It’s another unicorn week in fintech, although “only” $750 million of the nearly $1 billion in new funding was equity. Affirm’s $275 million round was rumored to include about $200 million in debt to fund its alt-lending efforts.

It’s another unicorn week in fintech, although “only” $750 million of the nearly $1 billion in new funding was equity. Affirm’s $275 million round was rumored to include about $200 million in debt to fund its alt-lending efforts.

But that wasn’t even the biggest deal this week. Zenefits, founded by serial entrepreneur and multiple Finovate Best of Show winner Parker Conrad (SigFig, Wikinvest), took in $500 million for its health insurance disruptor. The $4.5 billion valuation puts it at the top of the worldwide fintech private-company valuation-list. Assuming it hasn’t slipped, Square still holds claim to #1 with a $6 billion valuation (October 2014).

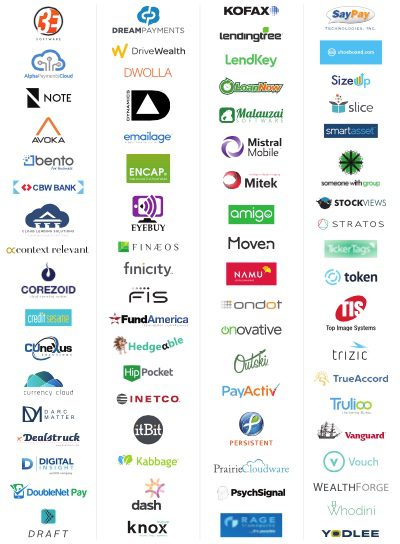

Two demoing companies at next week’s FinovateSpring (register here) received money this week:

- ItBit ($25 million) a NYC-based global bitcoin exchange

- Trizic ($3 million) a new wealth-management-platform provider

In total, 14 companies raised $974 million and change (includes about $200 million of debt). Here are the deals from 2 May through 7 May ranked by size:

Zenefits

Human resources and benefits platform

HQ: San Francisco, California

Latest round: $500 million Series C (at $4.5 billion valuation)

Total raised: $583.6 million

Tags: Health insurance, SMB, payroll, 401k, benefits

Source: Crunchbase

Affirm

Alt-lending at the point-of-sale

HQ: San Francisco, California

Latest round: $275 million (including an undisclosed amount of debt, about $200 million according to TechCrunch)

Total raised: $320 million (including debt)

Tags: Indirect lending, underwriting, point-of-sale financing, SMB, payments

Source: Crunchbase

Real Matters

Real estate risk management (aka Solidifi and iv3CUS)

HQ: Markham, Ontario, Canada

Latest round: $60 million Private Equity

Total raised: $127.1 million (includes $5 million debt)

Tags: Risk management, property valuation, real estate, residential, commercial, enterprise software

Source: Crunchbase

RobinHood

Simple mobile trading service

HQ: Redwood City, California

Latest round: $50 million Series B

Total raised: $66 million

Tags: Investing, stocks, trading, mobile

Source: Crunchbase

ItBit

Global bitcoin exchange

HQ: New York City, New York

Latest round: $25 million

Total raised: $28.3 million

Tags: Bitcoin, crypto-currency, Singapore (market), FinovateSpring 2015 presenter

Source: TechCrunch

Artivest

Curated investing

HQ: New York City, New York

Latest round: $15 million

Total raised: $15 million

Tags: Investing, hedge funds, private equity

Source: Crunchbase

Fintellix (formerly iCreate)

Business analytics and risk management for banks

HQ: Bengaluru, India

Latest round: $15 million

Total raised: $27.4 million

Tags: Enterprise, BI, risk management, compliance

Source: FT Partners

Digit

Automated savings/investing platform for beginners

HQ: San Francisco, California

Latest round: $11.3 million Series A

Total raised: $13.8 million

Tags: Investing, savings

Source: Crunchbase

Zanbato

Private placement tools

HQ: Mountain View, California

Latest round: $8 million Series B

Total raised: $12.1 million

Tags: Investing, institutional investors, alt-investing

Source: FT Partners

VersaPay

Merchant payment processing and electronic invoicing

HQ: Vancouver, British Columbia, Canada

Latest round: $4.8 million Post-IPO equity

Total raised: Unknown

Tags: Payments, acquiring, SMB, merchants, invoicing

Source: Crunchbase

Third Financial Software

Wealth management software

HQ: London, United Kingdom

Latest round: $3.8 million

Total raised: Unknown

Tags: Tercero (brand), investing, portfolio management

Source: FT Partners

Trizic

Wealth management platform

HQ: San Francisco, California

Latest round: $3 million Seed

Total raised: $3 million

Tags: Investing, wealth management, FinovateSpring presenter

Source: Finovate

Omise

Digital payment provider in Southeast Asia

HQ: Bangkok, Thailand

Latest round: $2.6 million Series A

Total raised: $2.9 million

Tags: API, payments, mobile, 500 Startups (investor)

Source: TechCrunch

TradeLab

Indian provider of software for trading platforms

HQ: Bangaluru, India

Latest round: $390,000

Total raised: Unknown

Tags: Banking software

Source: FT Partners

Update: An update of this post

Update: An update of this post  It’s another unicorn week in fintech, although “only” $750 million of the nearly $1 billion in new funding was equity. Affirm’s $275 million round was rumored to include about $200 million in debt to fund its alt-lending efforts.

It’s another unicorn week in fintech, although “only” $750 million of the nearly $1 billion in new funding was equity. Affirm’s $275 million round was rumored to include about $200 million in debt to fund its alt-lending efforts.