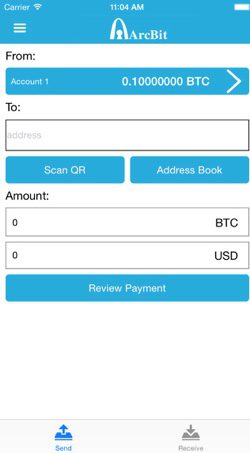

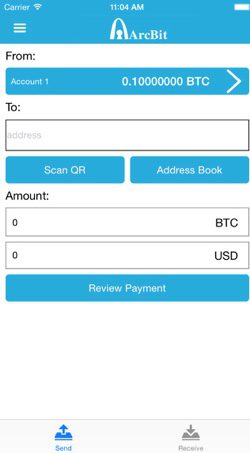

One of the challenges facing broader adoption of bitcoin is having a safe, ready, and convenient way to store, send and receive your cryptocurrency.

ArcBit founder and former Blockchain.info developer Tim Lee has a solution: a full-featured, secure, and easy-to-use bitcoin wallet app with built-in email and help support.

And while the wallet is built for beginners, ArcBit has plenty of functionality for bitcoin veterans as well. The wallet supports forward, reusable, and stealth addresses, and can import bitcoins from outside sources including bitcoin private keys, encrypted keys, and watch-only addresses.

ArcBit founder Tim Lee demonstrated the ArcBit bitcoin wallet at FinovateFall 2015 in New York City.

ArcBit facts:

- Founded in June 2015

- Headquartered in New York City, New York

- Four employees

- Currently available on iOS, with web-based and Android versions expected in 2016

How it works

In many ways, the ArcBit bitcoin wallet functions as any other digital wallet. Users can send and receive bitcoins from a contact list. Senders get instant notification and recipients get instant delivery—all without the cost or inconvenience of a middleman.

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.”

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.”

Historically, it has been too difficult or too inefficient for most people to secure bitcoin wallets. Up until recently, Lee says, best practices were simply backing up the entire wallet on a USB then tucking it safely away. Lee even suggests that the complexity of backing up contributed to the downfall of bitcoin exchange, Mt. Gox.

ArcBit solves the problem with the use of a 12-word passphrase. For those who prefer not to rely on passcodes, ArcBit also features the ability to back up the wallet to iCloud.

Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.

Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.

The future

Tim Lee has little time for those who insist on trying to separate bitcoin from the increasingly headline-grabbing blockchain technology that supports it. “They are inseparable,” Lee said. “Tech folks get it, but banks still need the explanation.”

According to Lee, others who get it are people living in developing countries where the idea of having control over your money can be an almost existential concern. “Consider what happened in Cyprus, in Greece,” Lee said. He has seen interest in the technology from people living in countries with very high inflation as well as countries with poor banking systems. “Most of the benefits (of bitcoin) will come out of emerging markets,” he said.

Part of Lee’s goal in attending Finovate was to gauge the interest in the technology among the venture capital community. Lee gives VCs more credit for understanding the technology, saying that it is very different from how it was as recently as three years ago. “They kinda get the technology,” Lee said. The trick, he added, is “convincing them of ArcBit’s role in it.”

Check out the demo video from ArcBit from FinovateFall 2015.

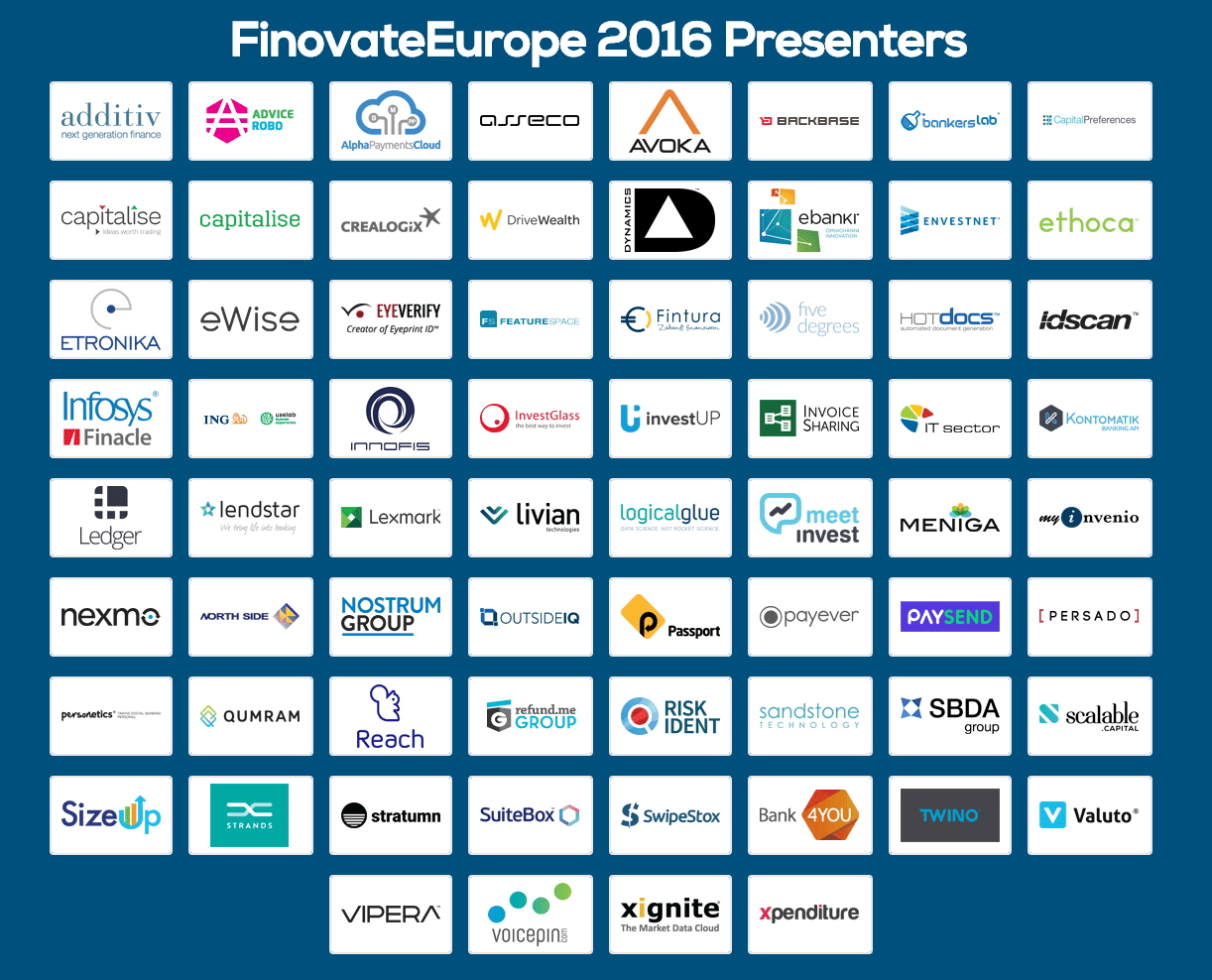

![]() A look at the companies demoing live to 1,500 fintech professionals. Get your tickets to join us in London!

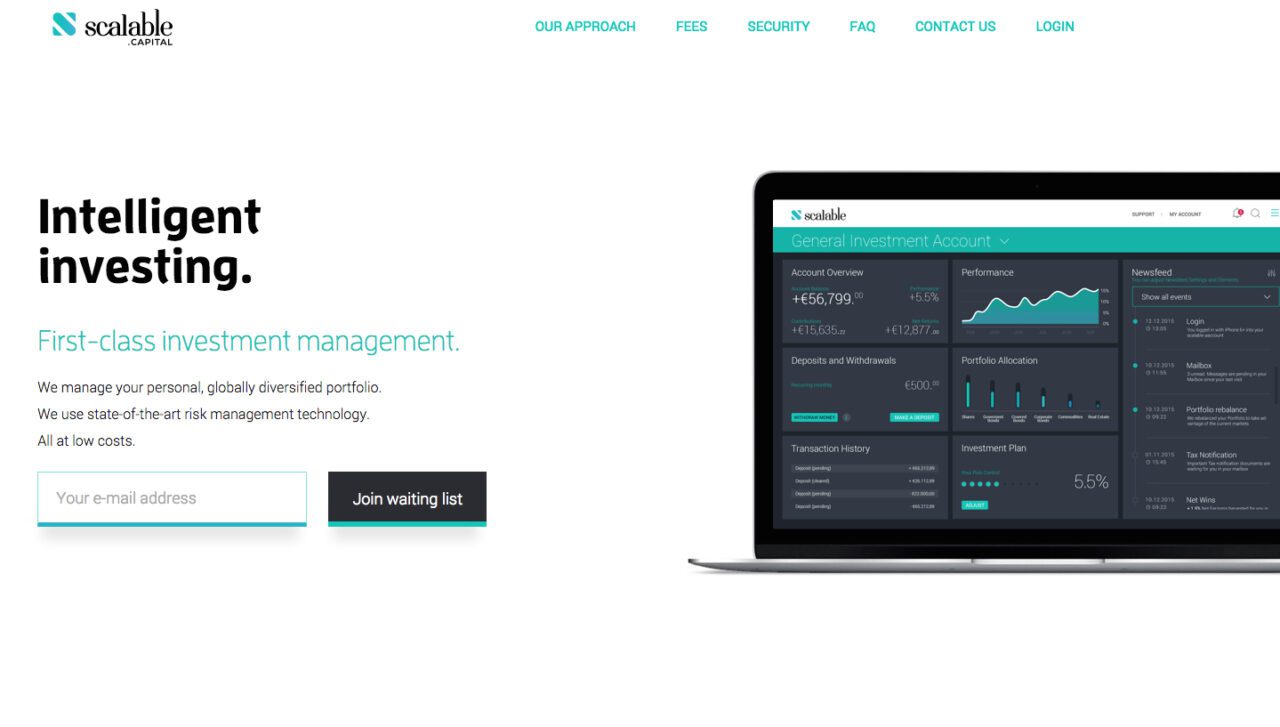

A look at the companies demoing live to 1,500 fintech professionals. Get your tickets to join us in London! Presenters

Presenters Adam French, Founder and U.K. Managing Director

Adam French, Founder and U.K. Managing Director

Presenters

Presenters Bob Youakim, CEO

Bob Youakim, CEO

Presenters

Presenters

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.”

What sets apart the ArcBit wallet is the way it enables the user to back up and store digital assets. “How do you secure your wallet if you are the only one who controls it?” Lee asks, insisting that “when you have full control over your money, you also bear the responsibility of keeping your own money safe and secure.” Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.

Unlike ordinary passphrases that simply provide access, ArcBit users can recover their entire wallet balance on another device—without requiring ArcBit to be installed on that device, or even a cloud-based backup. This is because the back-up technology is an open bitcoin standard. “This is one of the many great things about an open platform like bitcoin,” said Lee. To back up, all the user has to do is access the wallet’s “Restore Wallet” feature in settings, and copy and paste their passphrase. Backing up the wallet takes only a few moments.