- Revolut has acquired India-based Arvog Forex. Terms of the deal were not disclosed.

- The purchase will help Revolut launch services in India in the latter half of this year.

- Arvog Forex has more than 20 branches across India and served more than 15,000 customers last year.

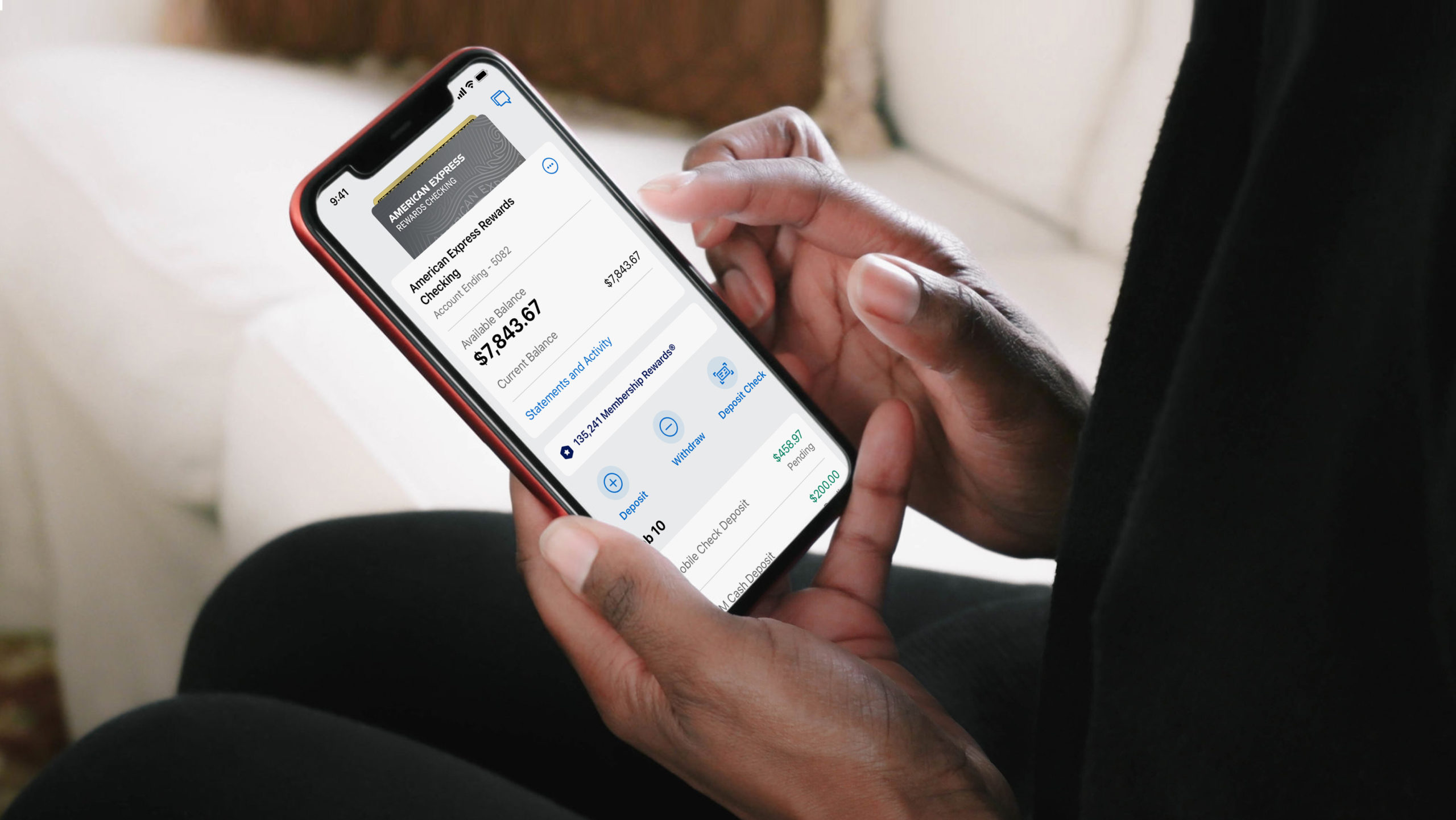

Global financial services innovator Revolut recently acquired Arvog Forex to deepen its roots into India, a region with a population of 1.3 billion and ripe for fintech disruption.

Arvog Forex, an international money transfer and currency exchange company, is headquartered in Mumbai. With more than 20 branches across India, the company served over 15,000 people with its remittances and other forex services last year.

Revolut, which plans to invest $25 million into the Indian market in the coming years, expects the purchase will strengthen its foundation in India. The company initiated its India expansion plans last April after hiring Paroma Chatterjee, a former Flipkart executive, to lead its India operations. Under Chatterjee’s leadership, Revolut plans to launch bespoke financial products that serve the unique needs of Indian consumers.

The company is aiming to launch services in India in the latter half of this year. The Arvog Forex acquisition should streamline this, helping Revolut offer remittances and multi-currency accounts to Indian customers.

Chatterjee calls the buy a “first step” towards the company’s aspiration to usher in a “digital financial revolution” in India. “Our significant investment plans, this acquisition, and the quality of the team we are putting together reflect our intention to rapidly roll out these innovative products and services. India is a key region in our global expansion plan and this acquisition is testament to the rapid strides we want to make here. It is an incredible time to be a fintech company in India and we plan to make the best of this opportunity,” she said.

U.K.-based Revolut was founded in 2015 and has already expanded into other Asia-based countries, including Japan and Singapore, but has yet to enter into China, a market that will prove to be highly competitive. On the other side of the globe in North America, Revolut has applied for a bank charter in the U.S., but withdrew its operations in Canada last March. The fintech plans to reenter the region later this year.

Photo by Aditya Siva on Unsplash