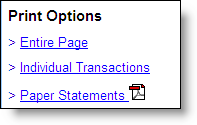

PayPal is advertising its PayPal Plus card with this box located in the upper-right of the main account start-page within the secure area (click screenshot below for a closeup).

PayPal is advertising its PayPal Plus card with this box located in the upper-right of the main account start-page within the secure area (click screenshot below for a closeup).

With the falloff in response to traditional direct mail raising acquisition costs to $200 or more, a pitch delivered within an online banking session can be far less expensive. And with online banking users typically wanting to get in and out quickly, the 30-second response shows that the company is sensitive to the time constraints of its customers (notice they did NOT say that it was a 30-second process).

The PayPal card is issued by GE Money Bank, the same company behind PayPal Buyers Credit used by sellers to offer longer-term financing of major eBay purchases. The Plus card includes a free rewards program offering 1 point per dollar purchased. The current rewards structure includes three levels:

The PayPal card is issued by GE Money Bank, the same company behind PayPal Buyers Credit used by sellers to offer longer-term financing of major eBay purchases. The Plus card includes a free rewards program offering 1 point per dollar purchased. The current rewards structure includes three levels:

- 1,000 points – Free shipping up to $7 on a PayPal purchase

- 2,500 points – $25 voucher (for merchandise at most PayPal merchants)

- 9,500 points – $100 voucher (for merchandise at most PayPal merchants)

The card carries a variable rate from 14.24% to 24.24% and has no annual fee.

Here's the main account page displayed after login:

Here's the landing page displayed after clicking on the apply button: