Our expanded FinovateFall conference is coming up on September 11 through 14, and we’re taking a look at each of the six summit discussions that will take place after the demos. Today, we’re examining Digital Banking and Payments.

Summit #1: Digital Banking & Payments

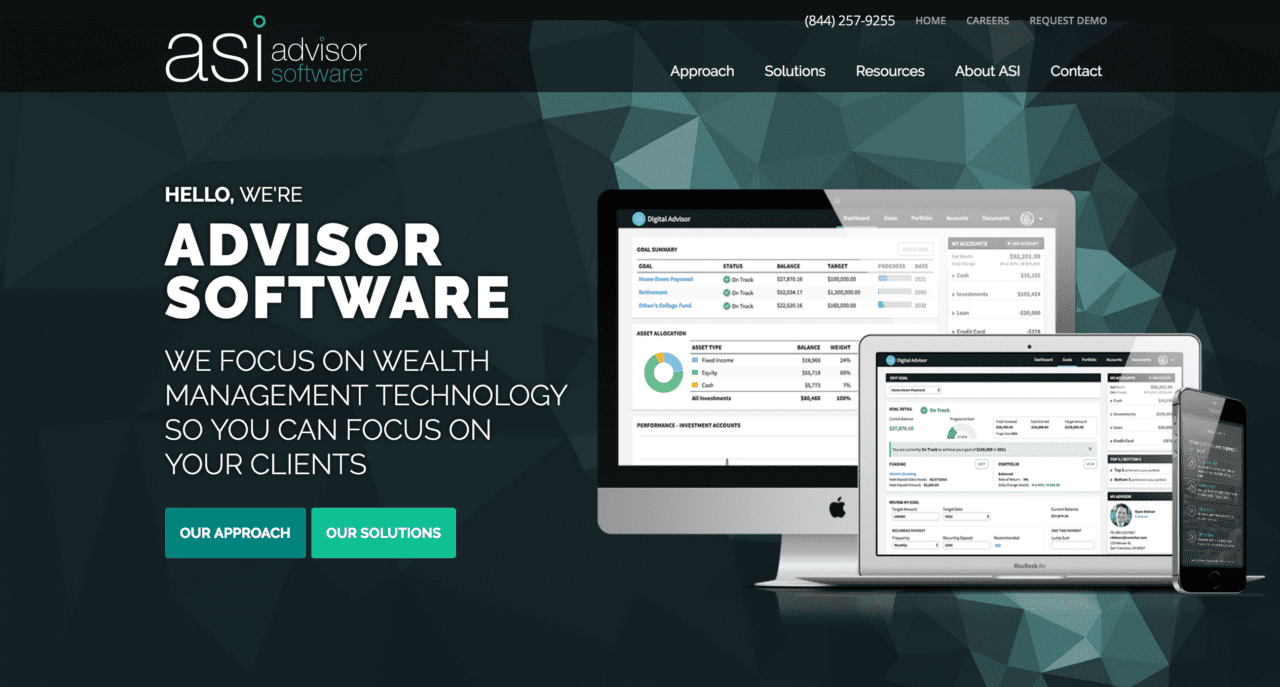

One of the major tracks of FinovateFall’s Summit discussions, Digital Banking and Payments, is such a huge concept that it’s important to focus on key elements. As a preview to the upcoming panel discourse on the topic, here are three pillars of digital banking that every FI must build around.

Customer experience

The clients of a bank define its success, so their happiness should be a priority. Crafting a digital banking strategy around a superior user experience is no longer optional, given increasingly viable product offerings from non-bank players such as PayPal. By offering a simple, clean user interface with intuitive navigation on web and mobile platforms, banks can be in a better position to compete. Leveraging features such as hamburger menus can hide seldom-used but necessary functions, while buttons keep frequently-used tasks accessible.

While there are plenty of wrong ways to build a user experience, there’s no single “right answer.” Fortunately, it is possible to guess, check, and re-work interfaces when and where necessary.

Security

With hacks in the news on almost a monthly basis, securing clients assets is no longer a simple regulatory checkbox. Unlike building a superior user experience, there is no room for error with security. What is similar, however, is that banks need to ensure that security doesn’t interfere with the customer experience.

One of the best tools to reduce friction while enhancing security is biometrics. Using fingerprint biometrics to secure a mobile app and voice biometrics to authenticate a customer’s call offers enough security for basic banking functions and won’t stymie the user experience the bank has worked so hard to create.

Payments

Becoming top-of-mind and top-of-wallet can boost a bank’s bottom line, but the increasing competition from non-bank players is making the race to the top more difficult. Fortunately, there are a variety of fintechs working in this space, and partnership opportunities abound.

Offering advanced card features such as remote card lock and unlock functionality, credit score reporting, and mobile push notifications for spending and balance alerts gives a bank leverage over competing payment methods. For P2P payments, check out the network from Zelle (formerly clearXchange). Created by Bank of America, Capital One, JP Morgan Chase, U.S. Bank and Wells Fargo in 2011; multiple banks, credit unions, and community FI’s have joined, each adding to the number of users in the network.

The upcoming Digital Banking and Payments Summit at FinovateFall will span two days of discussions from industry thought leaders, top fintechs and banks. Be a part of these live panel discussions at FinovateFall; register before July 7 and save on your ticket. A few highlights include:

- P2P Payments: Maturing Millennials and the Future of P2P Transfers

- UX/UI Design: Empowering End Users with 21st Century Design

- Biometrics & Authentication: Authentication, Biometrics and the State of Cybersecurity

- Community banking: Bankruption: How Community Banking Survives Fintech

- Impulse Savings: Leveraging Technology for “Set It and Forget It” Savings

This is the first of our six FinovateFall Summit series. Stay tuned later this week, when we’ll cover digital lending.

and initiate new trading relationships and foster trade growth.”

and initiate new trading relationships and foster trade growth.”