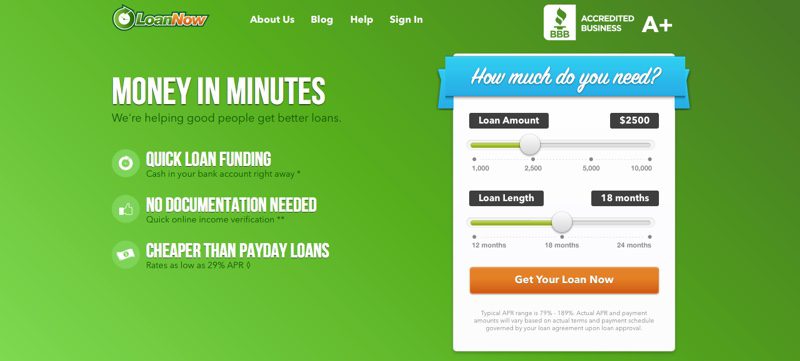

Years after the financial crisis, lenders remain reluctant to fund borrowers with less than perfect credit. LoanNow combines more than a decade of experience in lending; top engineering talent (“most of our team is ex-Amazon” the LoanNow team tells me); and a fresh approach to managing risk to provide better loan programs to the subprime borrowing population.

Company facts:

- Founded June 2013

- Headquartered in Santa Ana, California

- More than $5 million in funding raised

- More than $3 million in loans issued

- 25 employees

“Everybody has friends with bad credit,” says LoanNow CEO Harry Langenberg in a conversation during Finovate week. “But you’d still loan them your car. We’re trying to help people outperform their FICO scores. [In doing so] we are producing a lower-cost loan during the lifetime of the loan.”

From left: LoanNow co-founders Harry Langenberg, CEO, and Miron Lulic, COO, demonstrated LoanNow Group Signing at FinovateSpring 2015 in San Jose.

The story

What makes LoanNow possible is a combination of technological and regulatory opportunities and a group of individuals eager to take advantage of them. Company founder and CEO Harry Langenberg and COO Miron Lulic have more than 12 years of experience building a variety of companies that addressed different consumer needs. After the financial crisis, with banks shunning borrowers with less than sterling credit, Langenberg and Lulic saw an opportunity to work with subprime lenders.

“We saw ourselves as a team of A players in a C-level industry,” they explained. “We could succeed where others were afraid to go.”

What Langenberg and Lulic brought to subprime lending was a belief that a closer focus on individual borrower behavior can bring default rates down. They use algorithms and a variety of technical tools to look at far more factors than the FICO score. “FICO is a bad way to judge people in subprime categories,” Langenberg says. “We don’t just look at past data. We also look at the real-time performance while the borrower is in the loan, as (the borrower) pays it down.”

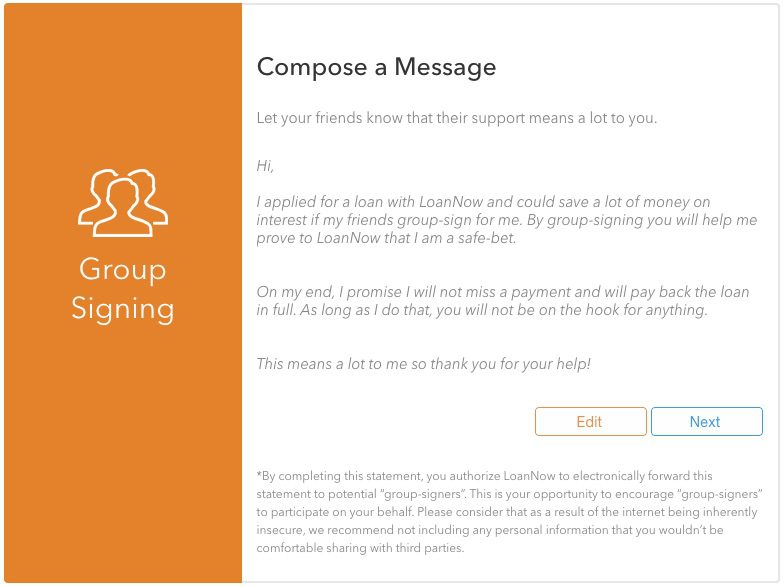

LoanNow’s Group Signing feature, demonstrated at FinovateSpring 2015, is another example of leveraging technology with an understanding of the borrower to make better loans to those unable to rely on traditional lenders. Group Signing lets borrowers leverage their social networks, encouraging friends and family members to pledge to help retire some fraction of the loan if the borrower defaults. Based on the number of group signers and the amounts vouched for, borrowers earn credits to lower the loan rate.

Since lending is risk-based, the core problem of subprime must be solved: reduce the risk of defaults. Langenburg says the goal becomes how to manage and drive down risk when interest rates are high and pricing is up because of defaults.

There’s more to the LoanNow platform than the Group Signing feature. But the feature, demoed at FinovateSpring 2015 in San Jose, is both new and a great example of LoanNow’s concept of “social credit” in action.

How it works

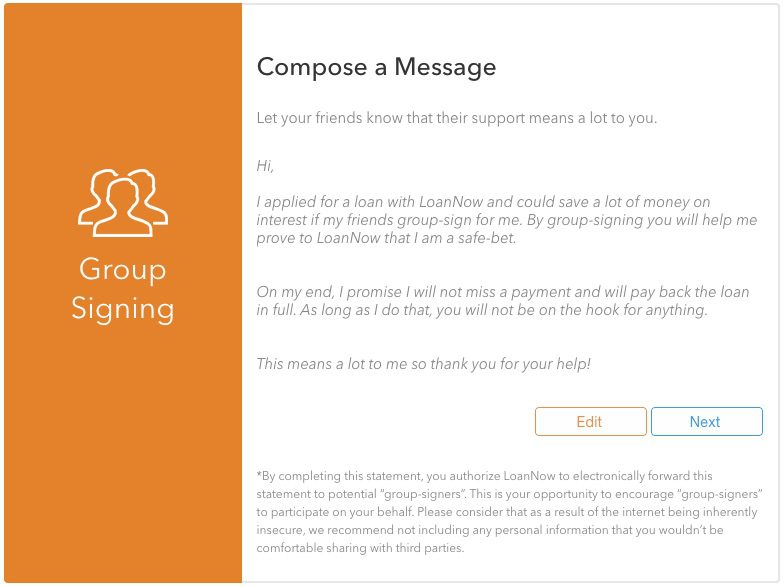

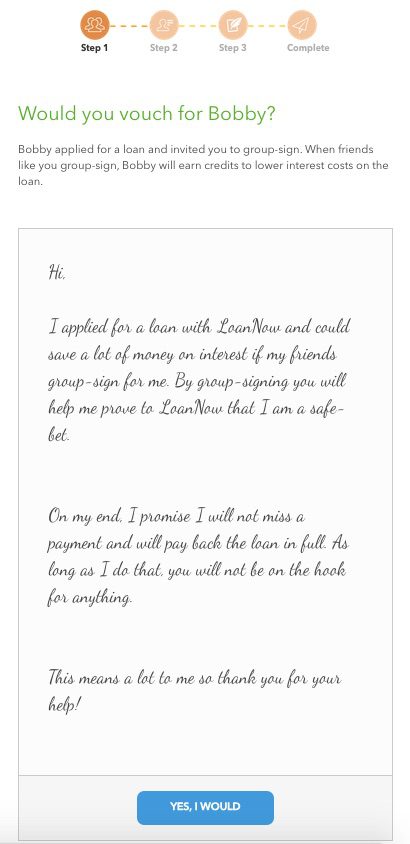

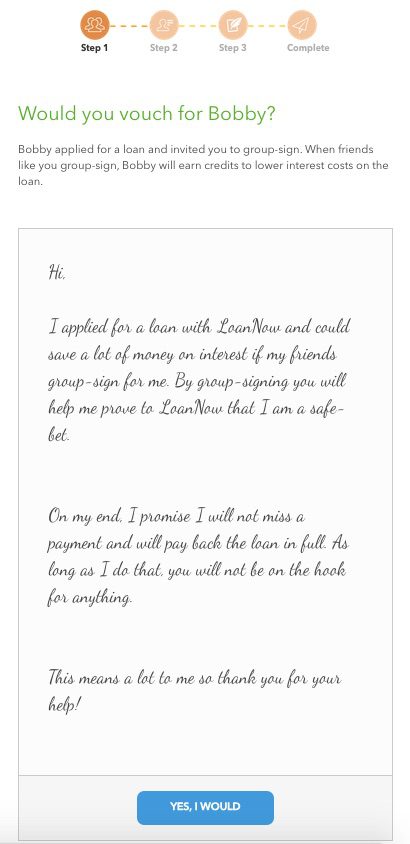

Group Signing takes the traditional concept of co-signing and brings in into the 21st century. Borrowers taking advantage of the Group Signing option use the LoanNow platform to send a note to friends and family members who might be willing to vouch for the LoanNow loan. By vouching, Group Signees agree to pay a fraction of the borrower’s loan in the event of default.

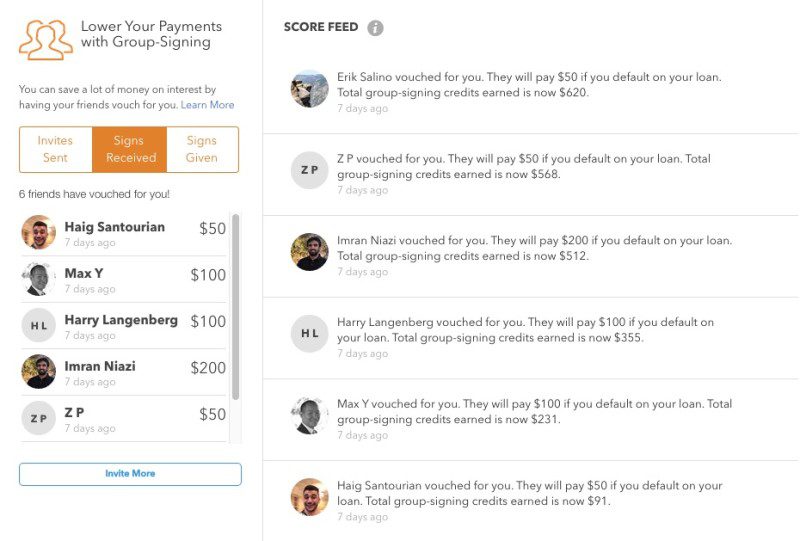

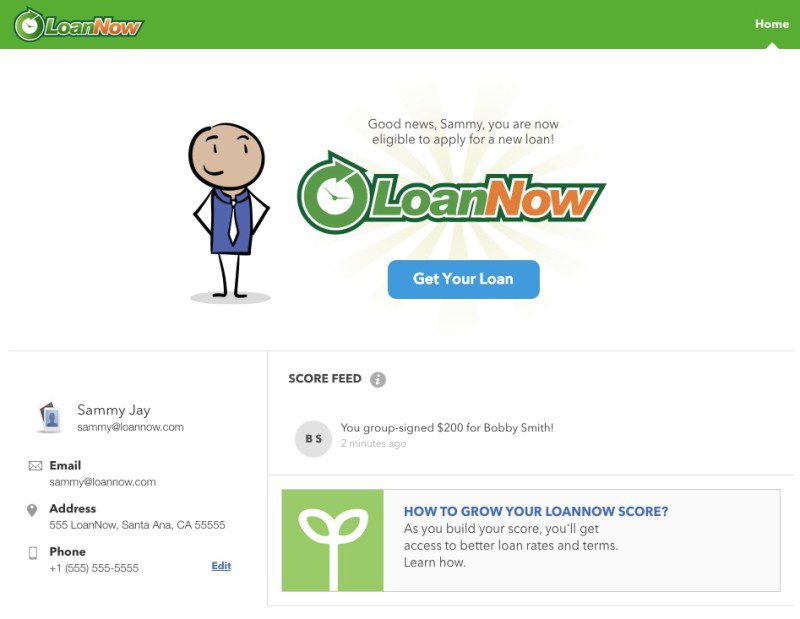

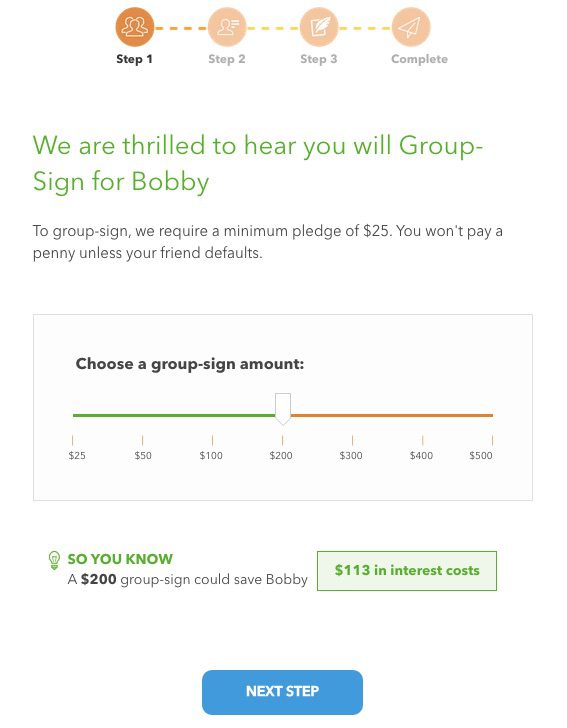

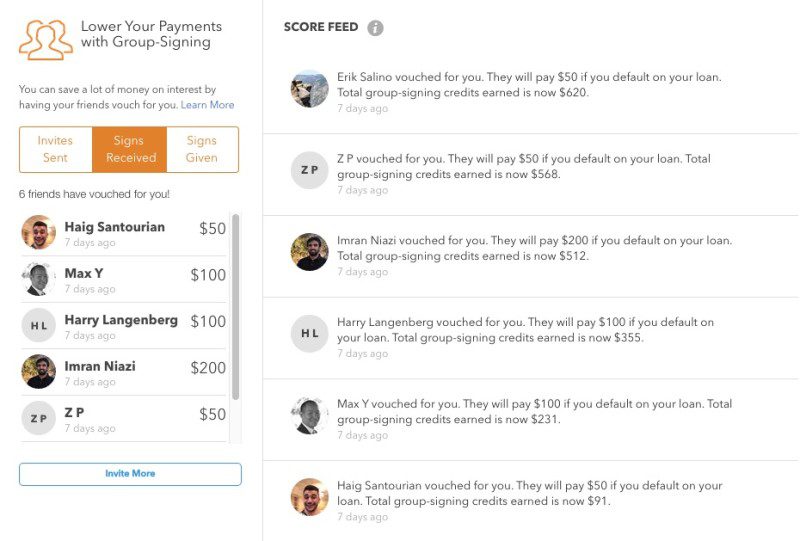

Having a large number of Group Signees (and/or having a significant amount of the loan “group-signed”) gives the borrower credits used to lower the interest rate on the loan. By making debt less expensive and easier to retire, borrowers are better able to improve their credit score. LoanNow’s ultimate goal is to help subprime borrowers move out of the category altogether.

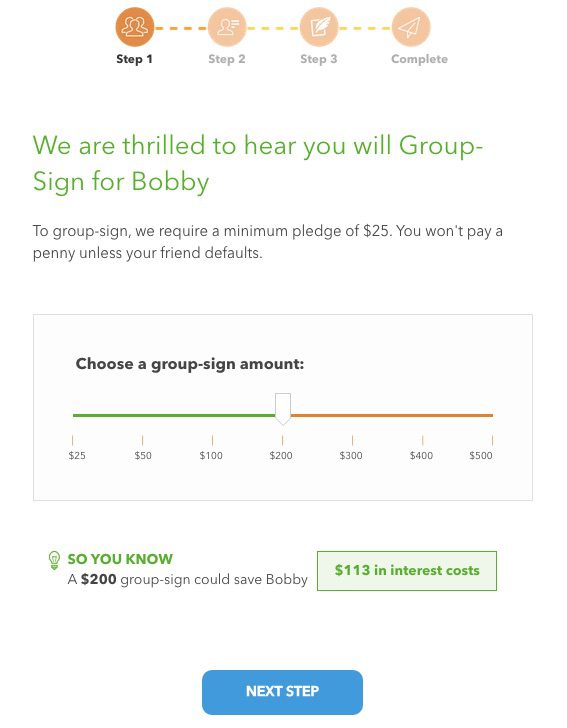

After accepting a Group Signing invitation, the platform thanks the Group Signee for participating and asks for a pledge amount ($25 minimum). Pledges are made with credit/debit cards from Visa, MasterCard, Discover, Maestro, or Visa Electron. Cards are not charged unless the borrower defaults.

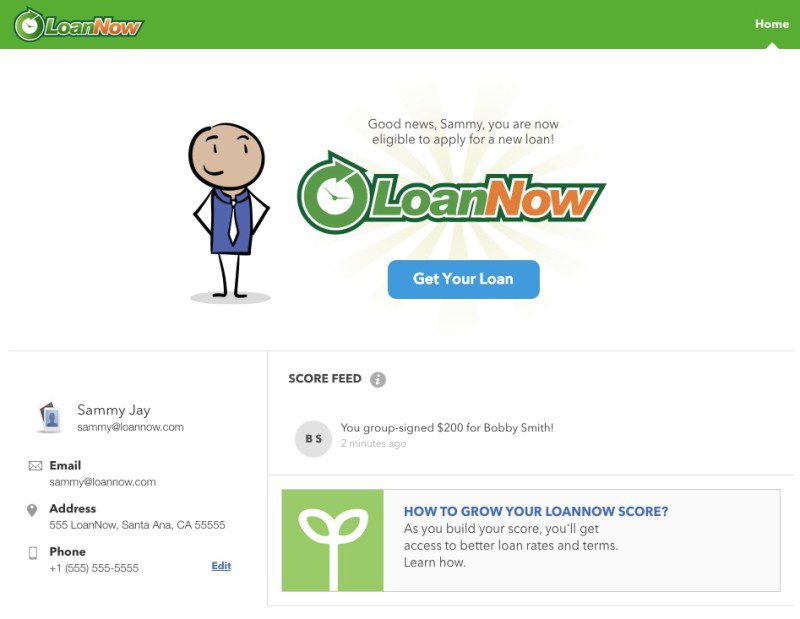

The LoanNow platform provides the borrower with a dashboard to track loan obligations. Friends and family members who have agreed to group-sign or “vouch” loans not only can be tracked, but also any loans the borrower has vouched for. The dashboard also gives a “Score Feed.” The Score Feed reminds the borrower of those who have group-signed for the loan, and also shows the vouch amount and how that vouching contributes to the borrower’s overall group-signing credit total.

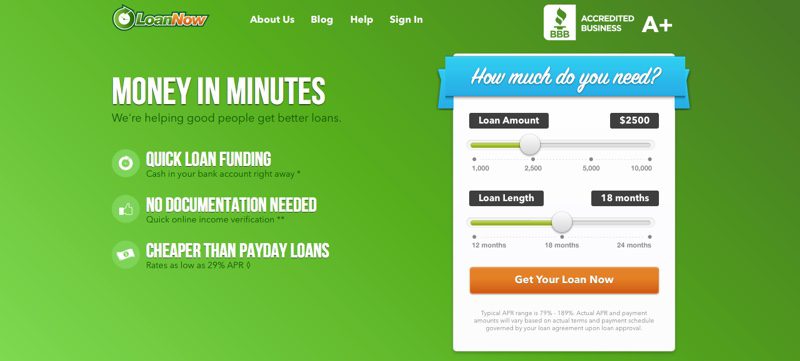

LoanNow currently operates in its home state of California as well as in Utah and Missouri. Loan amounts range from $2,500 to $5,000 in California, and $1,000 to $5,000 in Utah and Missouri. Terms range from 9 months to 24 months. Application is a quick, five-minute process and, as a direct lender, LoanNow can guarantee a rapid response. Loans are deposited directly into the borrower’s account.

The future

Going forward, LoanNow’s biggest focus is to expand operations. Currently in three states, and with 20 employees, the company is looking to double or triple its headcount by the end of the year. While currently lending half-a-million a month, LoanNow would like to triple or quadruple that number in the same time frame. The company is finalizing talks with a financial partner, with a potential announcement coming by the end of June 2015.

“We came to Finovate to meet banks and credit unions and are looking to partner with them,” said Langenberg. “Our platform for subprime borrowers is also a place to monetize leads and [pick up] a mismatch in their loan programs that we can help them fix and monetize.”

“We are investing heavily in the platform, more so than before,” said Langenberg. And that represents a commitment of not only financial capital, but also human capital. “Our platform is an entire banking infrastructure built from scratch,” he said. “We are always looking for great engineers.” LoanNow also boasts of a strong legal team to make sure they remain compliant; the company is also looking for legal talent, with plans to double the size of their legal team by January 2016.

“We are specialists on the behavioral data in this space,” said Langenberg. “We are looking to extend beyond consumer loans to work with less than perfect credit in other categories such as auto loans. We want to be the white-hat leader in this space.”

LoanNow demoed its LoanNow Group Signing technology at FinovateSpring 2015 in San Jose.