This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

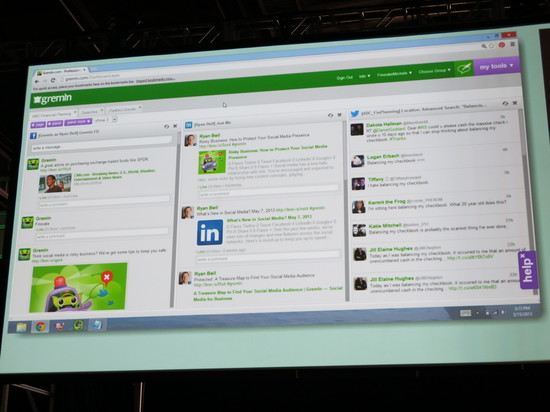

Social media like Facebook and Twitter offer both opportunities and challenges for most financial institutions looking to use these tools to better engage with their customers. Coming next to the stage is

Gremln, with technology specifically geared toward helping FIs take advantage of social media.

“Gremln is introducing its new Secure Social Media version, designed for financial services companies. This new product creates the ability for marketing and compliance departments to work together toward the common goal of utilizing social media to build business and retain customers through engagement; all without violating guidelines set forth by regulatory bodies like the SEC, FFIEC, and FINRA.

Keyword and phrase filtering, abstract concept matching, a structured approval process, archiving and custom permission settings for each department and team member. All posts are subject to an approval process that you custom design. Maximize your use of social media fearlessly.”

Product Launched: November 2012

HQ Location: San Francisco, California

Company Founded: May 2011

Metrics: $750,000 raised; 10 full-time employees; more than 130,000 registered users

Twitter: @Gremln

Presenting Ryan Bell (CEO) and Michele Lain (Customer Service Manager)

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.