A fundraising round of $1 billion has given Checkout.com a valuation of $40 billion, more than 20x the valuation the company earned upon its first fundraising three years ago. The investment takes Checkout.com’s total capital raised to $1.8 billion, and the company said that it plans to use the funds to support growth in the U.S. market, launch its marketplaces solution, and strengthen its position in Web3.

“At our core, we help enterprise merchants to navigate the complexity of moving money around the world, whether in fiat currency or bridging the gap to Web3,” Checkout.com founder and CEO Guillaume Pousaz said. “By combining an elegant technology stack with industry expertise and an ‘extra-mile’ approach to service over the past decade, we’ve built deep partnerships with some of the world’s most innovative companies.” Pousaz added that while he considered this week’s investment to be a “validation” of the firm’s work to date, “we’re still in ‘chapter zero’ of our journey.”

Investors in the Series D included Altimeter, Dragoneer, Franklin Templeton, GIC, Insight Partners, the Qatar Investment Authority, Tiger Global, the Oxford Endowment Fund and “another large west coast mutual fund manager.”

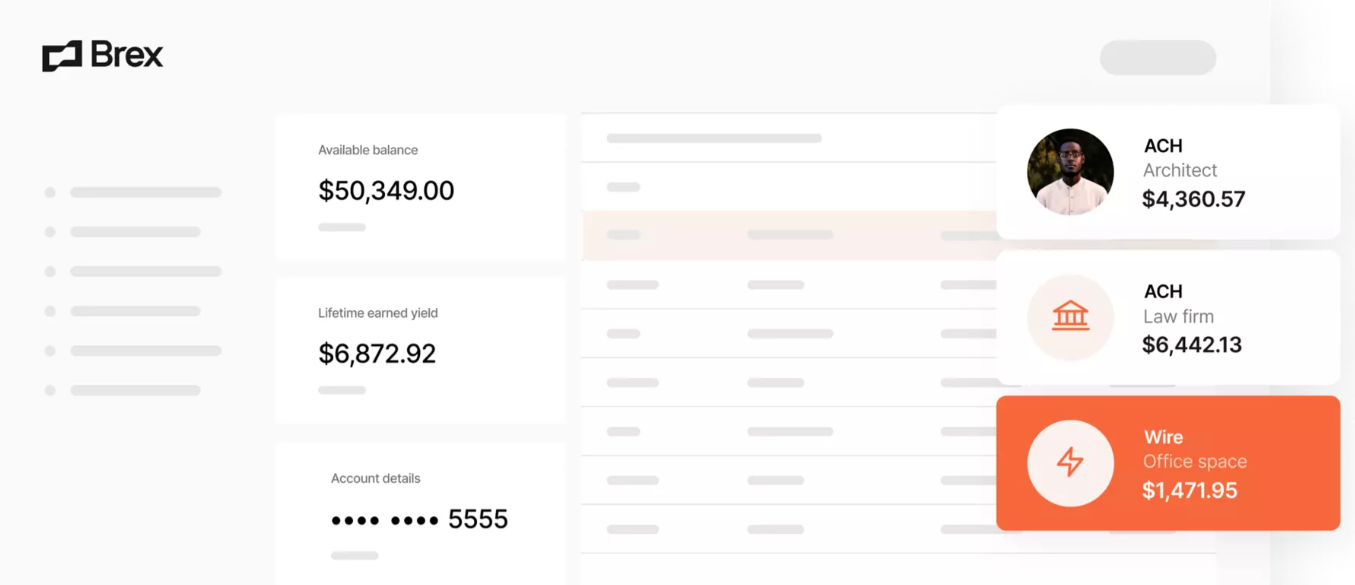

With customers ranging from Netflix and Pizza Hut to fintechs like Klarna, Revolut, and Coinbase, Checkout.com offers a full-stack online platform that makes payments easier for global businesses. Enterprise merchants that face significant challenges in moving money around the world have partnered with Checkout.com for its flexible, cloud-based payment platform that offers improved authorization rates, feature parity, and direct connection to local networks in key geographies and for all major alternative payment methods.

Looking forward, Checkout.com plans to launch a solution to service both marketplaces and payment facilitators later in 2022. The new offering will combine identity verification, split payments, and treasury-as-a-service functionality with Checkout.com’s Payouts solution, which helps companies send funds to both cards and bank accounts worldwide by way of a single integration. Checkout.com reports that both TikTok and MoneyGram have taken advantage of the service, with “billions of dollars in payout transactions” processed.

Headquartered in London and founded in 2012, Checkout.com spent 2021 opening new offices in six countries across four continents and making numerous major C-suite additions. These include a new Chief Financial Officer, a new Chief Technology Officer, and a new Chief Product Officer. The company announced an extension of its strategic partnership with JCB in September, and led a $110 million funding round for Saudi Arabian-based fintech Tamara in April.

Photo by Karolina Grabowska from Pexels