One of my favorite features unveiled last week, was Universal Checkbook from Personal Capital. And apparently I wasn’t the only one. Attendees voted the startup Best of Show (again) and hit Twitter with positive comments such as the one below from Brad Leimer (@leimer) of Mechanics Bank,.

One of my favorite features unveiled last week, was Universal Checkbook from Personal Capital. And apparently I wasn’t the only one. Attendees voted the startup Best of Show (again) and hit Twitter with positive comments such as the one below from Brad Leimer (@leimer) of Mechanics Bank,.

Universal Checkbook (see inset) allows users to move money directly between any linked bank/brokerage accounts, providing they have check-writing capabilities.

While many banks also support interbank transfers, they usually require funds to move in and out of the host bank account. To move money between two third-party accounts requires two separate transfers. And it would take 5 or 6 days (via U.S. ACH system) if you waited for the funds to arrive in the host account before sending them elsewhere.

While many banks also support interbank transfers, they usually require funds to move in and out of the host bank account. To move money between two third-party accounts requires two separate transfers. And it would take 5 or 6 days (via U.S. ACH system) if you waited for the funds to arrive in the host account before sending them elsewhere.

In the demo, Personal Capital showed how easy it is to enroll a new bank accounts using deposit capture to grab a check image from that account. However, this enrollment option is not yet available in the production iPhone app (note 2, 3).

Pricing: There is no word on pricing, but it looks like there may be a fee eventually. On the bottom of the pay screen it says, "Try Universal Checkbook FREE for three months!" Because Personal Capital offers basic PFM services ad- and fee-free, it will likely need fees for money movement, at least for users not committing any assets to the startup.

————————–

Tweet from Bradley Leimer (@leimer) during Personal Capital demo at FinovateSpring (8 May 2012)

————

Notes:

1. We took an in-depth look at truly virtual banks (Personal Capital, Bank Simple, and PerkStreet) in our Oct 2011 Online Banking Report.

2. The app doesn’t yet explain how to enroll new payment accounts, evidently the image capture capability is still in process.

3. Universal Checkbook has not yet been incorporated into Personal Capital’s iPad or desktop versions.

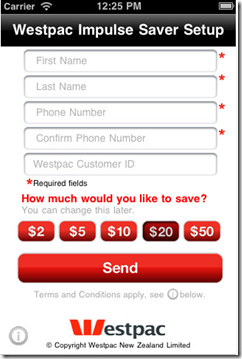

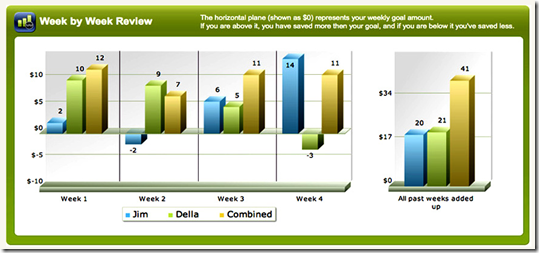

The amount of each transfer, from $2 to $50, is preset using the app settings (see second screenshot).

The amount of each transfer, from $2 to $50, is preset using the app settings (see second screenshot).