- ACI Worldwide unveiled its mobile engagement platform ACI Smart Engage this week.

- The new solution relies on location, voice, and image recognition to enable consumers to purchase goods and services remotely with a single click.

- The launch of ACI Smart Engage comes at the same time that ACI Worldwide announced a divestment of its business banking unit, ACI Digital Business Banking.

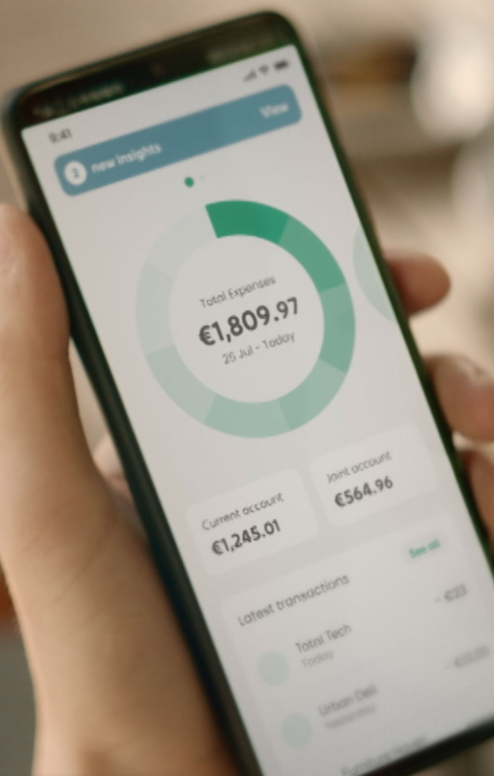

Real-time payments software company ACI Worldwide launched its mobile engagement platform ACI Smart Engage today. The solution leverages location, voice, and image recognition technology to enable merchants to offer their entire inventory of products and services directly to consumers’ smartphones. ACI Smart Engage combines geolocation with scannable media and audio tags inside a range of media types – including TV, print and radio advertisements, posters, magazines, catalogs, window displays, and more. Consumers can use the solution to instantly purchase products and services on-the-go with a single click.

“With ACI Smart Engage, merchants can reach consumers through their smartphones no matter where they are and turn every interaction into an opportunity to sell,” ACI Worldwide head of merchant Debbie Guerra said. “ACI Smart Engage combines the in-store and online experience for consumers by reaching them on their smartphones through various media, including supermarket labels, restaurant menus, or window displays, and driving true mCommerce sales through embedded one-click payments. With ACI Smart Engage, merchants can make ‘window shopping’ a reality.”

Merchants can integrate ACI Smart Engage into their existing mobile apps using Smart Engage SDK APIs. The technology is a part of ACI Omni-Commerce, a secure omni-channel payment processing platform that supports the in-store, online, and mobile needs of modern merchants. ACI Omni-Commerce also offers consumers more of the kind of purchasing experiences they are looking for.

“Consumers are reaching for their smartphones to make informed buying decisions more than ever before,” Guerra added. “With Smart Engage, we enable merchants to reach those consumers at the right time, when they are most likely to make a purchase and then help them complete the purchase with a single click. It fosters direct engagement between merchants and their customers.”

ACI Worldwide’s launch of ACI Smart Engage comes as the company announced a decision to divest its corporate online banking solutions to middle market private equity firm, One Equity Partners. The move is part of ACI Worldwide’s “three-pillar strategy” which is designed to support value creation for shareholders via a focus on growth.

“Our efforts to accelerate organic growth are firmly on track, and we are now making progress on the third pillar, step-change value creation through M&A,” ACI Worldwide president and CEO Odilon Almeida said. “The divestment is in line with our commitment to continually review the company’s portfolio to maximize shareholder value.”

The transaction for ACI Digital Business Banking, as the technology is called, has been valued at $100 million. The deal is expected to close in Q3 of 2022.

A veteran of both Finovate and our developers conference FinDEVr, ACI Worldwide offers real-time payment solutions to help corporations process digital payments, enable omni-commerce, and manage fraud and risk. Founded in 1975 and headquartered in Miami, Florida, ACI Worldwide is partnered with 19 of the top 20 banks around the world, and works with 80,000 merchants directly and through PSPs. The company’s technology facilitates more than 225 billion consumer transactions a year.

With 2021 revenues of $1.4 billion, ACI Worldwide is a publicly-traded company (NASDAQ: ACIW) with a market capitalization of more than $3 billion.