The goal of Alpine Data Labs, Marketing Manager Sanjna Parulekar explained during a conversation at the conference, is not just technology that “tells you things about your data.” But instead is a platform that offers truly predictive analysis for customers in wealth management, credit/risk analysis, and financial media—among other verticals.

A specialist in enterprise software focused on advanced analytics, machine learning and big data platforms like Hadoop, Spark, and relational databases, Alpine Data Labs provides companies with the tools and collaborative environment they need to build analytic applications. “How can you actually make the power of big data and machine learning accessible to everybody in your organization so that it hits them in their everyday activities?” company co-founder and Chief Product Officer Steven Hillion asked from the Finovate stage last fall. “That’s what drives us.”

Pictured (left to right): Alpine Data’s Steven Hillion, co-founder and CPO, and Josh Lewis, VP, industry applications, demonstrating Alpine Touchpoints at FinovateFall 2015.

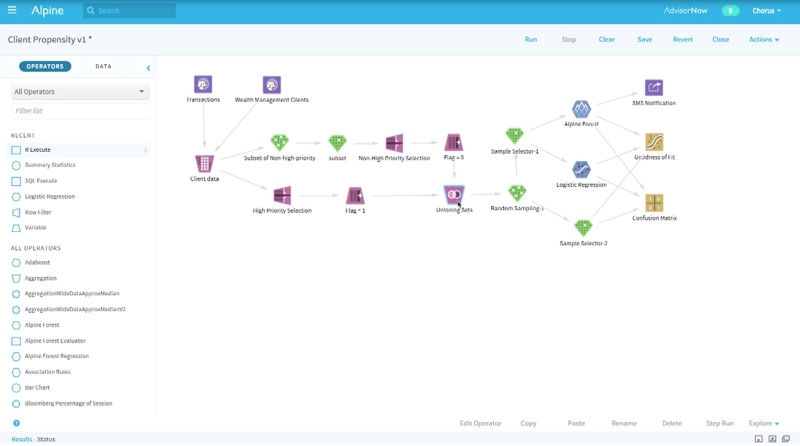

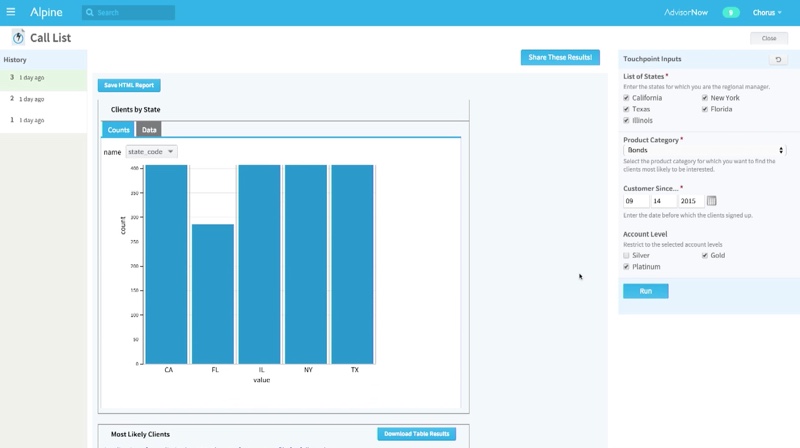

In its Finovate Debut, Alpine Data Labs introduced Alpine Touchpoints, a new layer to the company’s advanced analytics platform that allows everyday users to ask questions of their data and get answers “in the language of business, not the language of advanced analytics” as Hillion put it. Complex workflows leveraging machine learning and parallelized algorithms can be used to build tools like propensity models to help better match clients with products. Touchpoints allows the strategist then to build and test variations on these models and to deploy them automatically to the individual wealth manager via the Alpine platform—no APIs or data integrations required.

“And now we have this additional data point,” Hillion said, describing the newly updated dashboard of his sample wealth manager. ” But think about the power behind that column: “It’s using all the power of predictive analytics and big data machine learning to populate it. But in a way that is directly accessible to the wealth advisor,” he explained.

Stats:

- Founded in 2011

- Headquartered in San Francisco, California

- Raised $32 million in funding

- Joe Otto is CEO

How it works

We sat down with Alpine Data Labs Marketing Manager Sanjna Parulekar to learn a little bit more about the company and how is helping financial services businesses – and others –Â turn their Big Data into predictive analysis and information.

Finovate: What problem does Alpine Data Labs solve?

Parulekar: The goal of Alpine Data Labs is to build a broad analytics engine. The platform has many use-cases in financial services, such as wealth management. Alpine Touchpoints, which we are presenting at Finovate, helps wealth managers turn informational, largely historic data into actionable, predictive analytics.

The real problem is around the way wealth managers consume data. Much of it is historical data—birthdates, number of kids, income, etc.)—and not predictive. That’s our bread and butter—predictive analysis. Not just telling you things about your data.

Finovate: Who are your primary customers?

Parulekar:Â Alpine Data currently serves more than 1,600 wealth advisers. We have large customers in Europe, and our mature verticals include financial services, retail, and telecom, where we are helping reduce churn. Healthcare is also a vertical. There is a mix of maturities.

The company is growing very fast right now, but more thoughtful growth than aggressive growth, per se.

Finovate: How does Alpine Data Labs solve the problem better?

Parulekar: In a noisy market like this, it is important to be different, not just say you are different. The technology is an easy install. We don’t move data around. We partner with organizations and help build use-cases.

Data scientists and wealth managers can interact on the platform. There is a user-friendly front end on a complex infrastructure. We want to avoid exposing wealth managers to the underlying data science. The platform provides an end-to-end process of model creation, allowing the user to tweak values in the data.

Finovate: What in their backgrounds gave Alpine’s co-founders the confidence to tackle this challenge?

Parulekar:Â What’s interesting is that many big data companies are led by people with backgrounds in academia. Steve Hillion has an enterprise data background. It’s important to have more than just a love of data science. You must be enterprise effective. Along with Joe Otto, Steve is a pioneer in predictive analysis.

Finovate: What are some upcoming initiatives from Alpine Data Labs that we can look forward to over the next few months?

Parulekar: We unveiled Touchpoints this week, but we are making a formal announcement next week that will include a branding overhaul, new logo, etc.

Check out the demo video from Alpine Data Labs:

Wladimir Huber, co-founder & managing director

Wladimir Huber, co-founder & managing director

Andrey Morozov, co-founder

Andrey Morozov, co-founder

Amanda Steinberg, CEO & Co-founder

Amanda Steinberg, CEO & Co-founder

Gilad Golan, President

Gilad Golan, President