Cloud Lending Solutions has just released new enhancements to CL Lease, its cloud-based, automated, end-to-end leasing solution. The advancements represent more than 45 specific product upgrades and what they company called “hundreds of smaller updates.”

“Our latest version of CL Lease continues to enable lessors to streamline operations, enhance the customer experinece, effectively leverage partner ecosystem, and achieve sustainable revenue growth,” Cloud Lending Solutions CEO and co-founder Snehal Fulzele said. Pointing to the worldwide growth in the equipment leasing market and the need for integrated solutions, Fulzele added, “Lessors can now introduce and manage a broad spectrum of leases at a fraction of traditional costs.”

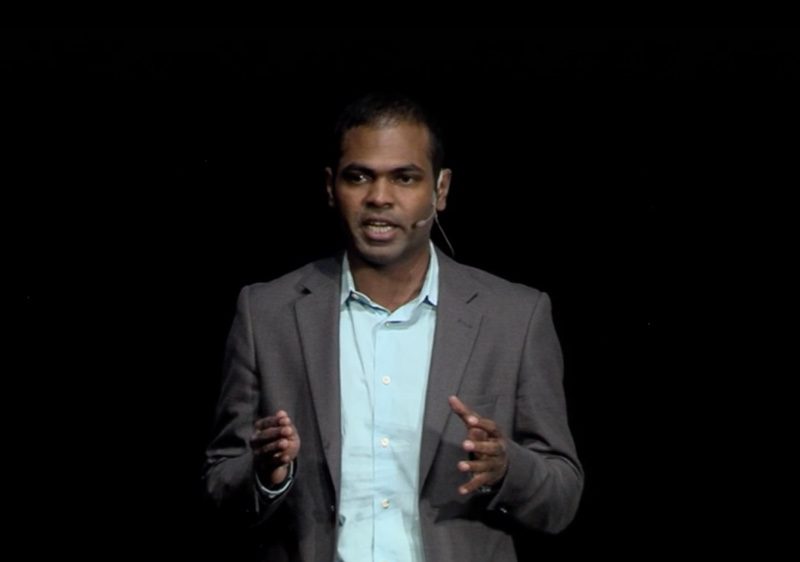

Pictured: Cloud Lending Solutions co-founder and CEO Snehal Fulzele demonstrating CL Exchange at FinovateSpring 2015.

CL Lease makes it easier to service leases on service equipment and vehicles. The solution enables lessors to setup online leasing portals, originate agreements and record contracts, manage multiple assets in the same contract, and collect decisioning data from multiple sources – including from identity, credit, banking, and valuation services. “CL Lease allows lessors to stay nimble and delight borrowers while offering a comprehensive view into their business operations and systems,” Fulzele said when the product was introduced in March of last year. “Lessors can now easily scale and grow their business to remain competitive in a dynamic market.”

The primary advancements for CL Lease announced this week include criteria-based scorecards, financial statement analysis, financial statement analysis, multi-company and multi-currency support, as well as credit exposure support. Feature updates include contract restructuring, debt schedules, delinquency management, asset tracking, cash management, reporting, and more.

San Mateo, California-based Cloud Lending Solutions was founded in 2012. The company demonstrated its CL Exchange, which facilitates the exchange of consumer and business loan applications among participating online marketplaces and lenders, at FinovateSpring 2015. This week’s announcement on CL Lease comes as the company unveils a variety of upgrades to its commercial lending products including CL Loan, CL Originate, CL Collections, CL Marketplace, and Cloud Lending Solutions’ latest innovation, CL Portal. Cloud Lending Solutions had raised more than $8 million in funding – including an undisclosed investment in a Series B completed in February. The company includes SF Capital Group and Cota Capital among its investors.

Presenter

Presenter

Presenters

Presenters Patrick Aber, Co-founder, CFO

Patrick Aber, Co-founder, CFO

Presenters

Presenters Ed Robinson, Co-founder and President

Ed Robinson, Co-founder and President