Here’s more “behind-the-scenes” coverage of some of the companies that presented at FinovateEurope 2014.

If you missed our previous installment from last week, click here to read “FinovateEurope: Behind the Scenes with AdviceGames, Nous.net, and Yseop.”

What They Do:

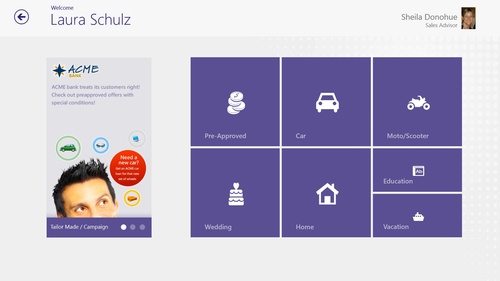

CRIF specializes in leveraging big data to help small and medium sized banks make sound credit decisions.

In a conversation the day before the company’s Finovate demo, CRIF’s Marketing Director Sheila Donohue noted that what’s critical for banks is flexibility: “Banks are more and more requesting the ability to change and make changes,” she said. “They don’t want to be dependent on vendors, or have their hands tied.”

CRIF Credit Framework serves this need by helping financial institutions use the platform to create end-to-end products such as custom apps for loan origination or tools for business analytics and intelligence. The company’s solutions have been deployed widely, from the Bank of Georgia in Central Europe to Interra Credit Union in north central Indiana.

Stats:

- More than $106 million in equity

- More than 2,400 financial institutions use CRIF technologies daily

- More than 1,500 employees/associates worldwide

- Total revenues in 2012 were 285 million euros

- Founded in Italy, CRIF recently celebrated its 25th anniversary

Use Case:

The new release of CRIF Credit Framework will be especially helpful for banks looking to deploy a 21st century sales force equipped with productivity-enhancing mobile solutions. The company’s mobile app can be used in-branch, as well as at the point-of-sale when customers are considering a variety of financing options.

CRIF is also unveiling a new version of its business-intelligence product, also optimized for mobile, which provides a dashboard that allows business executives better transparency and the ability to monitor KPIs.

This technology allows executives, rather than IT staff, to dig into the data behind their KPIs and make changes immediately. Changes are visible, graphical (not in programming language), and are tracked.

“You want to be fast,” Donohue said. “But if the regulators come by tomorrow, you want to be able to substantiate the changes you made.”

What They Do:

Mobino’s project is straightforward, if not simple: to enable everybody with a phone in their pocket to make mobile payments as easily as paying with cash.

“We are both independent from the card networks and the telcos,” said Mobino CEO Jean-Francois Groff in a conversation the day before his company’s Finovate demo. “But we are working very closely with the banking industry. We want to enable bank account holders to circulate real money just as easy as they would circulate virtual money.”

How Mobino Works:

Smartphone and feature phone users alike are able to take advantage of Mobino. With a smartphone, the solution is a downloadable app (available for both iOS and Android). “Dumb” phone users can utilize a voice-based service that provides the same basic functionality.

Users can load money to their Mobino accounts through a variety of methods, including bank account direct deposit, wire transfer, and by purchasing prepaid cards. The company’s independence from the card networks means that funding Mobino accounts via credit cards is not a part of the plan.

The service is free to use for consumers, both for making P2P payments as well as transacting with merchants. Merchants accepting Mobino pay a 1% commission, substantially less than card fees.

Use Cases:

Groff sees use cases for Mobino everywhere: from online transactions to point-of-sale shopping at brick and mortar retailers, to peer-to-peer payments, merchant payments and more.

Here’s an example of how a merchant using Mobino might interact with a Mobino-paying customer:

Step One:

The process starts with the merchant entering the transaction amount in the Mobino app.

The merchant will then receive a one-time token number, and will be instructed to show the token number to the customer.

Step Two:

The customer then enters the token number given by the merchant.

The customer agrees to pay the amount, and enters his or her private passcode.

The merchant and the customer receive notification confirming the payment by SMS.

Mobino allows the merchant to have funds transferred to the merchant bank account, and charges a 1% fee for the transaction.

During our discussion, Groff previewed yet another use case he would be sharing with Finovate audiences: “Each merchant who participates, who uses Mobino at their point-of-sale, can act as a cash machine. A sort of reverse ATM.” This is because Mobino operates on a prepaid basis. And in the same way Mobino allows consumers to exchange “e-money” for goods and services, Mobino also allows consumers with cash in pocket to exchange that cash for the merchant’s accumulated “e-money.”

Role for Banks:

Groff makes an interest

ing point about our relationship with our banks:

“(Online banking) was marketed toward us as banking without waiting. But in the end we do all the work, and the bank is not available when we need them. They are there when we need credit or want to buy a house or set up investments. But when we just want to do the basic movements of money that are paired with daily life, the banks are really in the background.”

How do move banks to the foreground? Groff suggests that the success of PingIt, launched in the United Kingdom by Barclays, reveals that there is a “latent, unmet demand from the population for simpler services coming from the banking world.”

Looking forward, Mobino is optimistic about the growth of his company and in the technology that makes his service work. Distribution is a major focus, the hard work especially of getting “mom and pop” shops with older POS hardware to consider Mobino.

And, as always there are regulatory issues. Here, however, Groff remains confident: “The regulators, in general, are quite open,” Groff said. “When we show them the potential the innovation has to enhance what they call ‘financial inclusion’ – helping people who would never have access to finance to actually do something with money – they really, really are open to experimenting.”

SaaS Markets

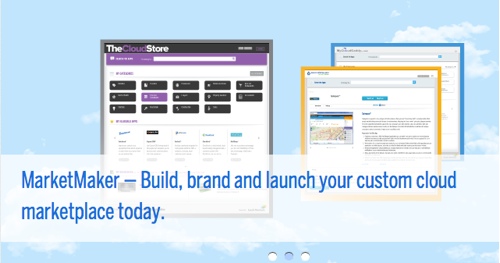

What They Do:

Saas Markets helps financial institutions build app stores to help their small and medium business clients solve their business challenges.

This is no small accomplishment. In addition to capital, one of the things that can help make a difference in the success of SMEs is their access to resources, especially business solutions that will save them money, create more efficient processes, and help them compete more effectively in the marketplace.

“We address three things,” Ferdi Roberts, SaaS Markets CEO said in a briefing in advance of his company’s Finovate appearance. “One, helping banks understand the challenges facing their business customers.Two, to help them provide solutions to those challenges. And, three, to give them a platform that helps them gain new customers and keep the customers they have longer, so there’s a stickiness to the product.”

To this end, SaaS Market’s MarketMaker cCloud platform provides a personalized, cloud-based marketplace containing more than 1,500 curated business apps from accounting to invoicing. Use of these SME apps is convenient for the business operator, who can take advantage of these app while never being more than one click away from their bank. It also increases stickiness and the potential for greater engagement for the financial institution that hosts the platform.

Benefits for Financial Institutions:

Making it easier for small and medium-sized enterprises to get the accounting and invoicing technology they need is a worthwhile business in and of itself. But in conversation with Roberts, and with Director of Marketing, Jay Manciocchi, it becomes clear that, in some ways, the app store is only the beginning.

This path toward a personalized app store is optimized by a technology called MarketMentor. MarketMentor works like a search engine within the platform, associating highly specific business problems to no less specific responses and solutions. “Even if you don’t know what you want,” Roberts said. “You know what your problem is – so let’s start with that. And Market Mentor helps crystalize that.”

The challenge for banks is that small and medium sized business customers tend to be the most numerous, the most profitable, and the most difficult to engage. Part of what SaaS Markets is trying to accomplish with its cCloud platform and Market Mentor technology is to boost engagement via personalized problem-solving. This helps banks become a more collaborative partner when it comes to helping SMEs solve their business problems.

The result is a win-win for banks, who benefit from greater engagement and less churn, as well as for their customers, who become better businesspeople with more resources at their disposal and a deeper understanding of their own business environment.

Stay tuned for next behind-the-scenes look at FinovateEurope 2014 later this week.

On Budget wins 2014 Paybefore Award as “One to Watch.”

On Budget wins 2014 Paybefore Award as “One to Watch.”