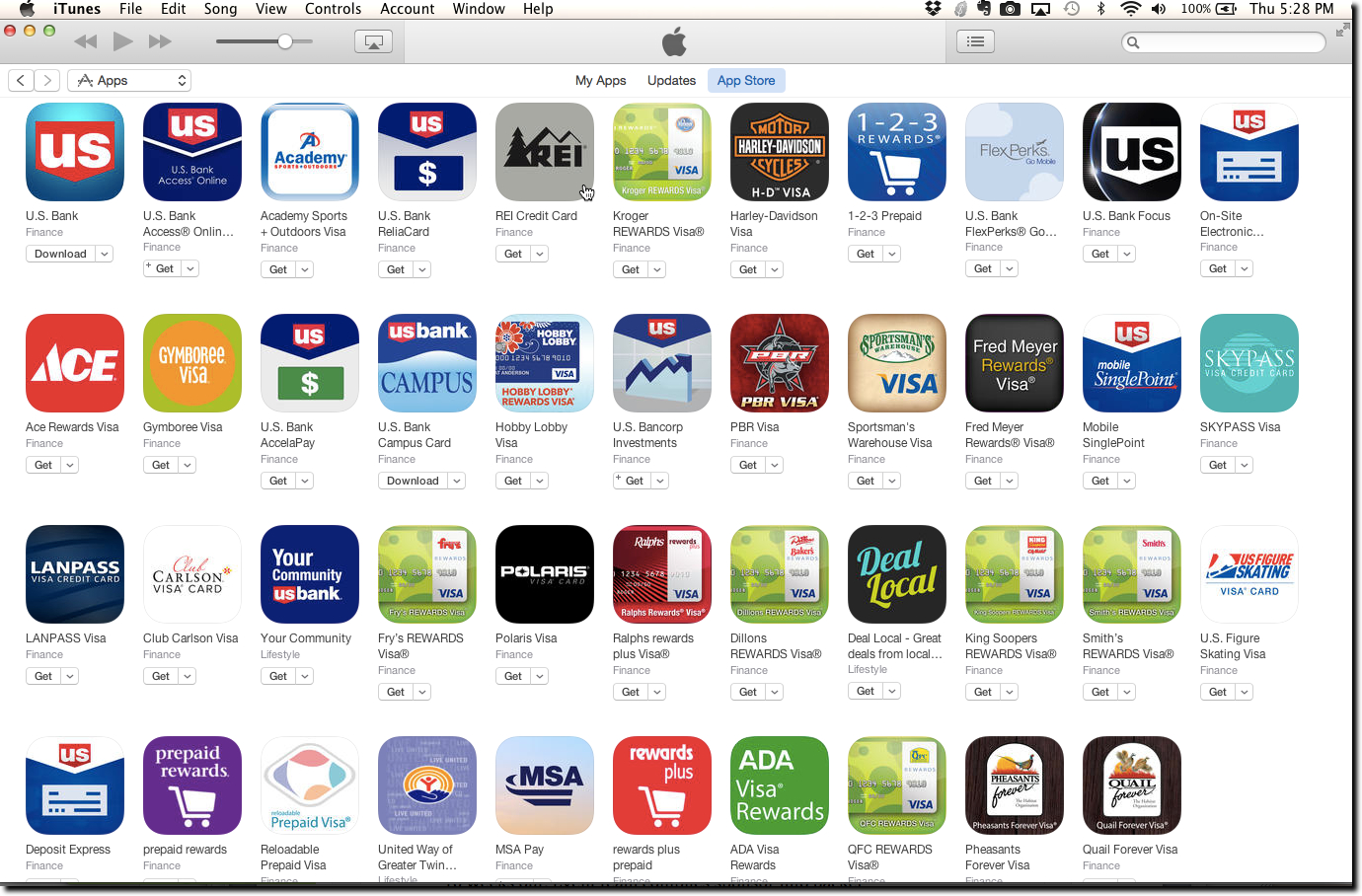

US Bank’s iOS app lineup

Early on in the smartphone era there was a debate as to whether native apps or the mobile web would carry the day. As an early iPhone user, I was solidly in the native apps camp. Some day there will be a better interface, but until then it’s an app world (though not every headline writer agrees). And now the question for financial institutions is not whether you need a native app, it’s how many do you need?

Until recently, most financial institutions hoped to have a one-size-fits-all mobile app, just like on the desktop. That’s the option that lowers development costs, simplifies tech support, and makes digital banking easier to manage. But since most financial institutions serve many customer segments, bundling too many features into one UI really gums up the overall experience.

So we are seeing more and more financial companies developing multiple native apps to support distinct business groups, customer segments, and even charitable activities. The most prolific? US Bancorp with 43 iOS apps alone, 28 of which are white-labeled for its affinity credit-card customers (see screenshot above).

Delving deeper, let’s look at the 25 most-popular free finance apps in the U.S. Apple App Store (data is from mid-March, when I started this post). The 13 financial institutions in that group have a combined 123 apps, for an average of nearly 10 per bank. However, excluding US Bank’s 28 white-label apps, the total is 93, or 7.2 per FI.

Bottom line: You may not need 7 or 8 apps, but it’s clear that multiple apps optimized for individual use have an advantage in usability and focus (ROI is a much more difficult question of course). In addition to a core mobile-banking app, most mid-size and larger FIs should evaluate dedicated apps for the following segments:

- Youth

- Small businesses

- Mobile wallet/cards (credit/debit/prepaid)

- Saving/budgeting/personal finance

- Home buyers/mortgage/home equity

- Car buying/auto loans

- College financing/student loans

- Retirement/wealth management/investing

- Optional: Insurance, HSA, any other stand-alone business line

——————–

Table: Number of iOS apps per financial services provider

Banks & Card Issuers: Total of 123 apps across 13 financial institutions

- US Bank: 43 (14 branded, 28 white-labeled affinity partners, 1 nonprofit)

- PNC Bank: 14 (all branded)

- Chase: 11 (6 Chase branded, 5 JPMorgan branded)

- American Express: 10 (8 branded, Plenti, Expert Care)

- Citibank: 10 (all branded)

- Bank of America: 9 (4 BofA branded, 5 Merrill Lynch branded)

- Capital One: 8 (7 branded, 1 CreditWise)

- Wells Fargo: 5 (all branded)

- TD Bank: 3 (all branded)

- Discover: 3 (1 branded, 2 Diners Club)

- Navy FCU: 2 (all branded)

- BB&T: 2 (all branded)

- USAA: 2 (1 branded, Savings Coach)

Payments: 15 apps across 4 companies

- PayPal: 9 (7 branded, Venmo, Xoom)

- Square: 4 (all branded)

- Western Union: 1

- Google Wallet: 1

Insurance: 2 apps from 2 companies

- Progressive: 1

- Geico: 1

Personal finance/investing: 18 apps across 6 companies

- Intuit: 13 (12 branded, Mint)

- Credit Karma: 1

- Digit: 1

- Acorns: 1

- Prosper: 1

- Robinhood: 1