eChecks.com | deluxe.com/blog/tag/epayments | @deluxecorp

Deluxe Corporation is a changing, evolving, growing company. Strategic acquisitions have created a unique suite of services helping businesses and financial institutions to attract and retain customers, including marketing services and payment solutions. Creativity, innovation and entrepreneurial spirit—combined with the resources and strength of a well-established company—creates a culture expected at a startup rather than a Fortune 1000 company. Our customer base includes nearly 4.6 million businesses, approximately 5,600 financial institutions, and 6 million individual customers. The eCheck is cutting-edge technology combining the best of check writing with the convenience of email, giving businesses a fast, easy payment solution.

Deluxe Corporation is a changing, evolving, growing company. Strategic acquisitions have created a unique suite of services helping businesses and financial institutions to attract and retain customers, including marketing services and payment solutions. Creativity, innovation and entrepreneurial spirit—combined with the resources and strength of a well-established company—creates a culture expected at a startup rather than a Fortune 1000 company. Our customer base includes nearly 4.6 million businesses, approximately 5,600 financial institutions, and 6 million individual customers. The eCheck is cutting-edge technology combining the best of check writing with the convenience of email, giving businesses a fast, easy payment solution.

eChecks—electronically delivered checks

Financial institutions process 20 billion paper checks worth $30 trillion every year in the U.S. alone. Deluxe eChecks combines the best of check writing with the convenience and speed of email delivery. We’ll explain exactly how eChecks technology works, including the ability to integrate remittance data as well as securely send thousands of payments at one time, and how you can easily leverage them in your application to send/receive payments without paying transaction fees.

Key takeaways:

- How the oldest form of non-cash payment, the check, has been modernized

- How to easily leverage eChecks into your application to send/receive hundreds to

thousands of dollars in payments at once - Why and how to use eChecks in your application

Presenter:

Dean Tribble, VP ePayment Product Engineering and Development

LinkedIn

Tribble has been innovating in technology for 30+ years, including asynchronous Promises before the internet, hypertext technologies that led to the URL before the web, and information marketplaces before eBay. He was CTO and founder of Agorics Inc. His teams architected the first Java-based client-server brokerage-information system for Schwab, the first electronic check service for the FSTC, and an enterprise-wide application and infrastructure security system for Sun Microsystems. Tribble invented secure email technology for business that was acquired by Microsoft, where he then led development of security and compliance features for Microsoft Exchange. As a principal architect, he participated in security and operating system incubation work that led, for example, to new asynchronous features, such as “awaits” in C#. Tribble co-invented the eCheck service as a founder and CTO of VerifyValid and continues to lead that development as the VP of ePayment product engineering and development at Deluxe.

American Express

American Express

Linqto

Linqto

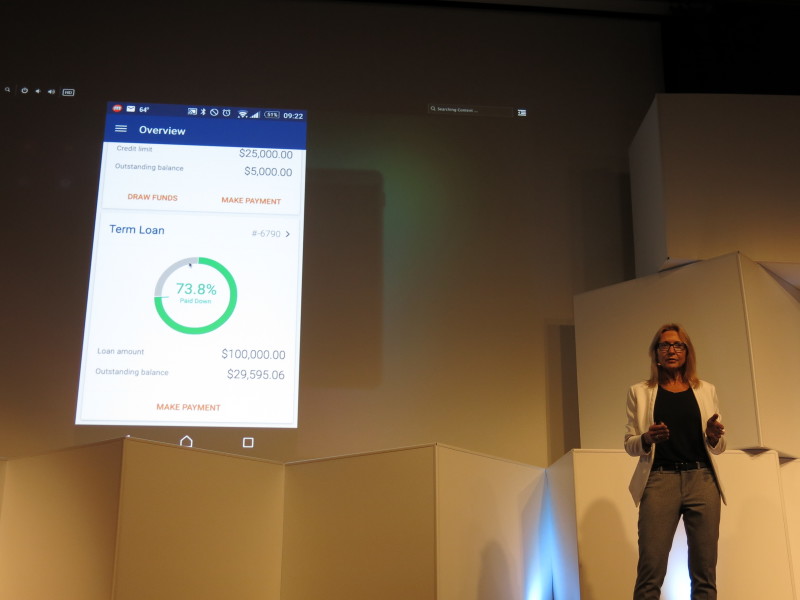

OnDeck

OnDeck