The Finovate Debuts series introduces new Finovate alums.

Behalf demoed its small business financing solution at FinovateFall 2014 in New York.

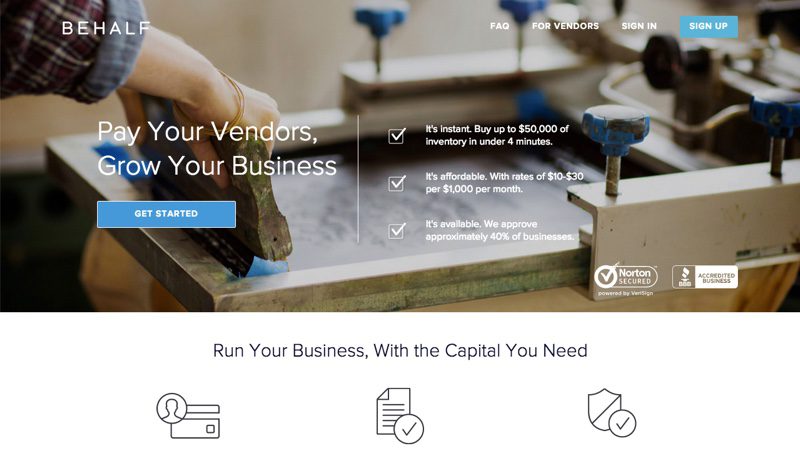

Behalf provides small- and medium-sized businesses, short-term capital in the form of direct payments to their vendors.

The Stats

- Founded in 2011

- Headquartered in New York City

- Raised $10 million

- Has 25 employees

- Benjy Feinberg is CEO

The Story

Seven years after the Global Credit Crisis, small businesses are still challenged to find the capital they need to grow. In this environment, entrepreneurs have emerged to fill the tap. Behalf, founded in 2011 and based in New York, is one such company.

Formerly known as “Zazma”, the company recently changed its name to Behalf to support their value statement: “We pay on your behalf and you pay us back on your terms.

More specifically, Behalf helps small companies and entrepreneurs deal with the often conflicting payment terms and conditions from various vendors. Perhaps one vendor won’t accept credit cards, another vendor offers only 30-day terms, and yet another insists on the promptest payment possible. Behalf uses short-term financing to pay for purchases of inventory or equipment, allowing businesses to “take their terms with them” to any vendor they are buying from and repay Behalf on a schedule that works for them.

In paying vendors directly, Behalf hopes to differentiate itself from other small business lenders. And while this adds risk to Behalf’s business, it also adds speed to the process, making the financing solution that much more attractive – for both merchants and their vendors. Businesses are able to better manage often-competing payment terms from different vendors, Feinberg explained, “and vendors are happy because they are getting paid on Day One. There are no issues with collections.”

The goal is to help small and medium-sized businesses better manage their cash flow, and ensure that a temporary capital shortfall does not undermine longer-term business opportunity. Moreover, using Behalf helps newer SMBs build the kind of credit that will be beneficial as the business grows and its capital needs change.

The Technology

The process of getting funding from Behalf is straightforward. Clients create an account with name, address, business name, email address, and a password, and are then taken through a credit application process. Here all that’s required is a personal and business address, as well as a social security number.

“We don’t ask for bank statements, or to connect accounting software, or endless questions abut the business,” said Andrew Abshere, Director of Product, from the Finovate stage last fall. “All we need are these three pieces of information. And like that we can return credit terms in real time.”

Behalf charges $10-30 a month for every $1,000 borrowed, and payment periods typically range up to 120 days. Borrowers are only required to provide their social security number for security and identity purposes. No bank statement is required to apply for funding, but for those setting up automatic repayments, some bank account information is necessary.

Users can even pay vendors directly from the Behalf platform. The “Add a Payment” feature lets users set up the various vendors to be paid, and the “Repayment” feature allows the user to establish the specific repayment terms for the vendor.

The Future

Companies looking to excel in this space need to accomplish what traditional small business lenders have not or can not. They need to have or have access to the capital small businesses need. They need to have a sophisticated method for establishing business creditworthiness that is ideally both unique and superior compared to existing methods. And lastly, the lending process needs to be as seamless and speedy as it is robust and secure.

As far as Behalf is concerned: so far so good. The company enjoys the investment support of institutions like Sequoia Capital, which led the Behalf’s seed round in 2011, and Spark Capital. And strong press from outlets like VentureBeat has been a benefit, as well, even as the company’s transition from Zazma to Behalf remains less than a few months old.

(Above, left to right: Meeka Metzger, VP Product; Andrew Abshere, Director, Product; and Benjy Feinberg, CEO)

Behalf’s approach to small business financing embraces an “electronic payments with big data” trend they have been on the lookout for

since at least 2013. And while there is an emphasis on the financing needs of small businesses, Behalf also looks to bring suppliers and vendors to the platform on the other end. Here, the idea is to help vendors provide better repayment terms to their clients, faster pre-approvals, and say goodbye to the collections process.

“Small businesses buy more, they take their terms with them, and their vendors sell more. So everybody wins from the process,” Feinberg said.

In terms of what’s next, the company has a “big announcement” they’ve been teasing since Q4 2014, giving Behalf watchers something to look for in the new year. Stay tuned!