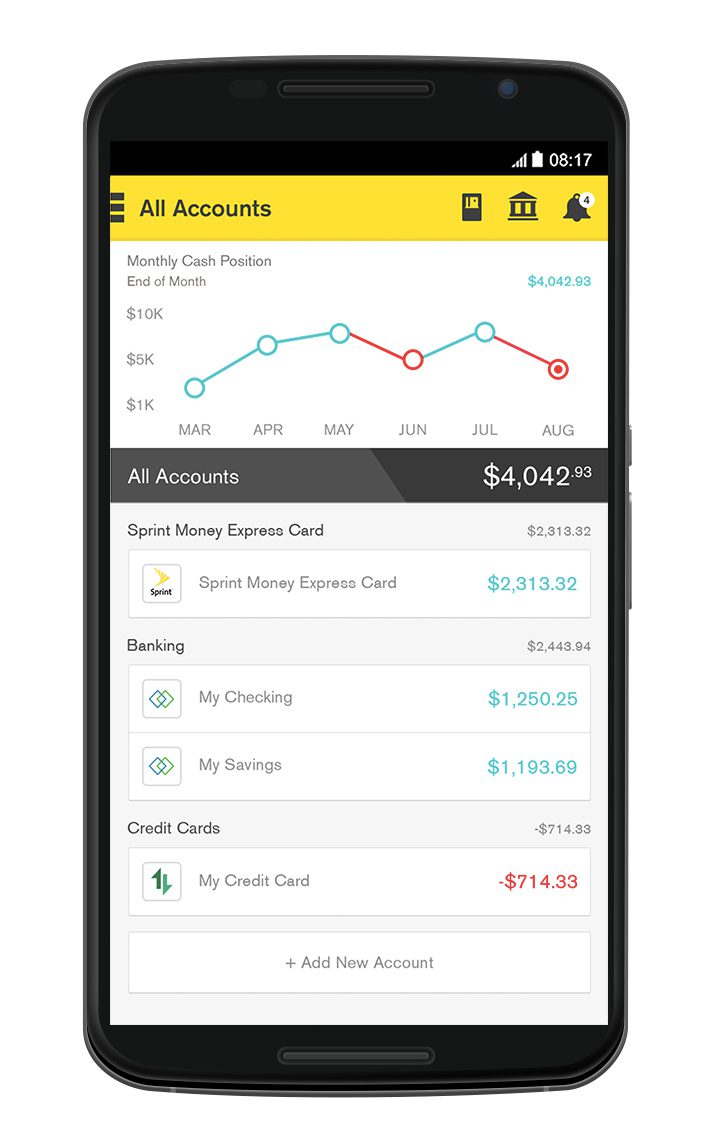

DriveWealth works by partnering with global companies to offer their customers access to U.S. stocks on their platform. “Historically,” Fitzgerald pointed out, “only the wealthiest foreign investors could access these stocks.” DriveWealth provides the widget, and companies using the platform get to use their own brand and interface.

Michael Fitzgerald, DriveWealth head of corporate strategy, demonstrated the DriveWealth Brokerage-as-a-Service platform at FinovateSpring 2015.

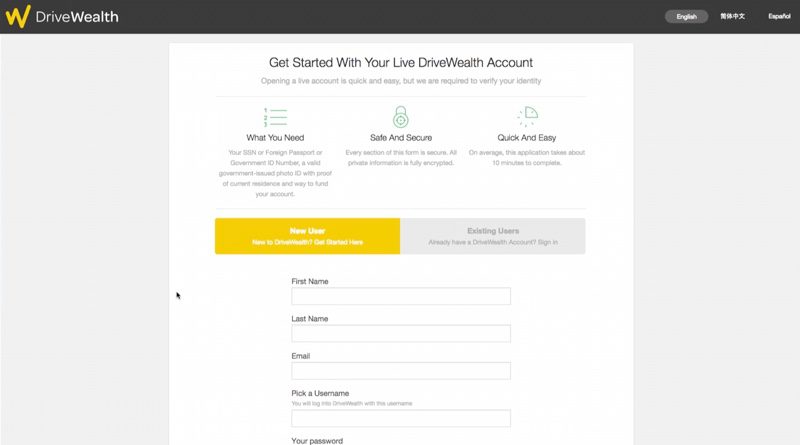

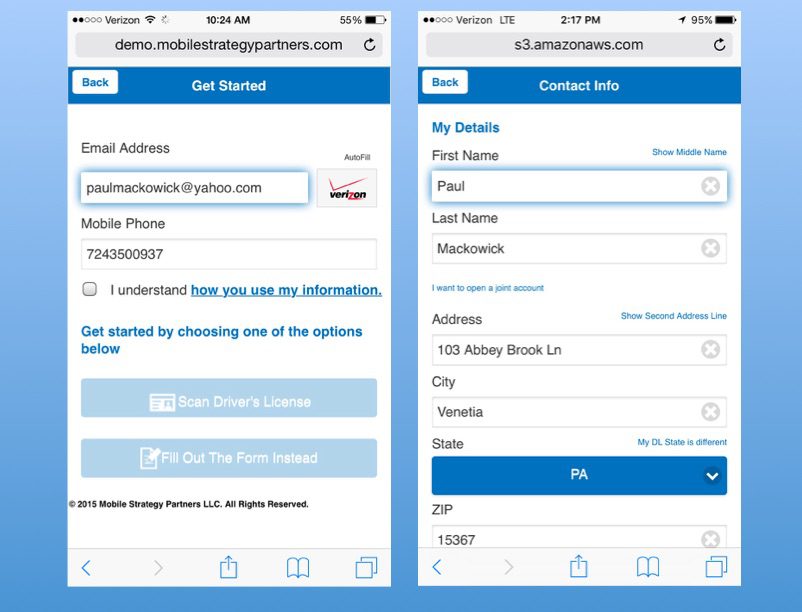

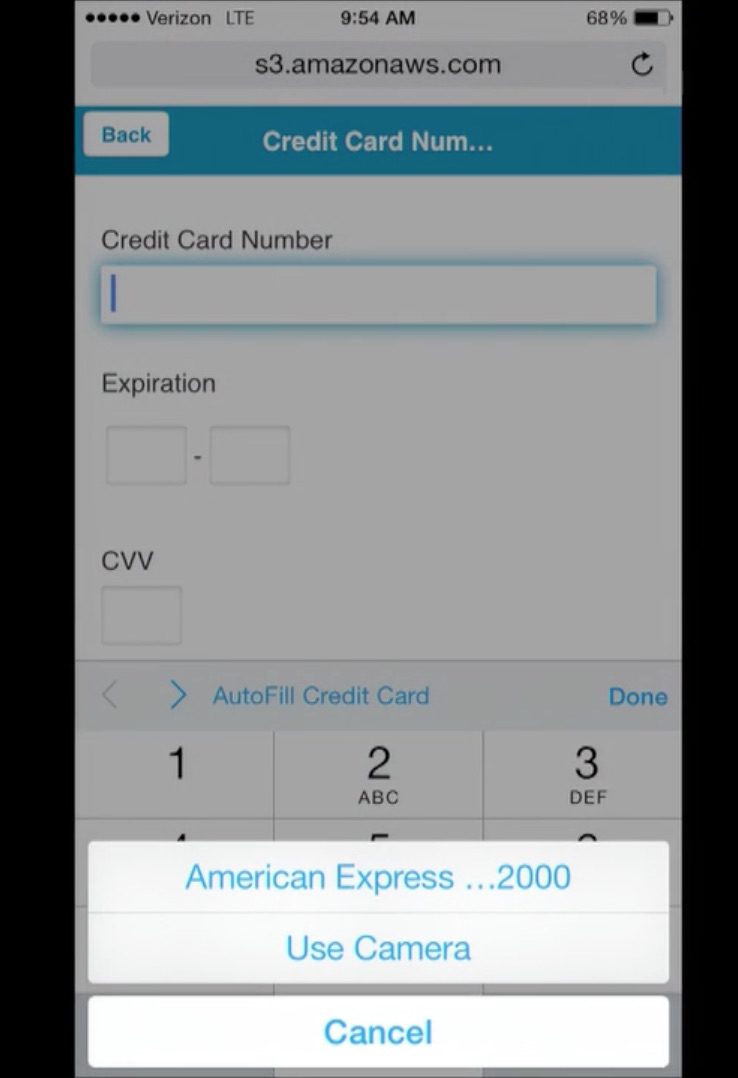

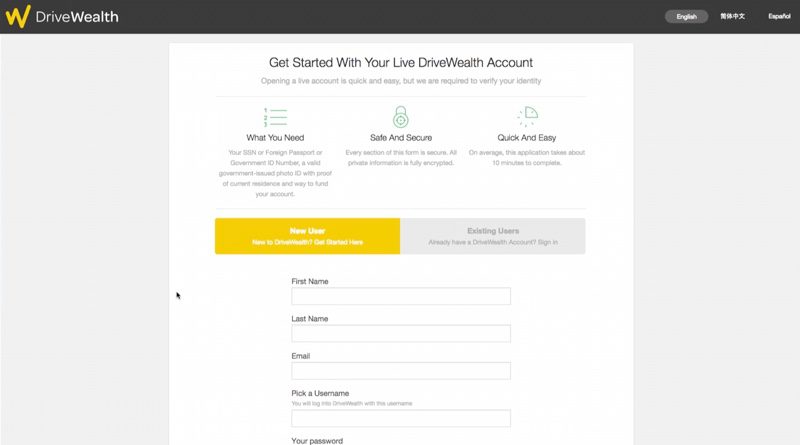

Getting started on DriveWealth is straightforward, with investors able to fund their accounts through a wide variety of methods: credit, debit, SafetyPay, wire transfers, paper checks—even using the services of fellow Finovate alums like Dwolla and TransferWise.

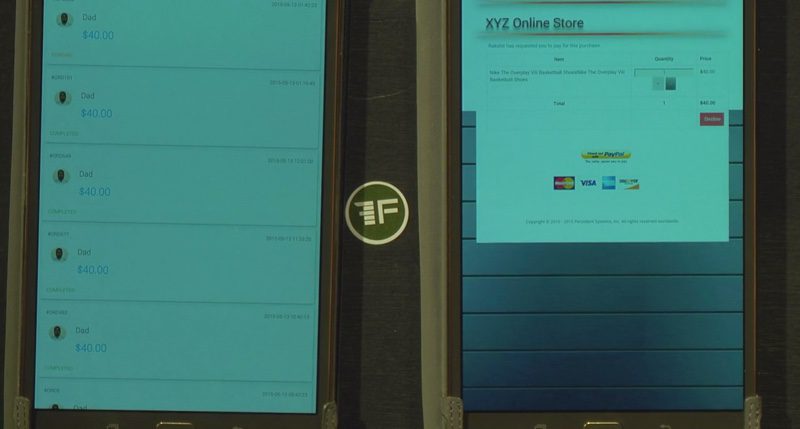

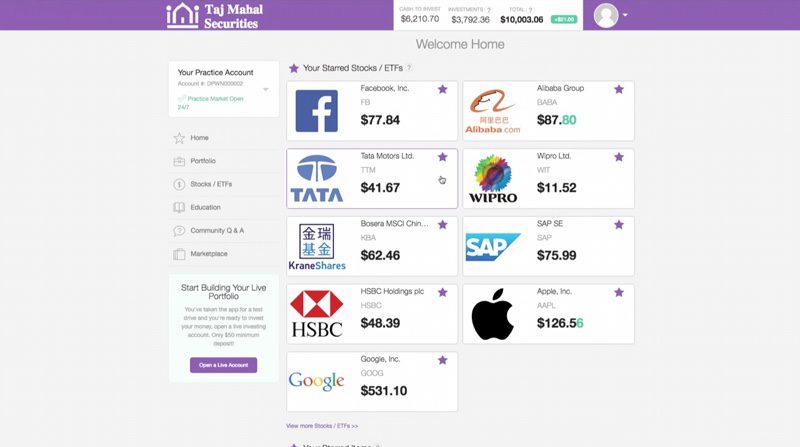

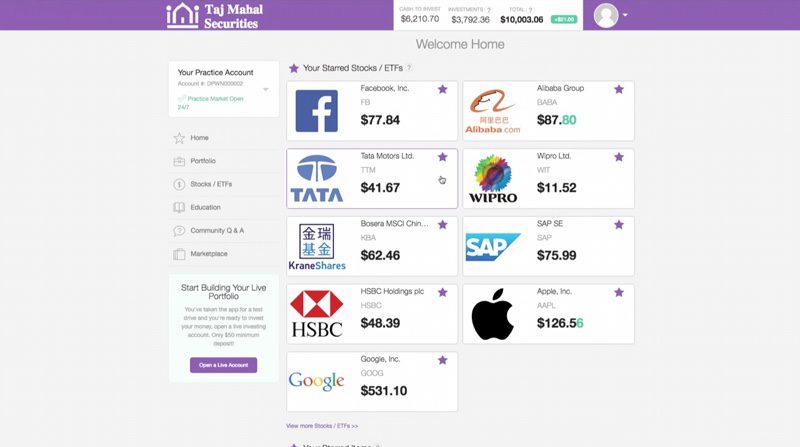

As a trading and investing platform, DriveWealth is available as a white-label service, and can be deployed in a day or two. Using a mock-up brokerage in their demo, Taj Mahal Securities, we can see an example of the interface. Investors can see which stocks are available for investment, review favorite lists, analyze metrics about the underlying company, study charts of price action and, ultimately, buy shares.

Technically, DriveWealth provides its partners with both low-level APIs and high-level HTML5 widgets. APIs are available as RESTful APIs, which provide login, accounts, orders, and trades functionality, as well as fully FIX-compliant APIs for those FIs familiar with the FIX protocol. Both APIs support order types such as market, stop, and limit.

For FIs seeking an even greater level of integration, DriveWealth provides a set of embeddable HTML5 widgets. These widgets can be embedded into websites or trading apps to provide functions such as reporting, funding, trading, and onboarding.

The future

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

“We are also interested in meeting fintech companies with products available here in the U.S., but who want access to global retail customers,” Fitzgerald said, noting that the DriveWealth platform can be leveraged for other purposes, other services. “We have a partnership structure as a B2B platform,” he said. “(Our partners) don’t have to be brokerages. They can be customer-centric companies that just want to provide the access.”

Currently in the pipeline are plans to launch with a number of large global partners. DriveWealth is also planning to offer fractional shares for investors, supporting the company’s focus on retail investors. “People can put $100 a week or a month aside and build their portfolio that way,” Fitzgerald said.

Looking further into the future, DriveWealth is interested in initiatives such as expanding aftermarket trading, which Fitzgerald says is “key for international trading and investing.” He added that DriveWealth is also looking to expand the ways investors can fund their accounts. “Debit cards, Dwolla, bitcoin …” he offered. “We want to remove as much friction as possible.”

DriveWealth will be among the more than 70 companies demonstrating their technologies at FinovateEurope 2016 in London in February. For more about our upcoming conference in the United Kingdom, visit our FinovateEurope 2016 page.

Check out the video from DriveWealth’s FinovateSpring 2015 demonstration.

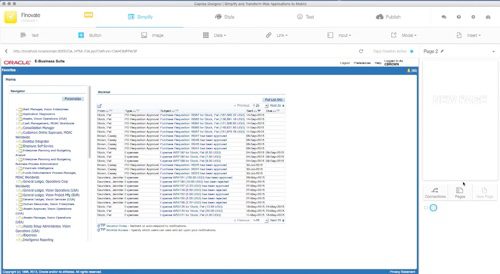

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

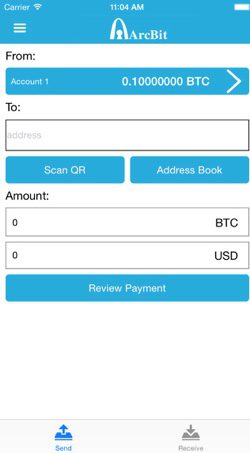

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.”

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.” Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.

Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”