Predictive analytics specialist Endor has raised $45 million in an initial coin offering that was launched just last month. This fast funding is a reminder that ICOs as a funding source for startups will be one of the big fintech stories of 2018.

“During the pre-sale we received a staggering amount of participation requests,” the company’s homepage reads. “Our motivation was to allow as many contributors as possible to participate, which was achieved by significantly limiting the individual contribution amounts, This torrent of support allowed us to reach our pre-defined cap of $45 million.”

More than a funding source, Endor’s ICO will also be the key to accessing the company’s predictive analytics platform. Known as “Google for predictive analytics,” Endor combines massive computing and MIT-developed proprietary social physics technology to create a predictive analytics platform that responds to questions asked in plain language with automated accurate predictions. This is accomplished without requiring coding experience or expertise in data science. And after the company’s successful ICO, all that businesses will need in order to take advantage of the new technology is a pocket full of EDR, the company’s cryptocurrency tokens.

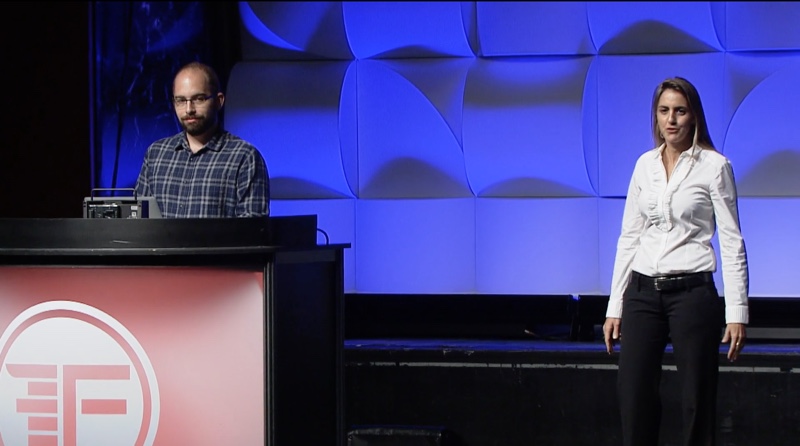

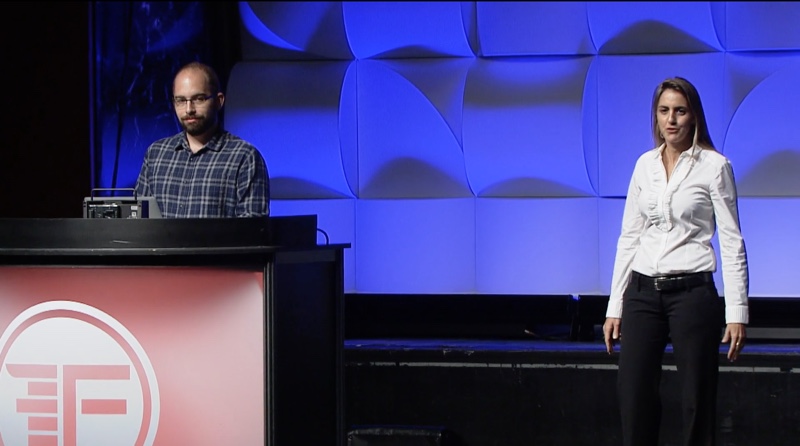

Left to right: Endor Chairman Doron Alter and COO Inbal Tirosh demonstrating the company’s predictive analytics platform at FinovateFall 2017.

The company has developed the ENDOR.coin protocol to help “democratize data science,” specifically by making predictive analytics more accessible to SMEs. Endor issued 1.5 billion EDR tokens, with 20% of the total available as part of the ICO. The company says that 40% of the tokens generated will be used to finance R&D efforts. The tokens were initially priced at $0.27 USD. In his review of the offering at CryptoCompare, Ricardo Bago points out that companies will pay in tokens for prediction analysis of their data and are compensated with EDR token “when insights derived from their data are being used for predictions.” This, Bago suggests, helps “incentivize the contribution and maintenance of high-quality data streams.”

For a deep dive into the data science behind, social physics and the Endor protocol, check out the white paper from Altshuler and Pentland published earlier this year. The technology promises:

- Constantly-expanding catalogue of predictions

- Do-it-yourself API for advanced users

- Automatic fusion of private and public data

- Guaranteed data privacy

- “Predictions by the people for the people”

Headquartered in Tel Aviv, Israel, Endor demonstrated the company’s predictive analytics platform at FinovateFall 2017. Endor was named a Cool Vendor in 2017 by Gartner, and a Technology Pioneer by the World Economic Forum. The company was featured earlier this month in a profile on UTB (Use the Bitcoin). Yaniv Altshuler is co-founder and CEO, having taken the helm from Doron Alter who transitioned to the position of company Chairman at the beginning of the year. Endor includes Coca-Cola, Twitter, and Mastercard among its clients and is partnered with fellow Finovate alum, Market Prophit.

Presenters

Presenters