As always, we had a blast watching the 71 companies demo their new tech live in front of the FinovateSpring audience in San Jose. It’s almost as fun to relive the conference through post-event press coverage and Twitter highlights.

Below is the press coverage so far. We’ll be adding articles as they are published throughout the next few weeks. If we missed your coverage, please send an article link to [email protected]).

Aite

2015 FinovateSpring Spree

by David Albertazzi’s

Link

American Banker

Accenture Teams with Moven to Develop Digital Banking Tools

by Jacob Passy

Link

Mitek Debuts ID Scanning Tech for Account Opening

by Penny Crosman

Link

New Banking App Aims for the Instagram Set

by Mary Wisniewski

Link

Asaahi

Finance and IT of fusion, hear how far to Finovate founder (in Japanese)

by Miyaji Yu

Link

Investment net settlement in the IT venture wave application of the U.S. financial (in Japanese)

by Miyaji Yu

Link

Bank Innovation

CIBC First to Launch Funds-Transfer for Apple Watch

by JJ Hornblass

Link

In the Bank Account of the Future, Context is King

by Philip Ryan

Link

Moven Preps PayPal Integration, Global Growth

by Philip Ryan

Link

Barbara Friedberg Personal Finance blog

Finovate, a Glimpse into Your Money-Tech Future

by Barbara Friedberg

Link

Beyond the Arc blog

Finovate 2015 Day 1: video commentary on financial innovation and fintech

by Steven Ramirez

Link

Finovate Spring 2015: Fintech innovation for banking and wealth management

by Steven Ramirez

Link

The Latest in Financial Services Innovation from Finovate

by Steven Ramirez

Link

Video interview with JP Nicols, Bank Innovators Council

by Steven Ramirez

Link

Biometric Update

SayPay Technologies, VoiceVault to deliver voice-biometric payments solutions

by Justin Lee

Link

Boston Financial Data Services

Friction is the Enemy of Speed

by Matthew Gould

Link

CBanque

FinovateSpring marque le retour du PFM

Link

CMO.com

What You Missed At Finovate: Social Banking Experiences

by Michael Hinshaw

Link

CU Times

Community FIs Out-Innovating Big Banks: Onsite Coverage

by Roy Urrico

Link

Finovate Emphasizes Engagement: Onsite Coverage

by Roy Urrico

Link

Finovate Presenters Share Innovations: Onsite Coverage

by Roy Urrico

Link

Mobile Tech Innovation Vital: Onsite Coverage

by Roy Urrico

Link

Payment Technology in the Cards: Onsite Coverage

by Roy Urrico

Link

Sizing Up Small Business Lending: Onsite Coverage

by Roy Urrico

Link

Dwolla blog

5 of our Favorite Demos from Finovate Spring

by Mariah Young

Link

The Financial Brand

3 Fintech Innovation Trends Banking Should Watch

by Steven J. Ramirez

Link

New Moven App Encourages Savings, Eliminates Product Silos

by Jim Marous

Link

Financial Services Club

Brett King’s Moven 4.0 wins Best in Show at Finovate

by Jim Marous

Link

Finextra

Moven and Accenture team up to sell digital tools to banks

Link

The Fintech Blog

My Take on Finovate

by Michael Halloran

Link

Finovate blog

FinovateSpring 2015 Best of Show Winners Announced

by David Penn

Link

Forbes

Moven Takes Its Mobile Banking Global with Accenture

by Tom Groenfeldt

Link

iontuition blog

Credit Sesame, iontuition join forces to empower students

Link

Javelin Strategy & Research blog

Dear Fintech, Give People Meaningful Experiences, Not Gold Stars

by Meg Cain

Link

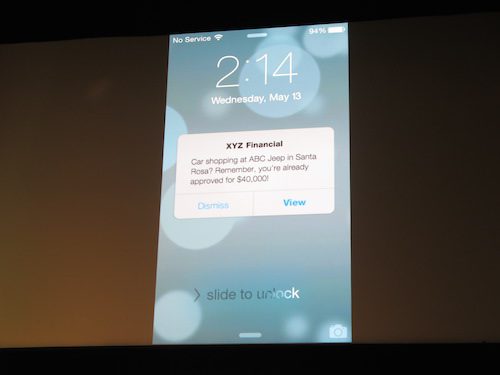

Finovate Showed That Fintech is Becoming Personal. Will Banks Have the Confidence to Be “Creepy,” Too?

by Ian Benton

Link

Lazy Man and Money

Who Wants In on the DRAFTApp Private Beta?

Link

Lend Academy

Cloud Lending Solutions Launches Loan Application Exchange

by Ryan Lichenwald

Link

Let’s Talk Payments

Breaking: Finovate Announces the Winners of its FinovateSpring 2015

Link

PFM App Moven Joins Forces with Accenture to Transform Digital Banking Solutions

Link

This Cloud Solution Provides Apple Pay-Like Payment Experience to Android Users

Link

Mitek Blog

Cool. Fast. ID Verification.

by Amber

Link

Mobile Payment Magazine

Dream Payments Mobile POS Device Presented @Finovate

by Peter Goggin

Link

Mobile Payments Today

Stratos upgrades digital card-issuance strategy

Link

Money Marketing

Ian McKenna: Dispatches from Finovate (Day one)

by Ian McKenna

Link (sign-up wall)

Ian McKenna: Dispatches from Finovate (Day two)

by Ian McKenna

Link (sign-up wall)

MoneySummit

Essential Fintech Reading: 9-15 May 2015

by Jon Ogden

Link

Nerd Wallet

NerdWallet Gets $64 Million on Road to $1 Billion Valuation as Money Pours Into Fintech

by Michael Halloran

Link

Payment Law Advisor

Finovate Summary

by Davis Wright Tremaine

Link

The Paypers

Accenture and Moven partner for digital banking solutions

Link

PYMNTS.com

Kabbage’s Next-Phase Finserv Solution for SMBs

Link

Mitek’s New Mobile Tech Verifies Driver’s Licenses

Link

SizeUp blog

Beyond the Arc: Emerging Theme of Small Business in Fintech with SizeUp FI

Link

The Street

Wells Fargo, Schwab Mingle with Disruptive Financial Tech Start-Ups at Finovate

by Michael HalloranFollow

Link

Taxes.about.com

10 Emerging Financial Technology Apps with a Tax-Angle

by William Perez

Link

TechCrunch

Credit Monitoring and Debt Management Service, Credit Sesame, Raises $16 Million

by Sarah Perez

Link

Vouch Raises $6 Million Series A for its Social Network for Credit

by Sarah Perez

Link

Visible Banking

Moven Demoes its Impulse Saving App on the Apple Watch

by Christophe Langlois

Link

Wall Street Journal Blog

Vouch Raises $6 Million for Loans Backed by Borrower’s Social Network

by Lizette Chapman

Link

WealthManagement.com

Finovate Spring 2015: 72 Startups Demonstrate New Fintech Products

by Ryan W. Neal

Link

Finovate Spring 2015: 7 Wealth Management Innovations, Day 1

by Ryan W. Neal

Link

Finovate Spring 2015: 7 Wealth Management Innovations, Day 2

by Ryan W. Neal

Link

Wharton Magazine

Finovate 2015: Reporter’s FinTech Notes

by Paulynn Yu

Link

William Mills Agency Blog

FinovateSpring 2015, Day 1: Afternoon Recap

by William Mills III and Steven J. Ramirez

Link

FinovateSpring 2015, Day 2: Afternoon Video Recap

by William Mills III & Steven J. Ramirez

Link

FinovateSpring 2015, Day 2: Morning Video Recap

by William Mills III & Steven J. Ramirez

Link

FinovateSpring 2015, Video Interview with Beyond the Arc and CCG Catalyst

by Steven J. Ramirez

Link

FinovateSpring 2015, Video Interview: Beyond the Arc and Fin Mason

by Steven J. Ramirez

Link

Live Blog at FinovateSpring 2015, Day 1

by William Mills III and Steven J. Ramirez

Link

Live Blog at FinovateSpring 2015, Day 2

by William Mills III and Steven J. Ramirez

Link

Morning Video Recap, FinovateSpring 2015

by William Mills III and Steven J. Ramirez

Link

Yodlee Interactive blog

Highlights from FinovateSpring 2015: Fintech Innovators and Yodlee Sense

by Jenna Cheng

Link

A huge thank-you to everyone who spent their nights and weekends covering the event!

While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

Alpha Payments Cloud

Alpha Payments Cloud