- Taulia is launching a virtual payment card solution for its users.

- The company is partnering with Mastercard for the new offering, which will be integrated across major ERP solutions.

- Degussa Bank and HSBC are piloting the launch.

Supply chain finance company Taulia is creating another payment option for its users this month. The California-based company is launching a virtual payment card in partnership with Mastercard and has integrated the new tool across major ERP solutions.

Taulia clients will be able to generate virtual cards through Mastercard upon request, which will save time and enable businesses to offer a better customer experience to their employees. In turn, the business itself will have more options to pay suppliers and control employee spending. Even suppliers will benefit, as they will see improved cash flow and better payments visibility.

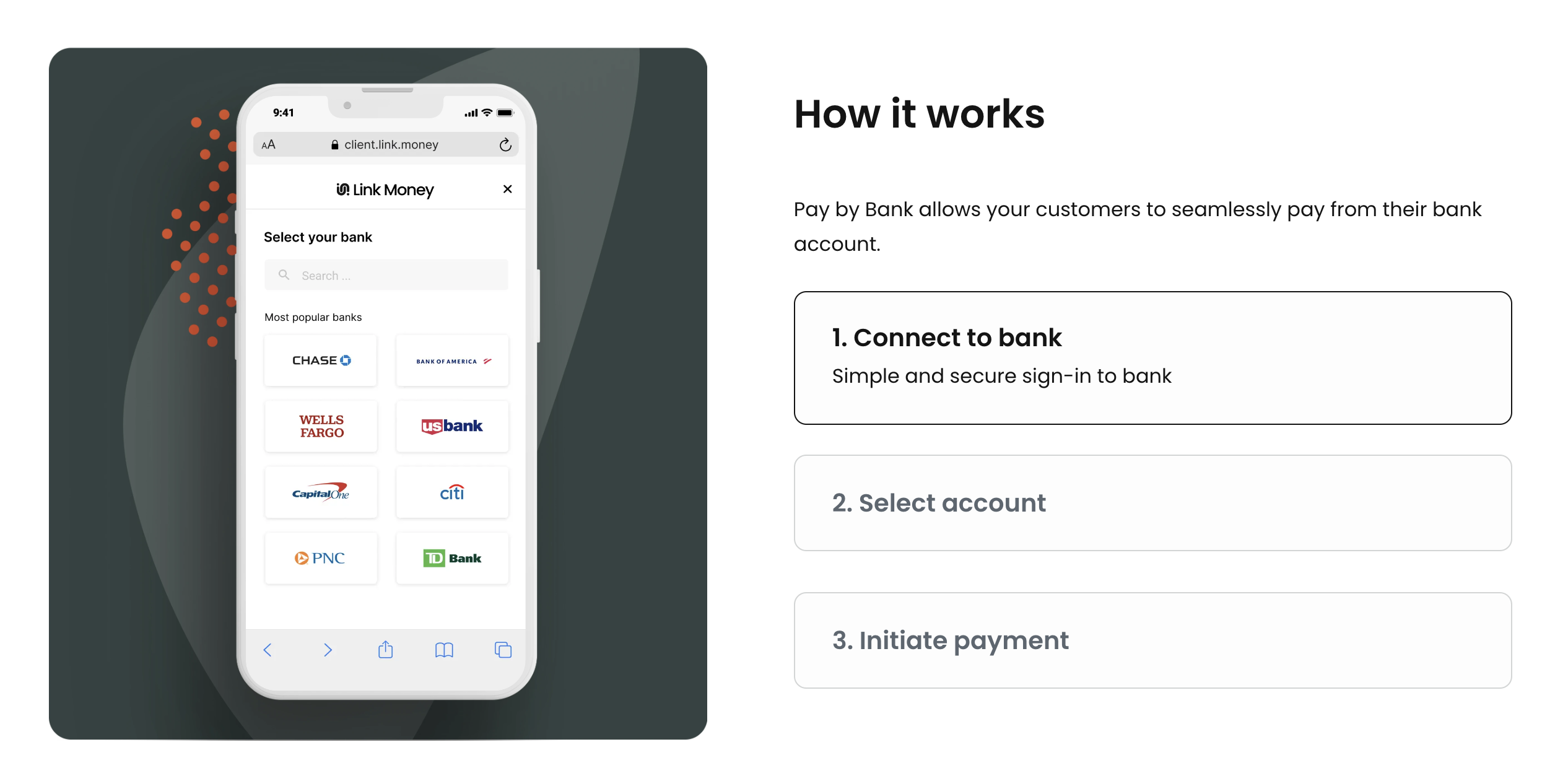

The virtual payment card solution offers a unique, “bring your own bank” feature that allows Taulia clients to deploy virtual cards and extend the benefits already offered by their existing banks. This convenience comes thanks to Mastercard’s virtual card platform, which connects to more than 80 banks across the globe. Degussa Bank and HSBC are piloting Taulia’s launch.

“We’re pleased to be embracing innovation through our partnerships with Taulia and Mastercard, which will now provide our clients with an integrated virtual card payment solution within the Taulia platform,” said HSBC Global Head of Commercial Cards Product Management Arati Kurien. “Embedding HSBC’s financial services into the systems that our clients use day to day is a key focus for us.”

Taulia was founded in 2009 to help companies make use of cash tied up in their payables, receivables, and inventory. Taulia maintains a network of 3+ million businesses to fuel its clients with more working capital, support their suppliers with early payment, and help them build sustainable supply chains. Taulia processes more than $500 billion each year for its clients, which include Airbus, AstraZeneca, and Nissan.

In the coming years, we’re likely to see more of this embedded approach to supply chain financing. Fintechs will likely explore integrating supply chain financing tools into existing business solutions, as Taulia is doing within ERP solutions. We can also expect the inverse, as well, as fintechs embed other financial services, such as insurance, directly into existing supply chain platforms.

Taulia was acquired by SAP in 2022 for an undisclosed amount. Cedric Bru is CEO.