Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).

Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).

In total, 11 companies raised $85 million ($2.7 million was debt) including three Finovate alums: CashStar ($15 million); Socure ($2.5 million); AnchorID ($200,000).

Here are fundings from 1 Aug through 7 Aug 2015 by size:

Ezetap

Mobile point-of-sale system

HQ: Bangalore, India

Latest round: $23.5 million Series C

Total raised: $35 million

Tags: Payments, POS, acquiring, credit/debit cards, mobile, merchants, SMB

Source: Crunchbase

SavingsGlobal

European deposit brokerage

HQ: Berlin, Germany

Latest round: $21.8 million Series B

Total raised: $32 million

Tags: Deposits, investing, savings accounts, brokerage

Source: Crunchbase

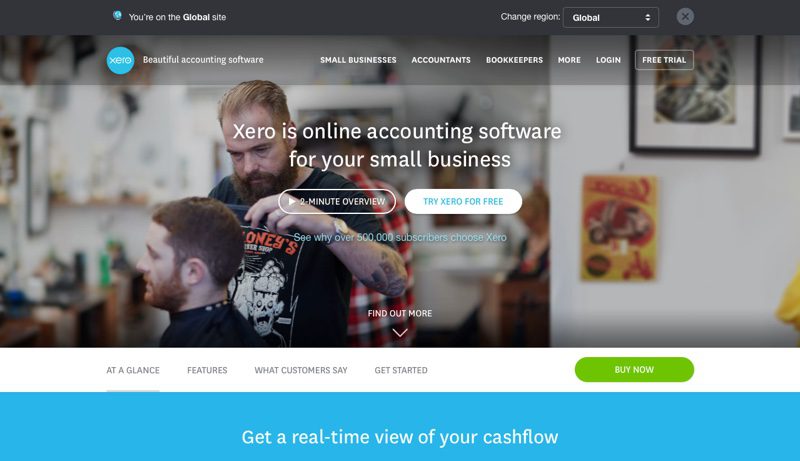

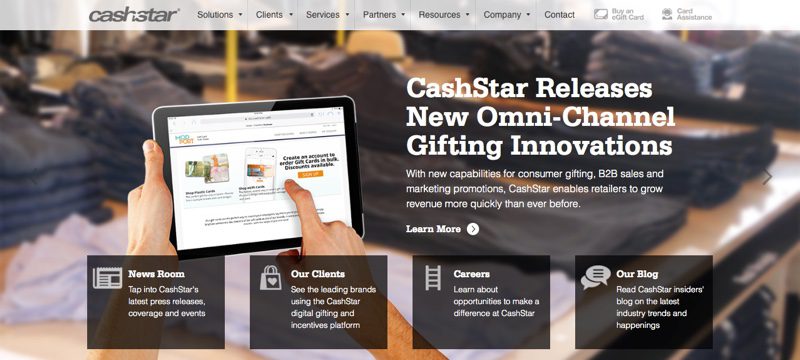

CashStar

Prepaid solutions for retailers and restaurants

HQ: Portland, Maine

Latest round: $15 million Series D

Total raised: $50 million

Tags: Payments, prepaid, gift cards, Finovate alum

Source: Finovate

Driveway

Smartphone telematics software

HQ: San Francisco, California

Latest round: $10 million

Total raised: $11.6 million

Tags: Insurance, automobile, auto loans

Source: FT Partners

Beat the Q

Mobile ordering and payments platform

HQ: Surrey Hills, Australia

Latest round: $5 million Series A

Total raised: $5 million

Tags: Payments, mobile, point of sale, POS, merchants, SMB

Source: Crunchbase

BankFacil

Consumer loan site

HQ: Sao Paulo, Brazil

Latest round: $3 million Series A

Total raised: $4.4 million

Tags: Loans, credit, lead generation, consumer

Source: Crunchbase

Socure

Social biometrics solutions

HQ: New York City, New York

Latest round: $2.5 million Debt

Total raised: $7.2 million ($4.7 million equity, $2.5 million debt)

Tags: Security, authentication, account opening, ID verification, Finovate alum

Source: Finovate

Payable

Contractor payments platform

HQ: San Francisco, California

Latest round: $2.1 million Seed

Total raised: $2.1 million

Tags: Payments, accounts payable, human resources, payroll, contractors

Source: Crunchbase

Nest Wealth

Canadian online wealth manager

HQ: Toronto, Ontario, Canada

Latest round: $1.5 million

Total raised: $1.5 million

Tags: Investing, wealth management, mobile

Source: Crunchbase

GREX

Equity marketplace

HQ: Pune, India

Latest round: $625,000 Series A

Total raised: $625,000

Tags: Investing, startups, equity, crowdfunding, peer-to-peer

Source: Crunchbase

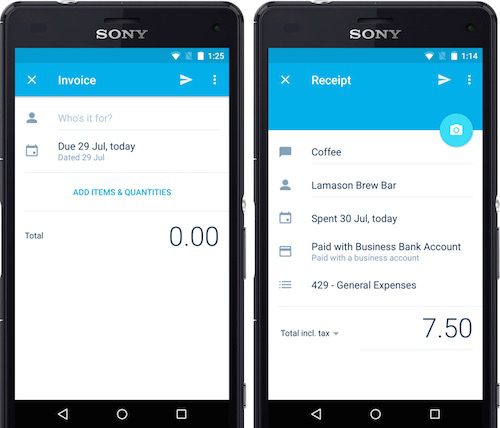

AnchorID

Mobile authentication solution

HQ: Kingston, New York

Latest round: $200,000 Convertible Note

Total raised: $800,000

Tags: Security, biometrics, authentication, account opening, credit score, Finovate alum

Source: Crunchbase

Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).

Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).