Every financial services organization produces data, but not all of them organize and “product-ize” the information because dealing with high data volumes is costly. GoodData seeks to help financial services companies monetize their data in a cost-efficient manner.

Blaine Mathieu, chief marketing and products officer, explains: “For us and for our clients, data and analytics are our profit center. We do this by helping you take your data, wrap it in analytics, and product-ize it and then distribute those products securely and on a massive scale.” Mathieu points out that “turning data into insight and finally into action is something we call a smart business application.”

At FinovateFall 2016 earlier this year, GoodData—used by companies across a range of industries—unveiled a product specifically for the financial services sector. The analytics delivered by GoodData help financial institutions personalize applications for clients’ needs, improve customer loyalty, and potentially increase sales.

Company facts:

- Based in San Francisco

- Founded in 2007

- 42% of Fortune 500 companies use GoodData

- Its network is made up of more than 40,000 global businesses across a variety of industries

GoodData’s Blaine Mathieu, chief marketing and product officer, and Marco Mankerious, senior sales engineer, on stage at FinovateFall 2016.

GoodData’s Blaine Mathieu, chief marketing and product officer, and Marco Mankerious, senior sales engineer, on stage at FinovateFall 2016.

We caught up with Roman Stanek, CEO and founder of GoodData, for a personal perspective on the company and its future plans.

Finovate: What problem does GoodData solve?

Stanek: The GoodData platform allows enterprises to take their latent data and turn it into a profit center. Customers embed analytics into their existing workflows to distribute customized analytics to their entire business ecosystem. GoodData allows you to launch data products in weeks or months, not years. Our team of experts support enterprises from inception through launch, and with thousands of successful launches we can help enterprises monetize their data assets quickly and easily.

Finovate: Who are your primary customers?

Stanek: GoodData’s primary customers are large corporations who have recognized the value in their data and are disrupting their markets by offering data products to their end users. GoodData works with companies in all verticals with the following industries leading the way: healthcare, media, retail, financial services, travel and hospitality, along with ISVs across all verticals.

Finovate: How does GoodData solve the problem better?

Stanek: By embedding analytics into the business users’ daily applications, thereby eliminating the need to toggle between applications, insight is delivered at the point of action. Given that most business users aren’t analysts, dashboards also provide suggested actions to front-line managers to easily make decisions.

Finovate: Tell us about your favorite implementation of your solution.

Stanek: One of my favorite implementations is with ServiceChannel, a facilities management company that has completely disrupted their market. Along with providing analytics to their customers, they’ve also provided data to the contractors vying for work who would not normally think about data analysis. They’ve also provided predictive analytics to their customers by bringing in weather and geography data to help gauge when they may need to contract for HVAC work prior to large storms or heat waves, as an example. We have dozens and dozens of examples of customers who have completely changed the way their industry looks at and uses data today.

Finovate: What in your background gave you the confidence to tackle this challenge?

Stanek: I became an entrepreneur in the mid-90s, and while there were some difficult lessons learned, as with any successful project, I enjoyed the challenge of building a team and a company. I am constantly innovating in the dynamic, high-tech sphere and have over 20 years’ experience to help guide my decision making.

Finovate: What are some upcoming initiatives from GoodData that we can look forward to over the next few months?

Stanek: GoodData is excited about helping companies building smart business applications to allow all those involved in the business ecosystem access to actionable analytics. We’re also very excited about how GoodData plays a role in AI with our predictive and prescriptive analytics capabilities.

Finovate: Where do you see GoodData a year or two from now?

Stanek: You’ll see GoodData partner with large SIs to expand our network and bring analytics to everyone in the business network. We’ll work with innovative companies interested in disrupting and transforming their industry. And we’ll continue to focus on our AI technology.

GoodData’s Blaine Mathieu, chief marketing and product officer, and Marco Mankerious, senior sales engineer, debuted at FinovateFall 2016:

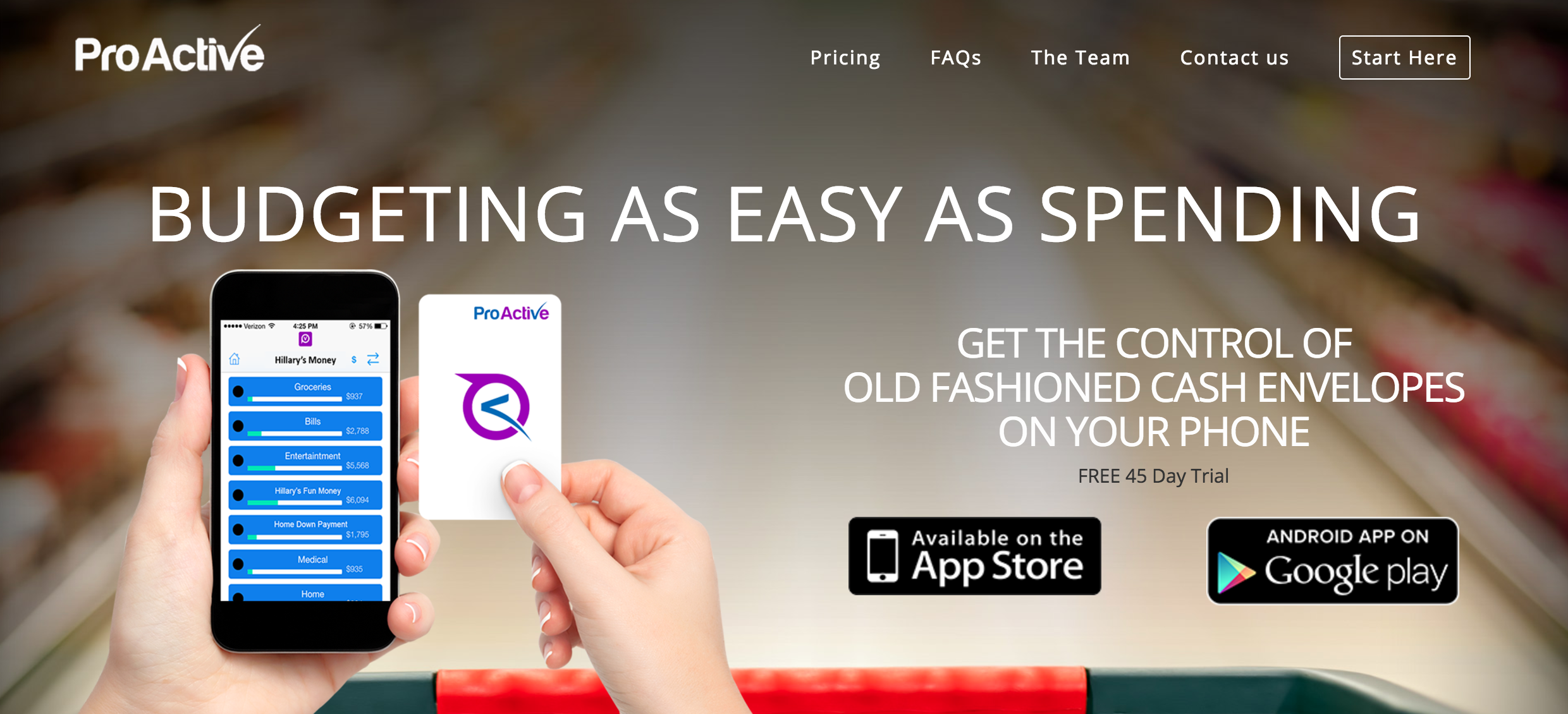

ProActive Budget CEO and founder Ryan Clark demos the startup’s digitized cash-envelope budgeting system alongside Ross Jardine.

ProActive Budget CEO and founder Ryan Clark demos the startup’s digitized cash-envelope budgeting system alongside Ross Jardine. We chatted with Ryan Clark, CEO and founder of ProActive Budget, for further insight into the startup and its goals for the long run. Clark has 10 years of experience as a personal finance adviser and has ranked in the top 10% of advisers nationwide.

We chatted with Ryan Clark, CEO and founder of ProActive Budget, for further insight into the startup and its goals for the long run. Clark has 10 years of experience as a personal finance adviser and has ranked in the top 10% of advisers nationwide.

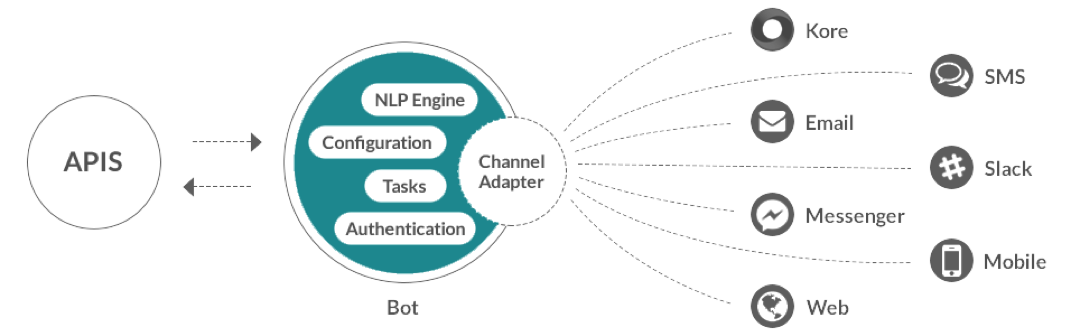

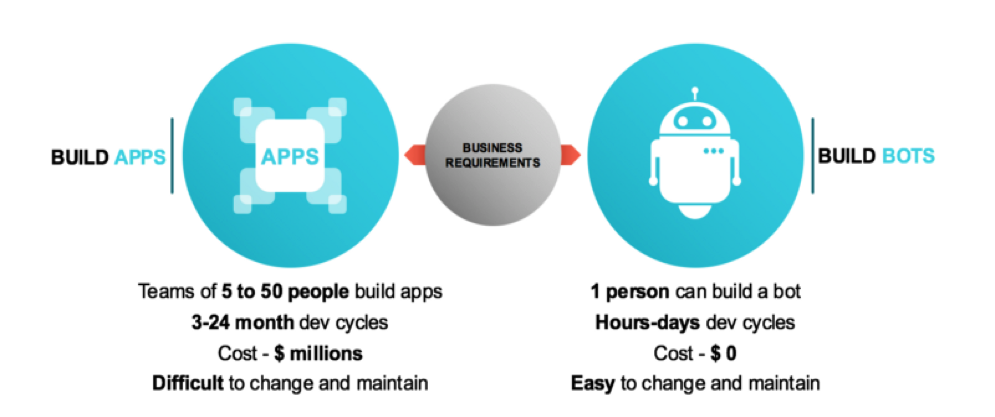

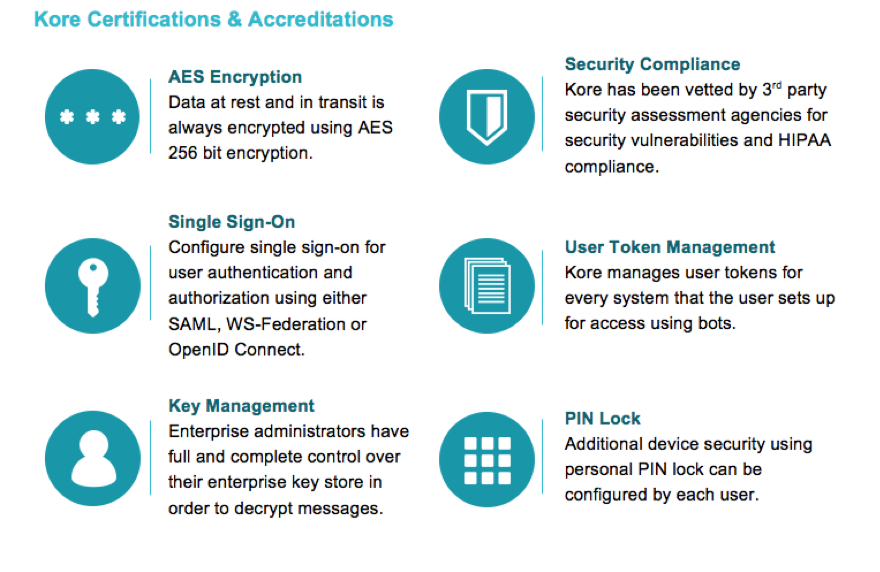

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

Kore’s Amit Aghara, SVP, solutions engineering, and David Schreffler, EVP, sales, presented at FinovateSpring 2016.

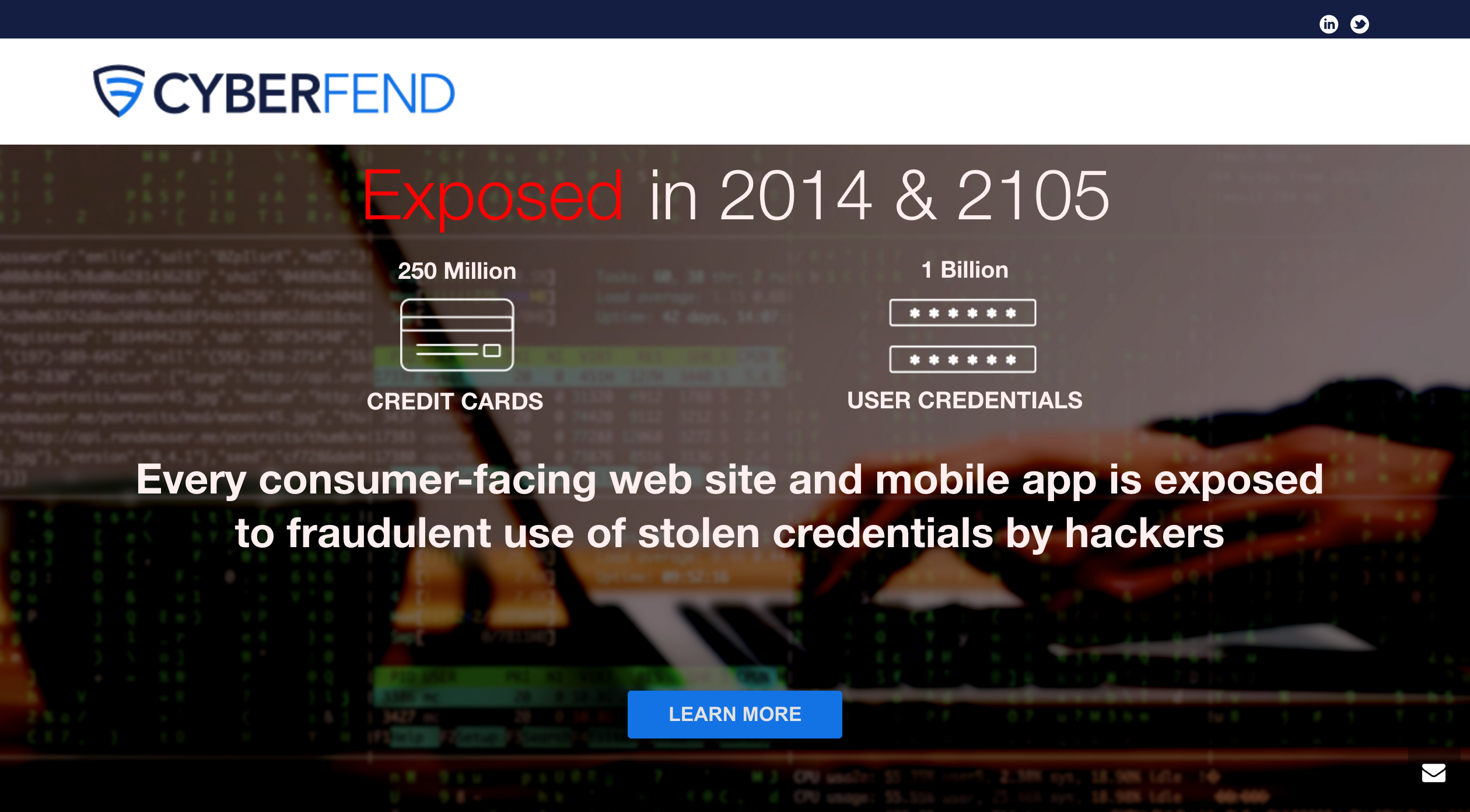

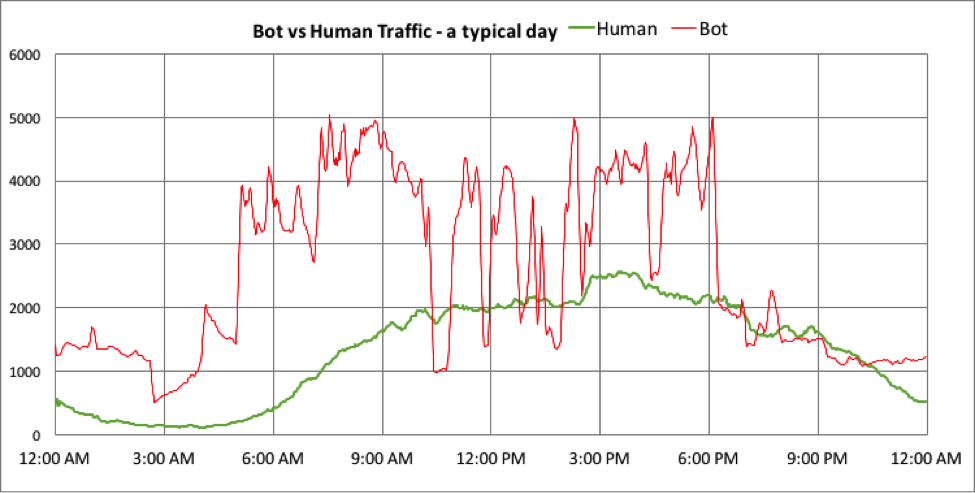

Bot traffic is up to 3x that of human traffic

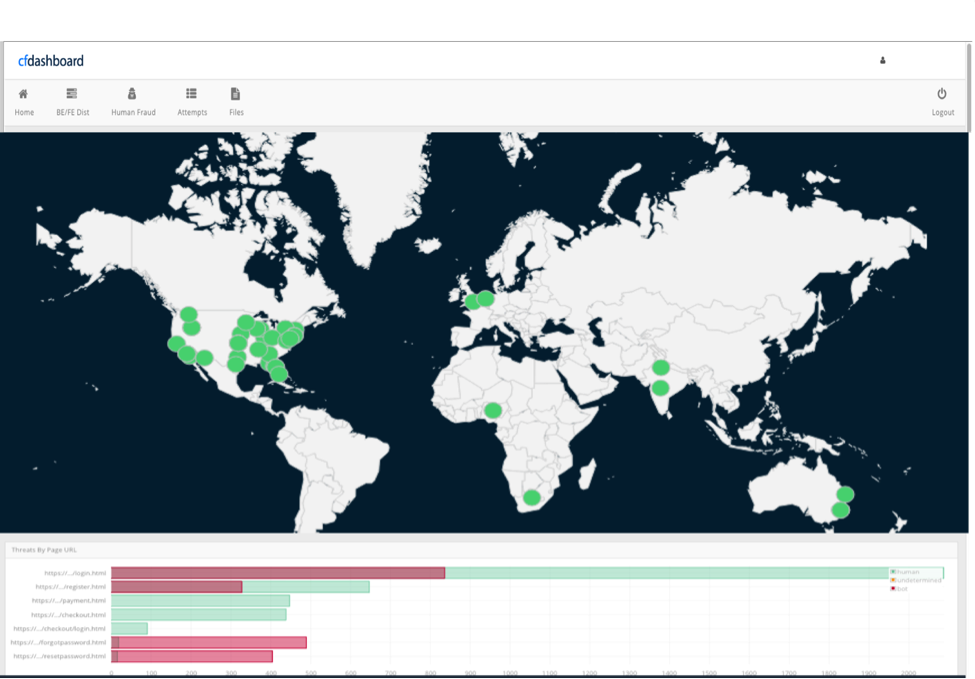

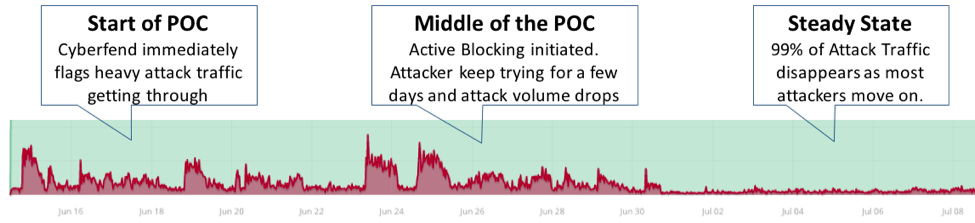

Bot traffic is up to 3x that of human traffic Cyberfend’s dashboard

Cyberfend’s dashboard

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016.

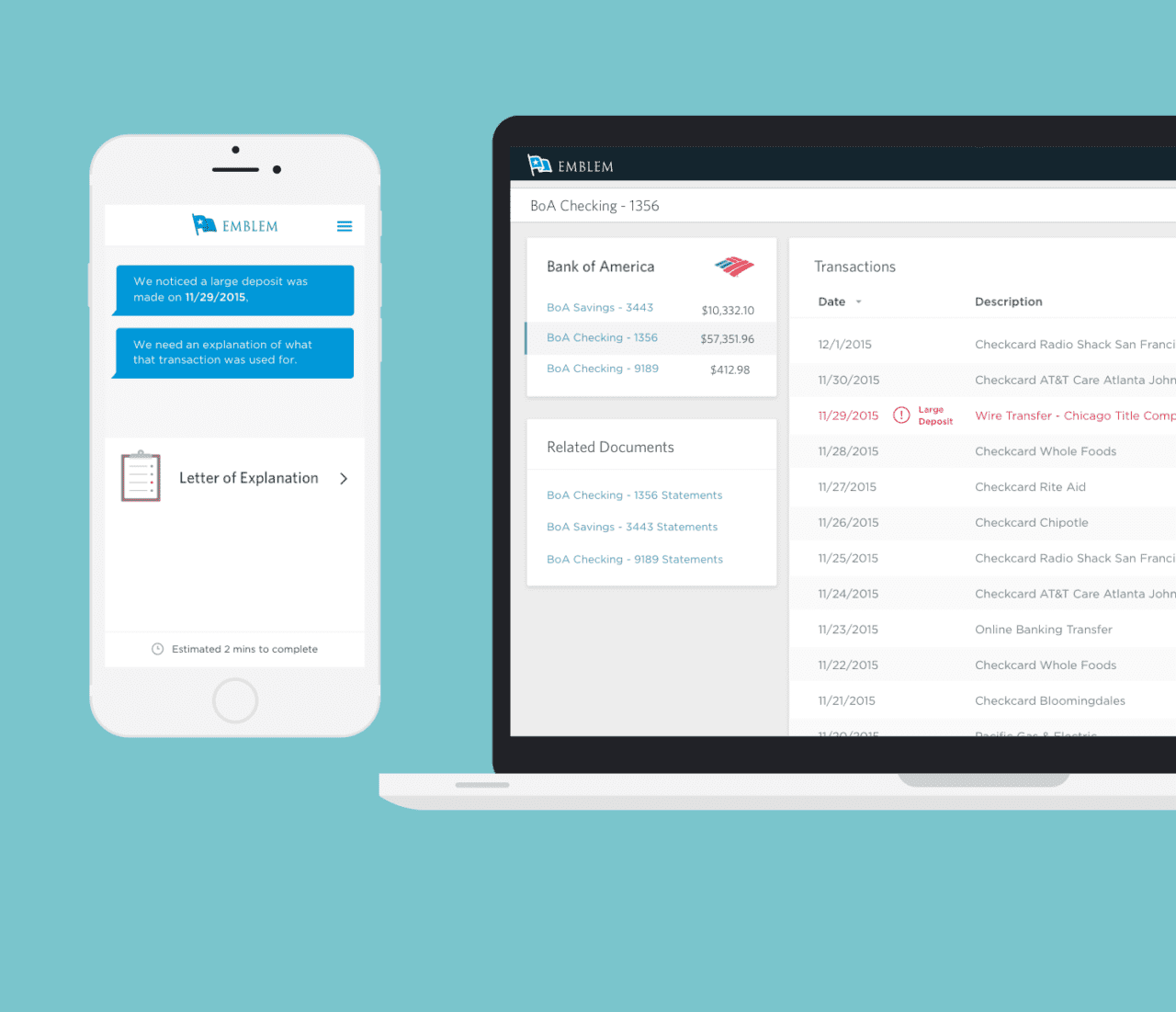

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016. Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

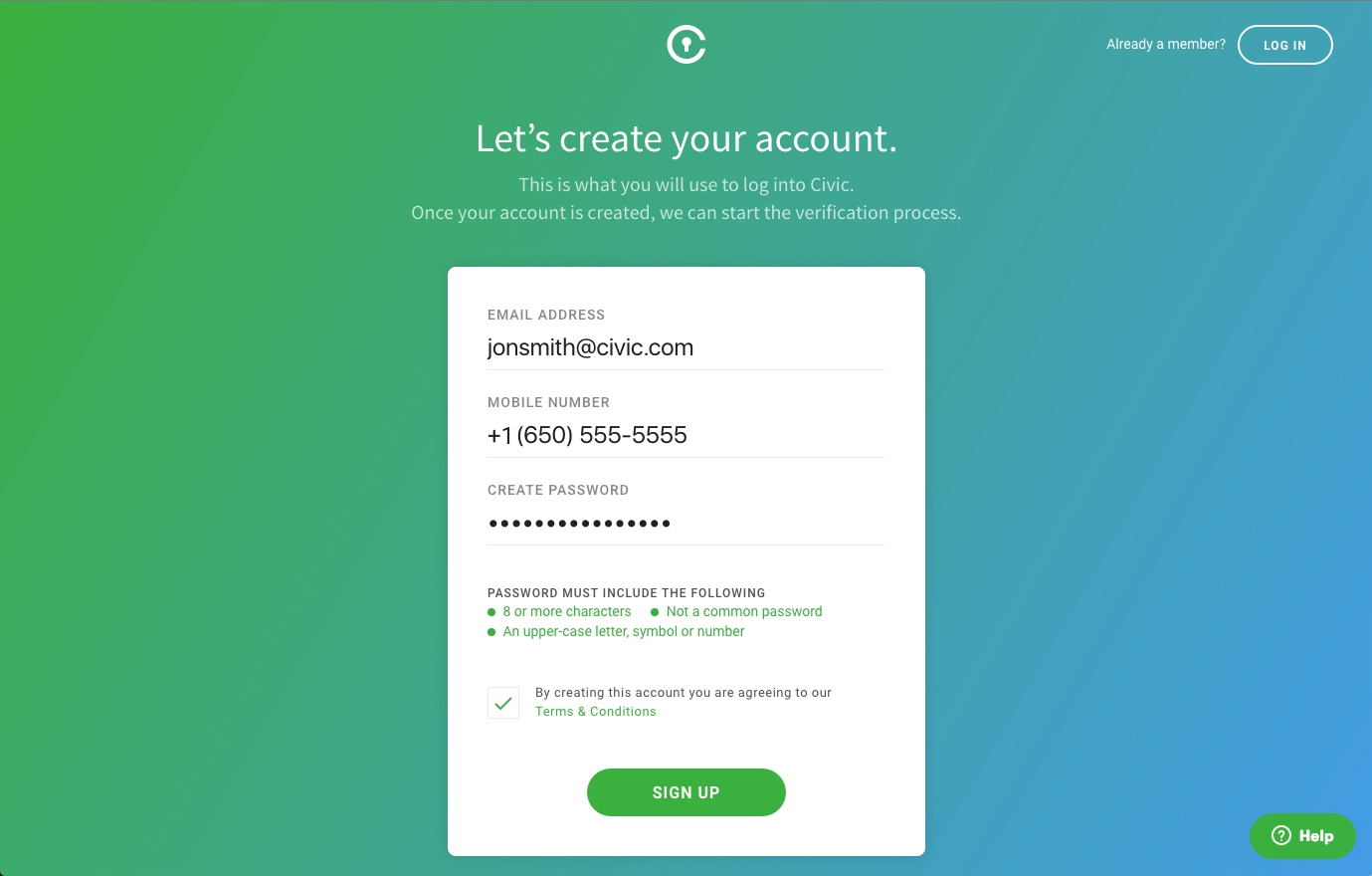

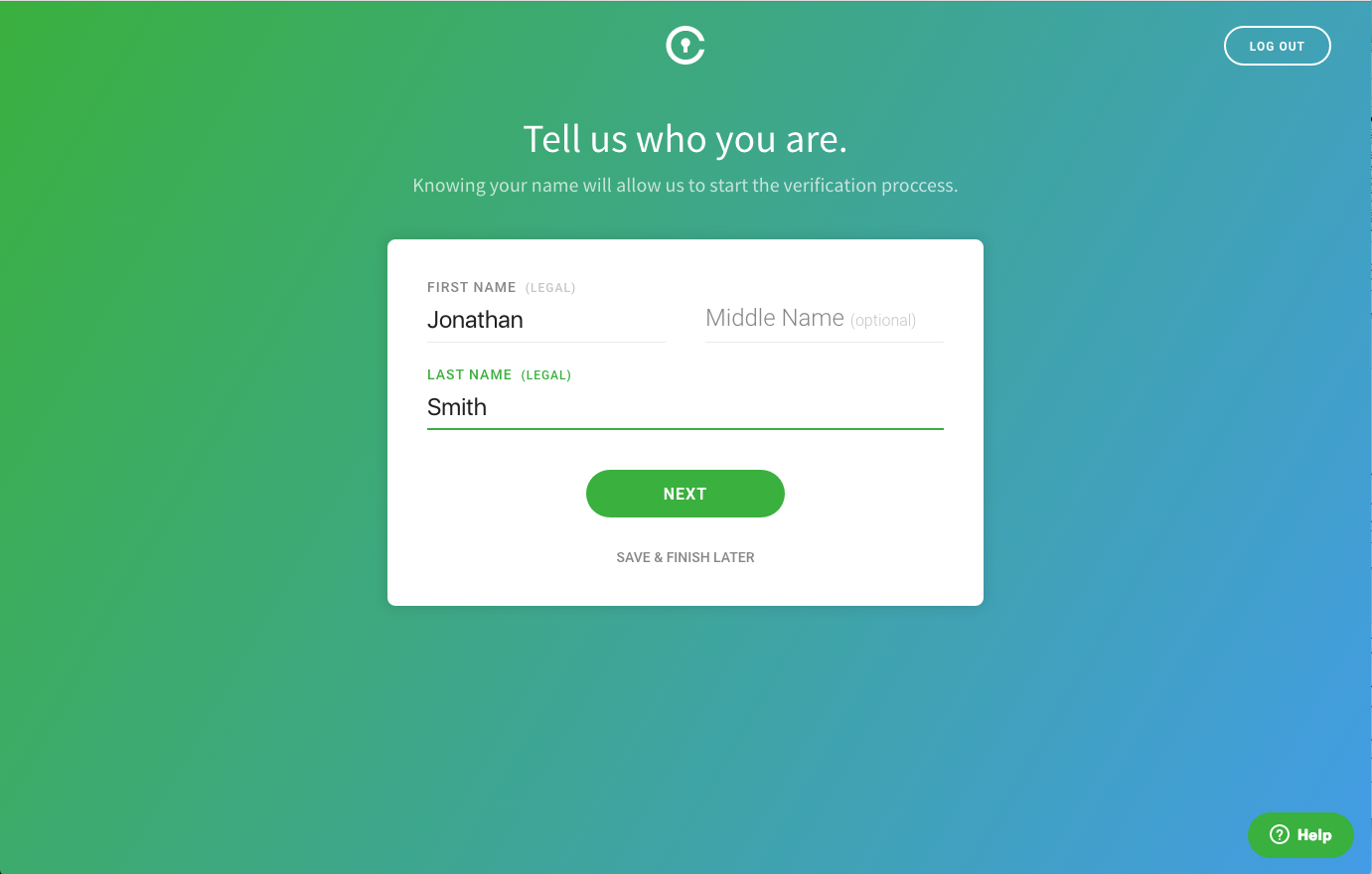

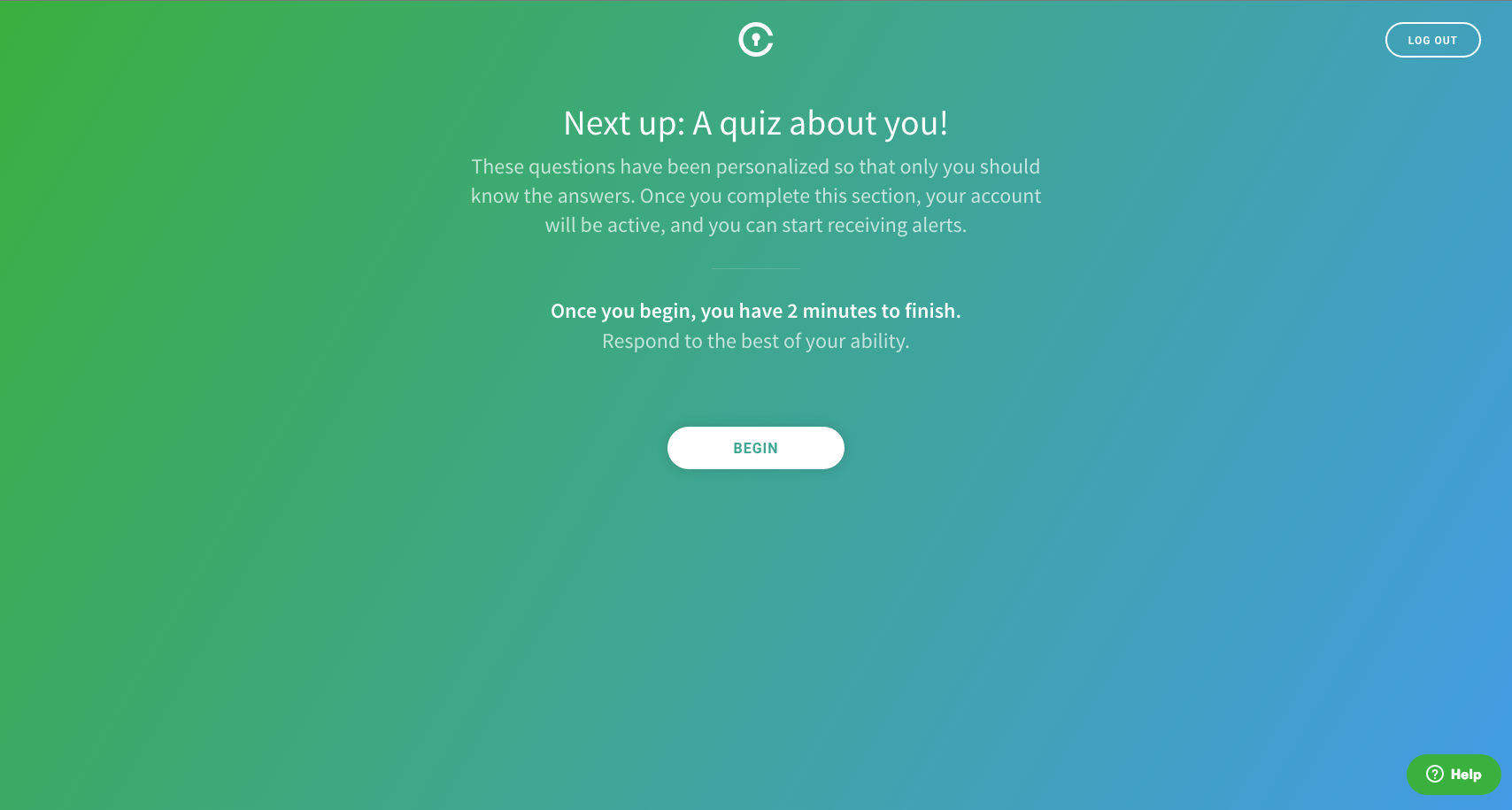

Civic CEO Vinny Lingham and CTO Jonathan Smith demonstrated Civic’s Identity Verification app at FinovateSpring 2016.

Civic CEO Vinny Lingham and CTO Jonathan Smith demonstrated Civic’s Identity Verification app at FinovateSpring 2016.

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

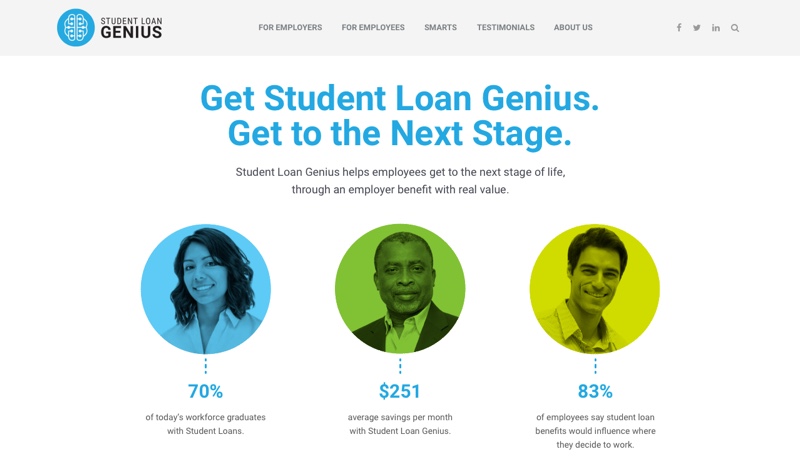

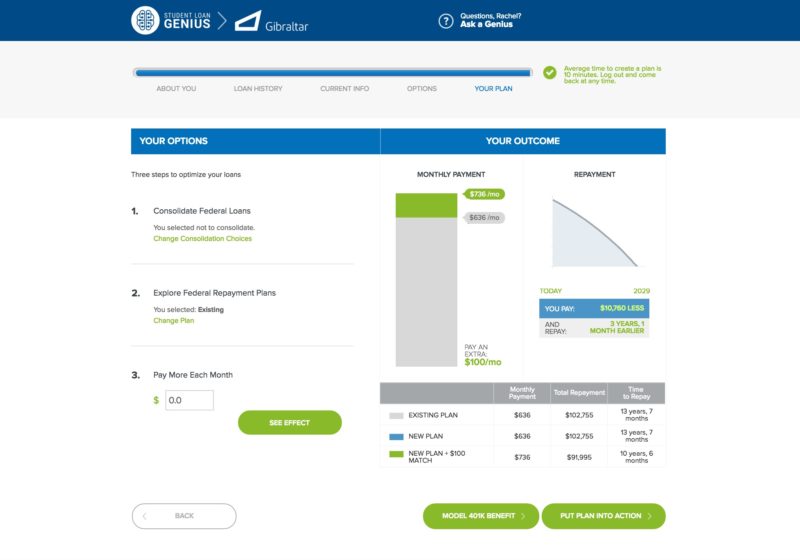

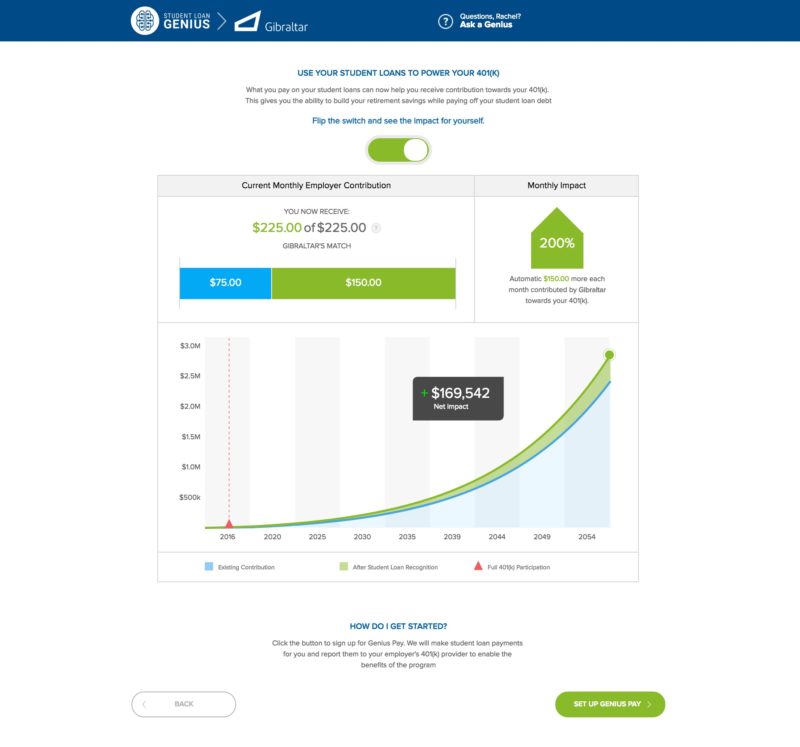

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

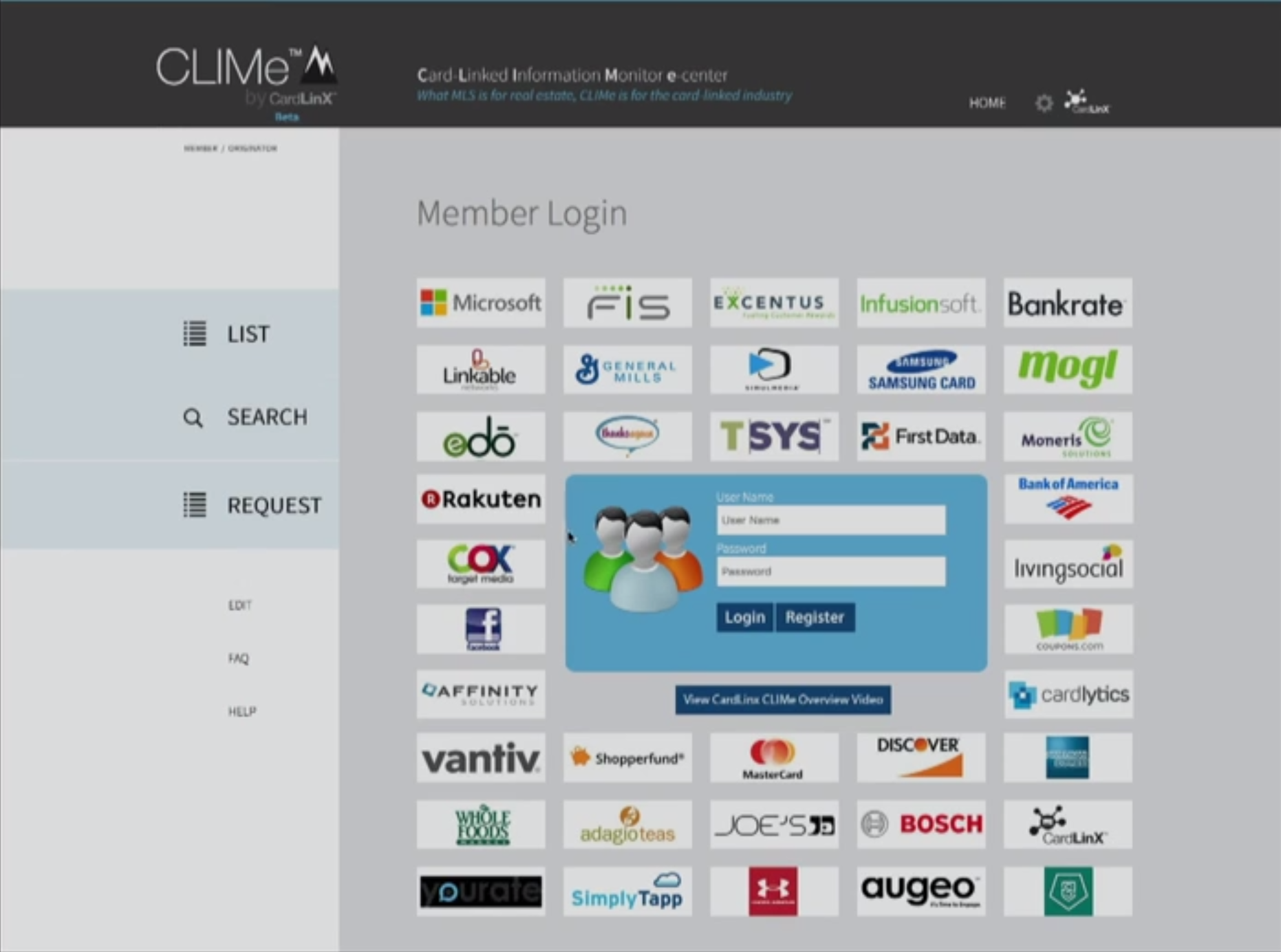

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

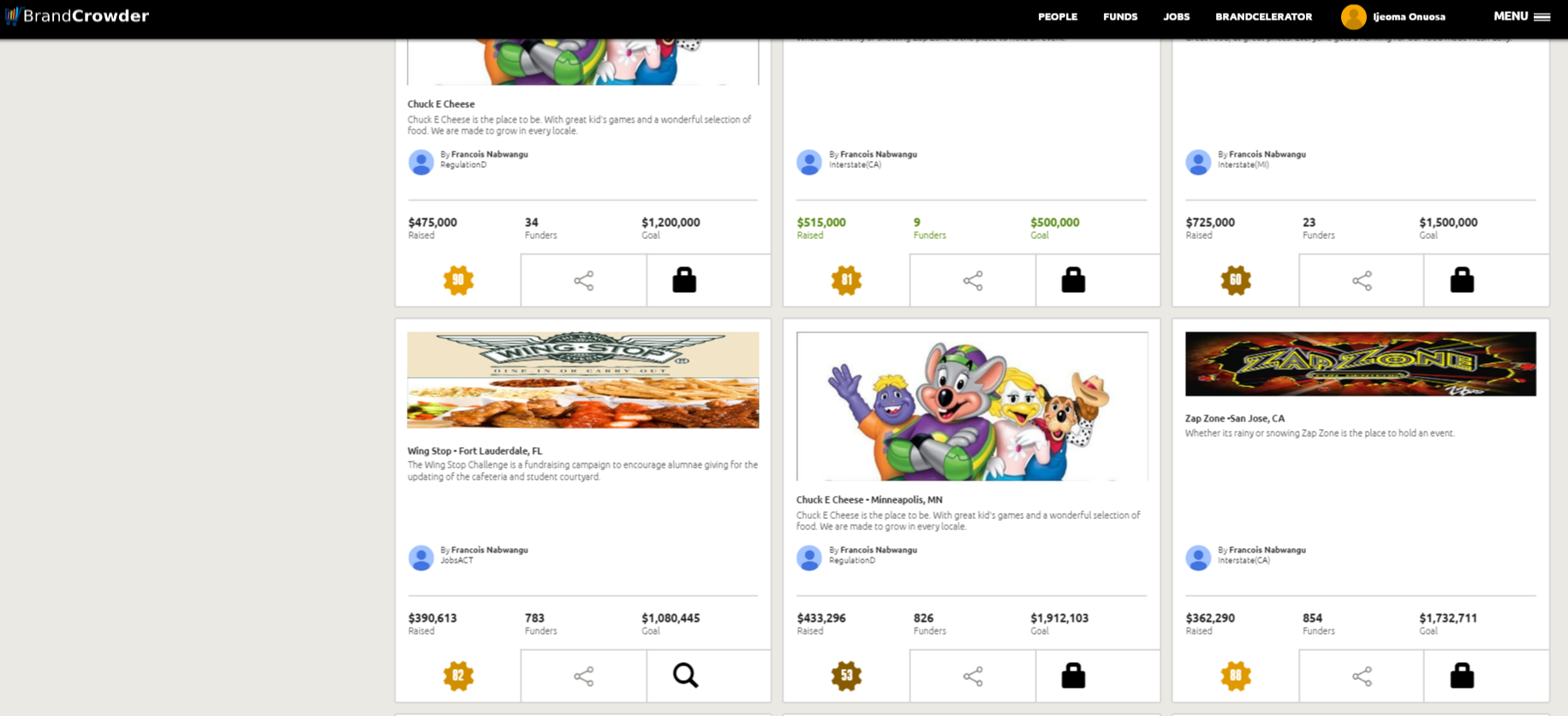

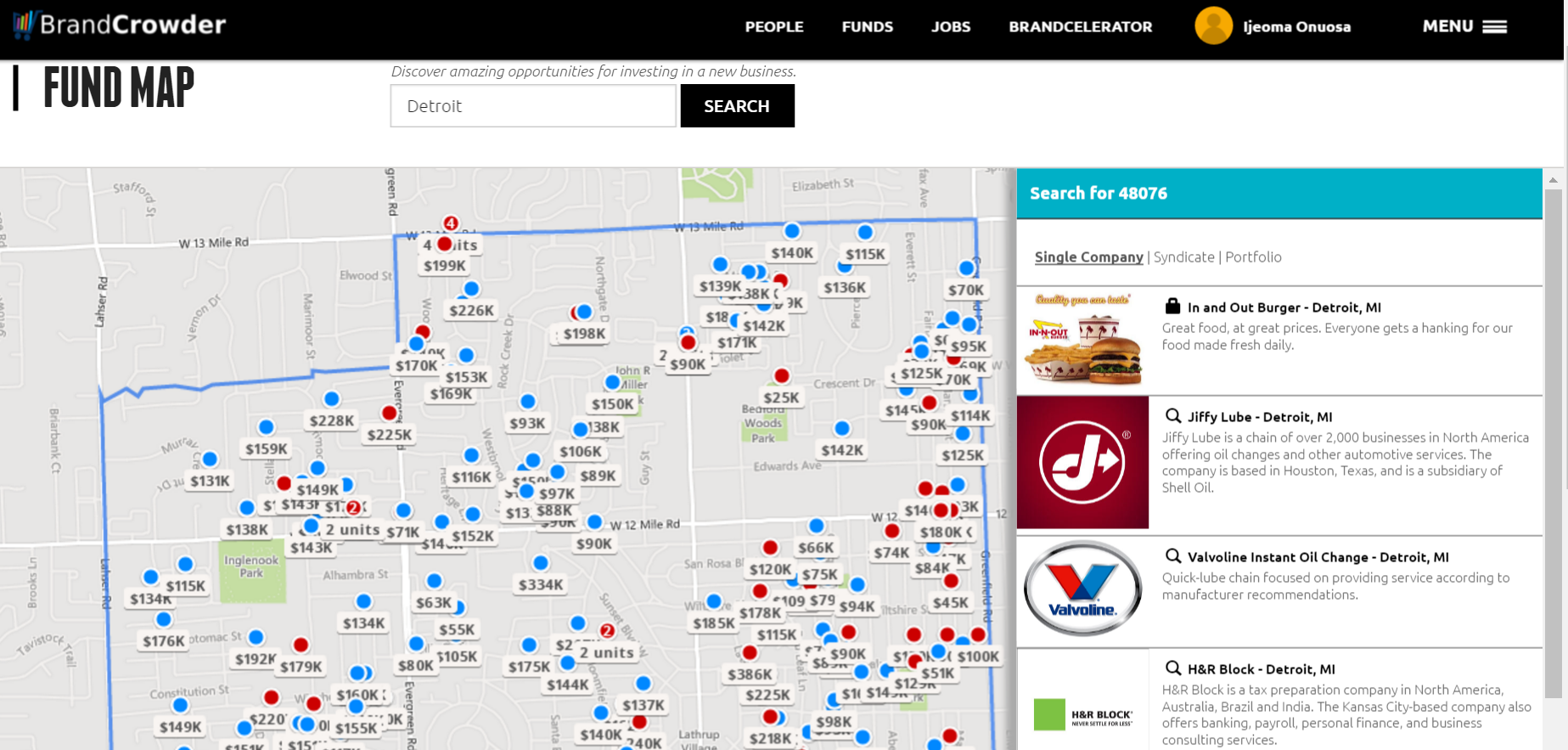

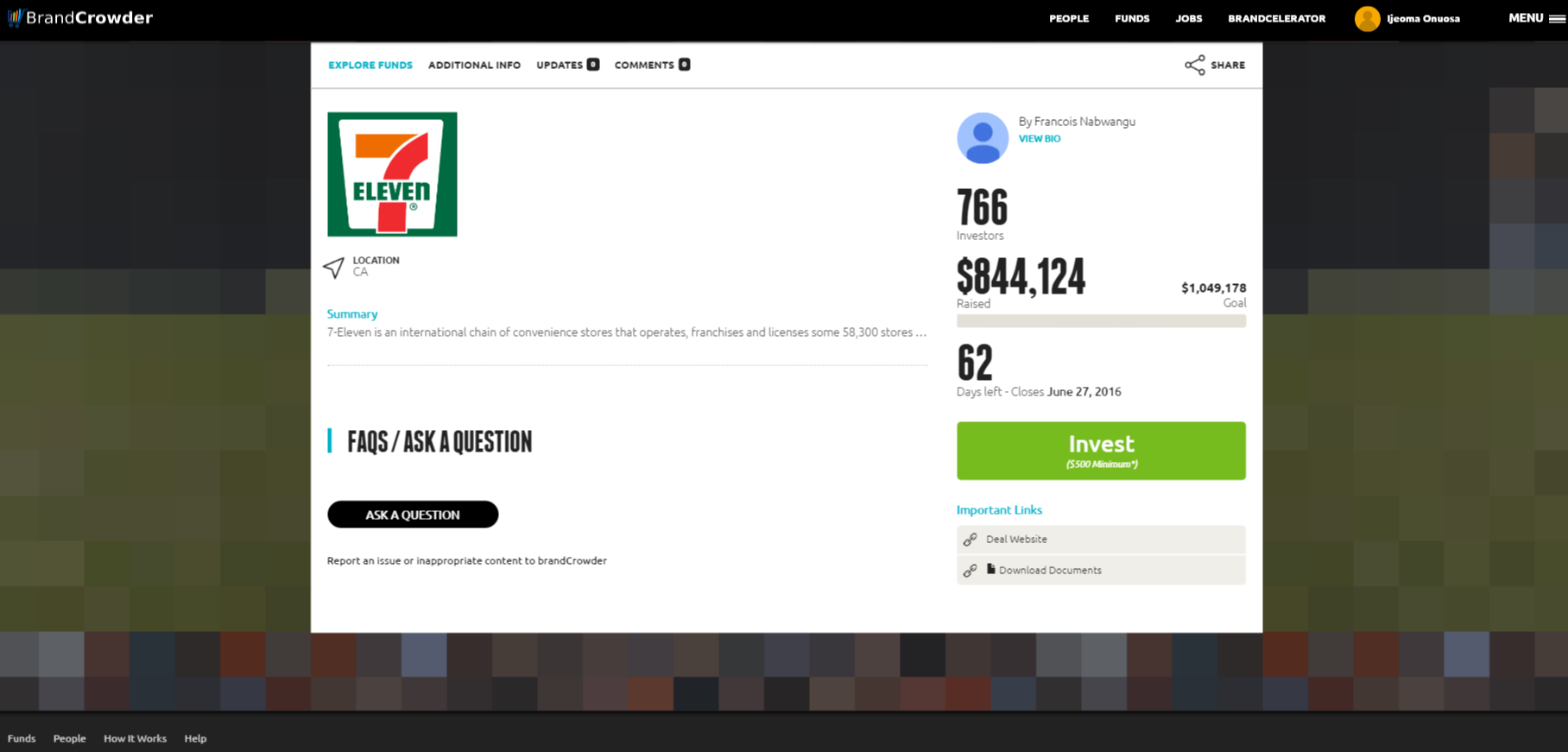

CFO Francois Nabwangu and President Ijeoma Onuosa, co-founder, demoed brandCrowder at FinovateSpring 2016

CFO Francois Nabwangu and President Ijeoma Onuosa, co-founder, demoed brandCrowder at FinovateSpring 2016 Before brandCrowder stepped onto the FinovateSpring 2016 stage, I chatted with Robert Armiak, the company’s CEO. Prior to joining brandCrowder, Armiak spent 18 years at Alliance Data where he served as SVP of finance and treasurer.

Before brandCrowder stepped onto the FinovateSpring 2016 stage, I chatted with Robert Armiak, the company’s CEO. Prior to joining brandCrowder, Armiak spent 18 years at Alliance Data where he served as SVP of finance and treasurer.

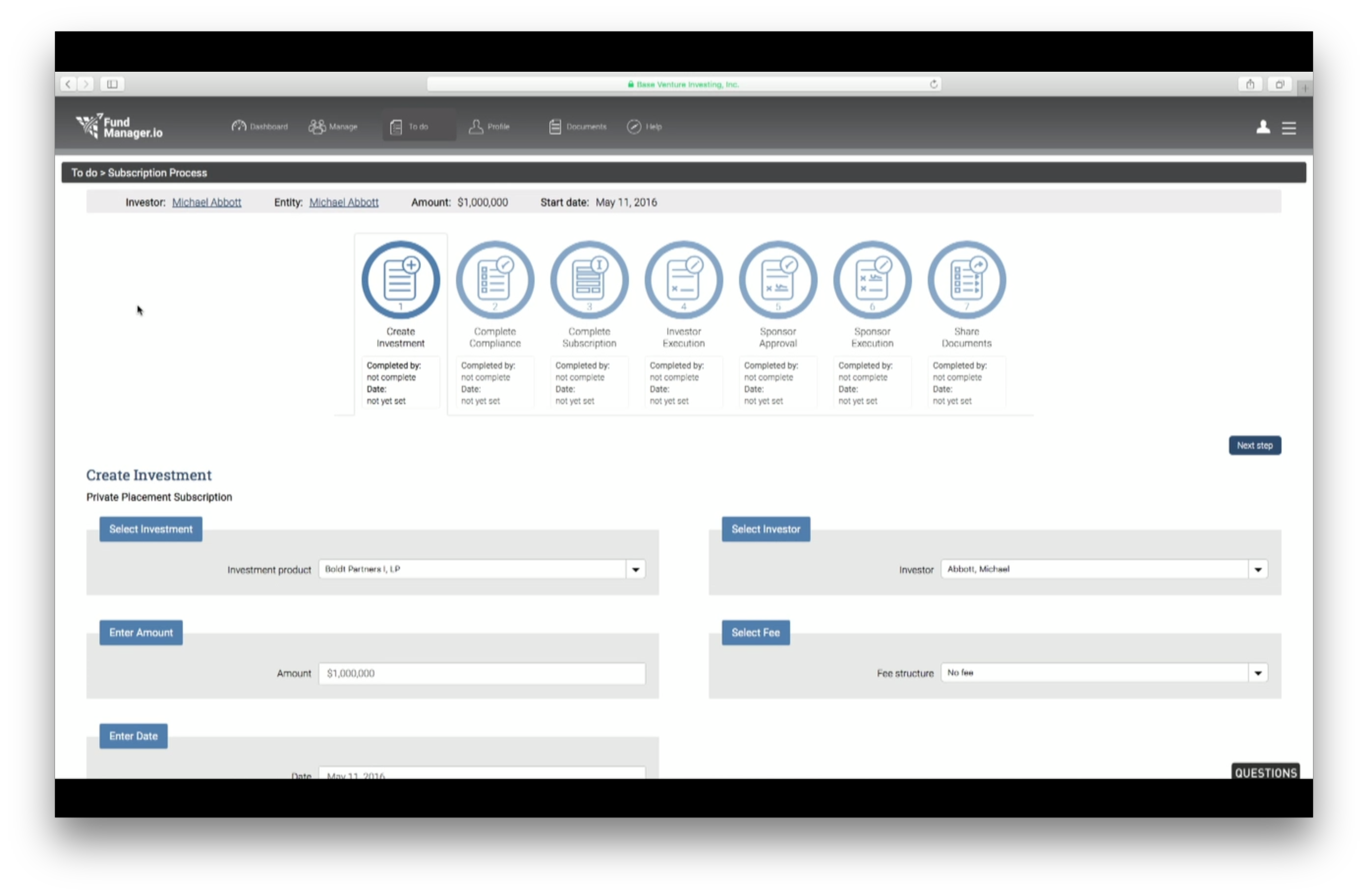

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company.

BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company. BaseVenture workflow

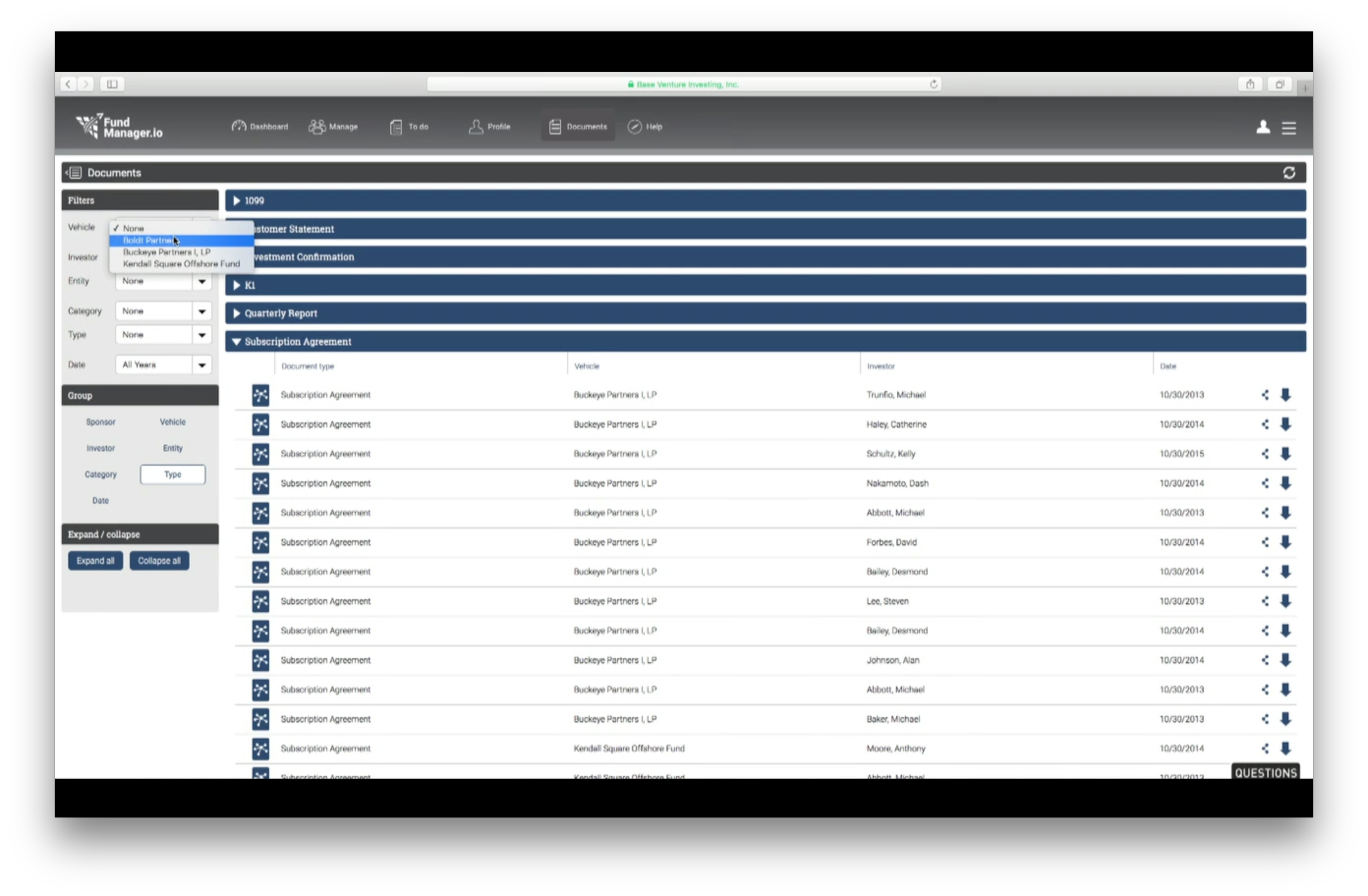

BaseVenture workflow BaseVenture filtering capability

BaseVenture filtering capability

We spoke with Jeff Helm, director of account services at Race Data, during the networking session on the final day of FinovateSpring in May. We followed up with a few questions by e-mail.

We spoke with Jeff Helm, director of account services at Race Data, during the networking session on the final day of FinovateSpring in May. We followed up with a few questions by e-mail.