No one knows for sure how Apple compiles the list of its top-selling iPhone apps, but it’s related to how many are sold during the past few hours. I’ve seen speculation that the measurement period is 2 hours (see note 1).

No one knows for sure how Apple compiles the list of its top-selling iPhone apps, but it’s related to how many are sold during the past few hours. I’ve seen speculation that the measurement period is 2 hours (see note 1).

But there is no doubt about the benefits of rising to the top. The winner receives prime exposure in the iTunes Store and on the iPhone itself (see screenshots below).

I’ve checked the Finance category rankings dozens of times since the store opened in July, and the top app had always been Bloomberg with Bank of America usually the runnerup.

But Friday, a new top seller emerged in the Free list in the Finance category (note 2), Chase Mobile while Bloomberg and BofA were each knocked down a spot to numbers 2 and 3. The Chase app was released just one week ago (12 Dec). But by Saturday morning (20 Dec), Chase had already been replaced at the top by online personal finance startup Mint, which released its iPhone app Monday (15 Dec), but it didn’t show up in the iTunes store until 1 AM Friday. Mint stayed at the top all weekend and is still number one now (10 AM Pacific, 22 Dec).

In the screenshot below and right, you can see the free publicity derived from holding the top spot. Also, note that you should put your name into the application. Bank of America, ranked number 3, neglected to include its name in the title, so it loses some branding value. Although, they would have to use BofA to fit into the space.

In the screenshot below and right, you can see the free publicity derived from holding the top spot. Also, note that you should put your name into the application. Bank of America, ranked number 3, neglected to include its name in the title, so it loses some branding value. Although, they would have to use BofA to fit into the space.

Chase App (link to iphone App)

The Chase app itself is attractive and is similar to Bank of America’s with a login button to the website and an ATM/branch-finder utility. As of this evening, 64 reviews have been posted with an average 3.5-star rating out of five, slightly better than the 3-star rating of Bank of America’s iPhone app with similar features.

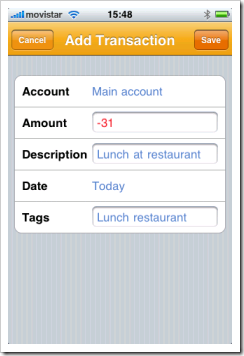

Mint App (link to iPhone app)

As expected from a company that is carefully using design to help distinguish it from the pack, Mint’s new app is great looking. Across all aggregated accounts, the mobile app shows account balances, transactions, and progress towards budget goals. A nifty alerts icon on the bottom provides a convenient way for users to keep tabs on important info on the go.

Another difference from most banking apps: Mint lets users choose whether they want password protection enabled after their initial login. If you choose to log out, then the app erases all data in memory, and you must log back in next time. If you choose not to log out, then your data remains visible until the next visit with no login required (note 4). This is a great convenience, but something that may not be allowed at regulated financial institutions.

Some users have reported trouble with the app on older phones. On my first-generation iPhone running version 2.1 software, the Mint app wouldn’t download. But once I upgraded the iPhone software to version 2.2, it downloaded flawlessly and all functions worked perfectly. In Mint’s forum, some users were reporting problems with the Budget feature, but it seems to work fine for me (forum thread) (note 3).

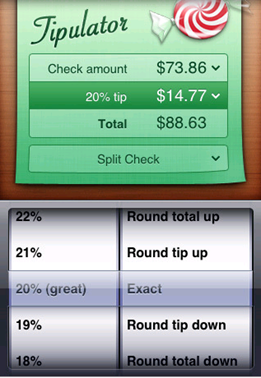

Top Apps in the finance category of iTunes’ App Store

(7 PM Pacific, 19 Dec 2008)

Top free finance apps list displayed on iPhone:

at 7 PM Pacific, Fri. Dec. 19 at 2 PM Pacific, Sat. Dec. 20

Chase Mobile iPhone app Mint iPhone app main screen

main screen (19 Dec 2009) (19 Dec 2009)

Notes:

1. That 2-hour window could be about right. When I made this screenshot, the new Mint app was at number 10; two hours later (9 PM) it had risen to number 5 (see screenshot above). By 9 AM Saturday morning (20 Dec) it had risen to number 1.

2. The App Store divides the top apps into two categories, free and paid. The top 20 free apps are listed on the right side and the top 20 paid apps are listed on the left. The apps in the middle are listed by newest first.

3. These operating system incompatibilities, a real problem in pre-1995 online banking services, had largely been left behind when banks embraced the Web in the mid-1990s. Unfortunately, mobile banking will add to your tech-support costs.

4. Mint also reminds users that they can choose to lock their entire iPhone for extra security.

5. For more info on the market, see our Online Banking Report on Mobile Banking.

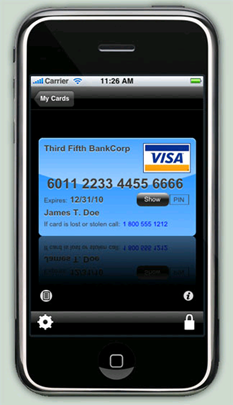

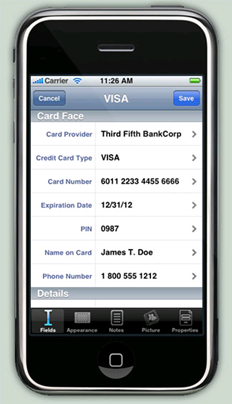

Today marked an Apple App Store milestone of sorts, the 1000th application available in the Finance category (USA store). Finance is less than 2% of the total store, which now stands at 63,300, according to AppShopper.com.

Today marked an Apple App Store milestone of sorts, the 1000th application available in the Finance category (USA store). Finance is less than 2% of the total store, which now stands at 63,300, according to AppShopper.com.  Four other new Finance apps debuted today, just missing the 1000 mark:

Four other new Finance apps debuted today, just missing the 1000 mark: