As Web 2.0 meets personal finance (see note 1), we are seeing for the first time, tiny one- and two-person startups entering the online banking and personal finance space. Back in the bubble days, there were numerous startups such as X.com, dotBank, and PayMe, but they usually required a bankroll of $10+ million just to push something out the door. Today, an innovative personal finance site can be created in a programmer's spare time (eg. BudgetTracker) or for less than $100,000 if the principals take their salary in stock.

As Web 2.0 meets personal finance (see note 1), we are seeing for the first time, tiny one- and two-person startups entering the online banking and personal finance space. Back in the bubble days, there were numerous startups such as X.com, dotBank, and PayMe, but they usually required a bankroll of $10+ million just to push something out the door. Today, an innovative personal finance site can be created in a programmer's spare time (eg. BudgetTracker) or for less than $100,000 if the principals take their salary in stock.

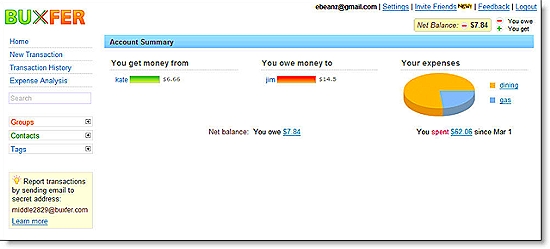

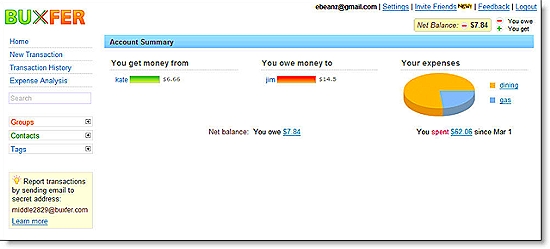

Despite being overly fascinated with issues of shared expenses, such as splitting the dinner bill (see Buxfer main default page at login below), there is much to be learned from the newcomers (note 2). They tend to be refreshingly designed and clever in their use of modern navigation and communication techniques, something that cannot always be said about typical banking sites.

And the newcomers are also trying to ride the "social networking" wave, and expense-splitting provides a so-called "social money" benefit for use in elevator pitches and press releases. And for couples with his and her checking accounts that divide bills and expenses between the two, expense-splitting features could be a marriage saver.

We'll be looking at a number of these sites during the next few weeks as we prepare a follow-up to our August 2006 Online Banking Report on Personal Finance 2.0 (link here). Wesabe is the best known of the bunch, having received a considerable amount of press as a social money site. But before we get to them, take a look at one of their competitors, recently featured on TechCrunch (here).

We'll be looking at a number of these sites during the next few weeks as we prepare a follow-up to our August 2006 Online Banking Report on Personal Finance 2.0 (link here). Wesabe is the best known of the bunch, having received a considerable amount of press as a social money site. But before we get to them, take a look at one of their competitors, recently featured on TechCrunch (here).

Buxfer is similar in many ways, but has not had near the attention. The company which recently relocated to Silicon Valley as part of the Y-Combinator program, came out of beta in September, but has recently added several new features.

They have several impressive features that no bank or credit union has offered to date:

- Login via third party authentication APIs from Google, OpenID, AOL, Yahoo and Facebook; really helps get users past the "do I really want to give this company my personal info" stage (see note 3)

- Transaction import, via simple browse/upload function (see note 2)

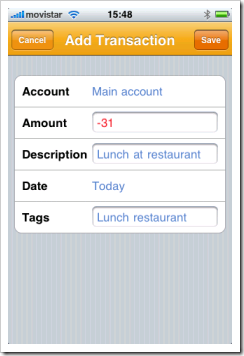

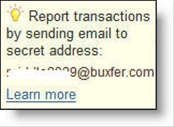

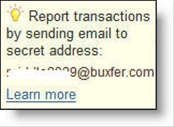

Transaction input via custom email address: Buxfer provides users with their own email address that can be used to send new transactions into the system (see inset)

Transaction input via custom email address: Buxfer provides users with their own email address that can be used to send new transactions into the system (see inset) - Auto-tagging: users can select any key word in a transaction description and have it auto-tagged, for example, say Fred works for you, and when you have a transaction called "lunch with Fred" you can have it auto-tagged with "business"

- File append: You can easily add note or attach files, such as receipts, to individual transactions

- Widget/gadget that shows expense breakdown that can be displayed directly on the desktop (see screenshot above)

Weaknesses:

- If you enter an email address for someone who you are setting up as a participant in a shared transaction, eg. splitting the dinner tab, Buxfer prompts you to save them as a new contact. In doing so, an automatic email is generated from the user, inviting them to join the service. That's fine, but the user needs to have more control over the invitations. Buxfer's blog provides a work-around, suggesting using something other than an email address, but spamming your friends should never be the default.

- The main page (screenshot above) focuses on who you owes money to whom, instead of the more common issue of what bills are due and when.

- No support for transactions. Other than being able to import transaction files that have been previously downloaded from banks and card issuers, it's all manual data entry. Helper tools such as "copy", "repeat entry" and "auto-tagging" help a bit, but to be an effective tool the service needs to integrate more closely with the actual bill and the payment. That's why these companies need to forge close ties with financial institutions to move beyond the outlier Tracker 2.0-user into the mainstream market.

Notes:

1. For more on online personal finance, see our full report on the subject, Online Banking Report #131/132 (here)

2. I suspect the expense splitting priority is a result of founders who are young, single, frugal, and obsessed with tracking personal finance details. They are the types that worry about whether the bar tab was split equally, and go home and code solutions to it, while the rest of their group is sleeping it off.

3. When logging in through a third-party service, users are not required to provide ANY personal info, i.e. there is NO registration process, an amazing experience.

4. Screenshot of file import:

TSYS makes Ethisphere Institute’s list of the world’s most ethical companies.

TSYS makes Ethisphere Institute’s list of the world’s most ethical companies.