Perhaps due to the holiday-shortened week in the United States, it was a week of smaller rounds as 16 companies raised a total of $68 million (of which $8 million was debt), with only two above seven figures (Payfirma, Kantox). That compares to an average of $340 million per week so far this year.

Perhaps due to the holiday-shortened week in the United States, it was a week of smaller rounds as 16 companies raised a total of $68 million (of which $8 million was debt), with only two above seven figures (Payfirma, Kantox). That compares to an average of $340 million per week so far this year.

And, like a fintech Noah’s Ark, everything was in pairs this week:

- Two companies out of Istanbul (TravelersBox, Iyzico)

- Two from Edinburgh (FreeAgent, Intelligent Point of Sale)

- Two out of London (Kantox, Monese)

- Two from Canada (Payfirma, Koho)

- Two new neo-banks (Koho, Monese)

- Two P2P lenders (Acquire, Fellow Finance)

- Two investment managers (InvestView, Wealthminder)

And of course, two Finovate alums received major new rounds ($11 million to Kantox; $8 million credit line to LendKey), while one other alum raised $300,000 of what is expected to be a $1.6 million round (FreeAgent).

The total raised in May 2015 was $1.6 billion and the YTD total is $7.2 billion.

Here are the deals from 23 May to 28 May by size:

Payfirma

Multichannel payment processing

HQ: Vancouver, BC, Canada

Latest round: $13 million

Total raised: $23.5 million

Tags: Payments, merchants, acquiring, POS, SMB

Source: Crunchbase

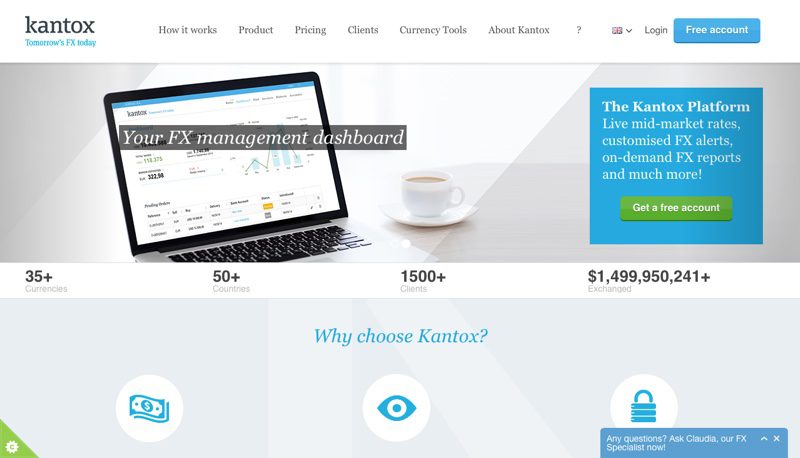

Kantox

Foreign exchange and remittance platform

HQ: London, United Kingdom

Latest round: $11 million

Total raised: $21.2 million

Tags: FX, currency exchange, remittances, payments, Finovate alum

Source: Finovate

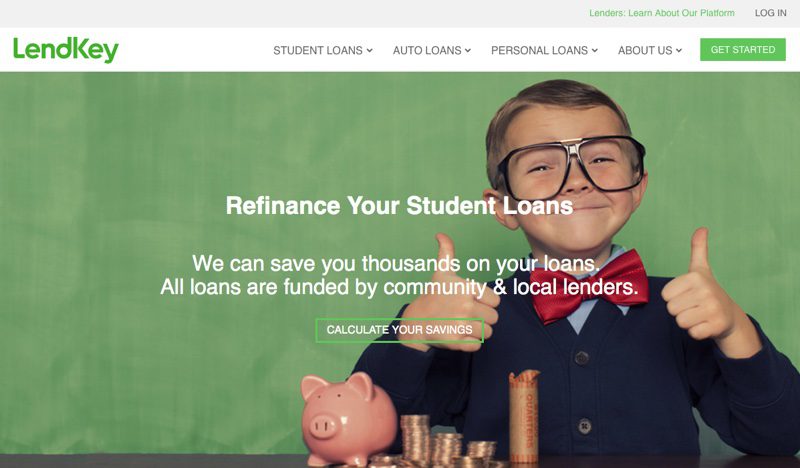

LendKey

Cloud-based lending platform

HQ: New York City, New York

Latest round: $8 million Debt

Total raised: $31.7 million

Tags: Lending, enterprise, loans, Finovate alum

Source: Crunchbase

Iyzico

Payment system management platform

HQ: Istanbul, Turkey

Latest round: $6.2 million Series B

Total raised: $9.0 million

Tags: Payments, enterprise

Source: FT Partners

Acquire Real Estate

Commercial real estate investing marketplace

HQ: New York City, New York

Latest round: $6.0 million

Total raised: $6.0 million

Tags: P2P lending, peer-to-peer, investing, crowdfunding, commercial mortgage lending

Source: Crunchbase

InvestView

Investing information

HQ: Red Bank, New Jersey

Latest round: $5.0 million

Total raised: $5.0 million

Tags: Investment information, education tools

Source: FT Partners

TravelersBox

Solution for collecting leftover foreign currency

HQ: Istanbul, Turkey

Latest round: $4.0 million (two weeks ago we reported $500,000 of this $4.5 million round)

Total raised: $4.5 million

Tags: Cash, currency, gift cards, rewards

Source: Crunchbase

eGifter

Online consumer gift card platform

HQ: Huntington, New York

Latest round: $3.5 million

Total raised: $8.9 million

Tags: Cash, currency, gift cards, rewards, consumer, prepaid debit

Source: Crunchbase

EverCompliant

Fraud and compliance solutions for merchant acquirers

HQ: Tel Aviv, Israel

Latest round: $3.5 million Series A

Total raised: $3.5 million

Tags: Payments, card processing, merchants, POS, SMB

Source: Crunchbase

Fellow Finance

Finnish P2P lending marketplace

HQ: Helsinki, Finland

Latest round: $2.2 million

Total raised: Unknown

Tags: P2P lending, peer-to-peer, alt-finance, crowdfunding, investing

Source: P2P-Banking.com

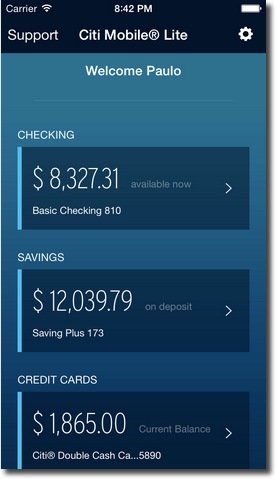

Monese

U.K.-based neo-bank

HQ: London, United Kingdom

Latest round: $1.8 million

Total raised: $1.8 million

Tags: Prepaid debit card, personal finance, PFM, mobile, consumer

Source: EU Startups

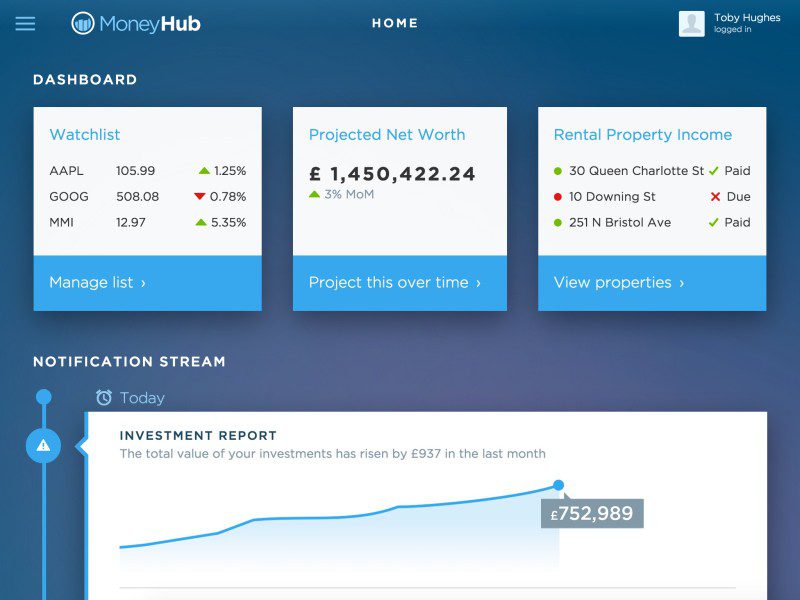

Wealthminder

Personal investment manager

HQ: Reston, Virginia

Latest round: $1.45 million Seed

Total raised: $1.7 million

Tags: Investing, PFM, wealth management

Source: Fortune

Koho

New Canadian mobile neo-bank

HQ: Toronto, Canada

Latest round: $1.0 million Seed

Total raised: $1.0 million

Tags: Mobile banking, prepaid debit card, personal finance, PFM, consumer

Source: Crunchbase

Intelligent Point of Sale

iPad-based POS system

HQ: Edinburgh, Scotland, United Kingdom

Latest round: $770,000 Angel

Total raised: $770,000

Tags: Acquiring, POS, SMB

Source: Crunchbase

FreeAgent

Online accounting service

HQ: Edinburgh, Scotland, United Kingdom

Latest round: $300,000 Series B

Total raised: $5.3 million (includes $5 million debt)

Tags: Accounting, bookkeeping, accounts receivables, SMB, Finovate alum

Source: Crunchbase

Newgen Payments

Ecommerce & payments platform for online merchants

HQ: New Delhi, India

Latest round: Undisclosed Angel

Total raised: Unknown

Tags: Ecommerce, payments, SMB

Source: Crunchbase