Live from FinovateFall 2017, Simon Moss, Fintech and Innovation Leader, Grant Thornton LLP discusses how the ‘Digital Revolution’ will change the entire DNA of the financial services sector.

Finovate Alumni News

On Finovate.com

- Bill.com Wins New Partner and Strategic Investor in JP Morgan Chase.

Around the web

- Xceptor appoints former IHS Markit executive Todd Rudley as Sales Director for North America.

- Gulf Coast Bank & Trust ($1.6 billion in assets) goes live with Banking Operating System from nCino.

- Ohpen acquires core banking system implementation consulting company, FYNN Advice.

- Appetite for Disruption podcast interviews Nvstr co-founders Patrick Aber and Bernard George.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Royal Bank Canada Leverages Personetics to Pilot New Automated Savings Service

Royal Bank of Canada (RBC), with the help of Personetics Cognitive Banking’s applications, will deliver two new services this autumn that provide AI-powered financial guidance and an automated savings programme through the bank’s mobile app, reports Antony Peyton of Banking Technology (Finovate’s sister publication).

The development follows on from last month, when RBC unveiled these two digital services: NOMI Insights and NOMI Find & Save.

Based on predictive analysis of individual behavior and spending patterns, Personetics said its solutions enable RBC to provide clients with personalized insight and advice for day-to-day money management.

Examples of insights include identifying unusual transactions which may require action, automatically issuing reminders based on past activity, and predicting potential issues.

Personetics is headquartered in New York and was founded in 2011. It also has offices in London and Tel Aviv. The company demonstrated its Personetics Anywhere chatbot solution for the financial services industry at FinovateFall 2016.

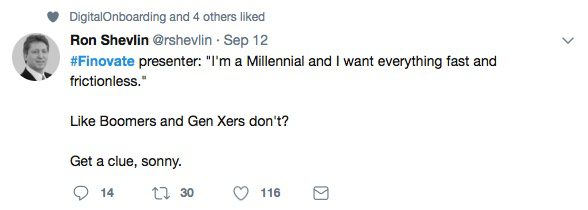

Live Demos and Deep Dives: FinovateFall Takes to Twitter

Image courtesy Jenna Bascom Photography

FinovateFall 2017 is in the books! And if the initial reports are any indication, our new, expanded, four-day format was a great addition to the fintech conference landscape. Two days of live demos followed by two days of deep dives into some of the most critical issues in our industry created a unique, exhilarating experience for all involved.

The enthusiasm for FinovateFall 2017 came through loud and clear on Twitter. Whether tweeting about favorite candidates for our Best of Show award or retweeting insights from our keynote speakers and panelists, our followers on Twitter made sure that #Finovate was a fun and informative place for “grizzled fintech professionals” and newcomers alike.

So here’s a sample at what our #Finovate community on Twitter had to say over the four days of FinovateFall 2017. And remember to follow us @Finovate!

Aleksandra Gren of Fiserv Advises ‘Teach STEM From an Early Age’ for Equality in Fintech

This article was first published on FinTech Futures on July 11th 2017.

Aleksandra Gren chats to us about her focus on making a success story out of fintech around the world. Today, she is Strategic Sales, Country Manager at Fiserv and Fortune Most Powerful Women US Mentoring Program Alumna. How does she think the fintech space will adapt as a more gender-equal environment, and how should we promote women in tech?

Aleksandra Gren chats to us about her focus on making a success story out of fintech around the world. Today, she is Strategic Sales, Country Manager at Fiserv and Fortune Most Powerful Women US Mentoring Program Alumna. How does she think the fintech space will adapt as a more gender-equal environment, and how should we promote women in tech?

How did you start your career?

I started my career in banking at 23 after I graduated from the University of British Columbia in Vancouver, Canada, with a degree in international relations. As I quickly realized that technology has a huge role in how things are run in the world of banking, I joined a fast growing U.S. technology company expanding its outreach in Europe and the Middle East. There, I saw first hand the continuing fusion of banking and technology in a number of economies around the world.

What sparked your interest in fintech?

From my experience of working in various countries, I saw how similar the challenges in banking were when it came to technology. In the mid-90s, technology and business departments within a typical bank didn’t talk to each other. As consumer-originated technologies started affecting the enterprise sector, business and technology began to realize how they need each other to be successful. Today most financial services’ CEOs acknowledge that running a bank is like running a big technology company which happens to be in banking.

What was your lightbulb moment?

I don’t think there was necessarily a “lightbulb moment”. Different regions around the world embraced change differently. For example, some banks in Asia and Central Europe benefitted from the leap frogging effect and went from very little computerization in early 90s, straight to full digitization today. They skipped cheques, implemented instant payments, and designed new business models by leveraging the newest technologies from the start. The technology journey for banks in the developed economies of Western Europe and North America has been more evolutionary.

What inspires you?

People are my biggest inspiration. I believe strongly in the power of the individual. We as individuals are not powerless; people on their own can do great things and make positive changes in the world, even if it is through small steps. I was always inspired by personal stories of great leaders and very early on developed a belief that every person matters and can contribute. I always believed that it is important to motivate people to tap into their inner potential. In my opinion, the key measure of leadership is how effectively the leader is able to build talent around them. Do they listen to the people closest to the battle field, who test management’s strategies first hand? For me the biggest source of insights are always conversations with the front-line people in any business.

Why is the #WomenInTech movement important?

With the onset of artificial intelligence, bots and virtual reality, we are witnessing a shortage of data science skills. Various sources refer to vacancies counted into millions in the data science fields around the world by 2020. It is important that STEM skills are taught from a very young age and that STEM becomes a key priority for domestic digital agendas. For me, the #WomenInTech movement is very important as women represent 50% of society. They have extra responsibilities assigned to their roles, which should mean more investment, more recognition, and more support at a state and corporate level. The #WomenInTech awareness and programs also have the power to capture the mindset of young girls before college years. Women need to be taught the STEM skills needed at primary school, as it will help them to perform in future digital industries and succeed in the workplace. There are certainly some excellent schemes out there at the moment, but we still have a little way to go to capture girl’s imaginations at a very young age.

What piece of advice would you give women starting their careers in fintech?

Always keep learning: from people around you, the industry and changes in technology. Stay curious and open minded. It is important for women to step outside of their comfort zone and keep pushing for more. Take a computer course, learn to code, do something you wouldn’t normally do. I would also say that women need to believe in themselves and know that their voice matters and that can drive innovation and change in the industry.

Throughout the year we will be profiling women in fintech, not simply to celebrate their success but also to hear what has worked for them during the course of their careers. Click here to read more inspirational stories from fintech’s leading women >>

Finovate Alumni News

On Finovate

- Royal Bank Canada Leverages Personetics to Pilot New Automated Savings Service.

- Live Demos and Deep Dives: FinovateFall Takes to Twitter.

Around the web

- Baker Hill teams up with BOLTS Technologies to provide streamline account opening.

- Jack Henry & Associates again named to 2017 IDC Financial Insights FinTech 100 Ranking.

- Insuritas hires former credit union CEO, Rose Ann Lambert, as EVP of Corporate Sales.

- CREALOGIX notes growth in international sales in release of 2016/2017 financial year results.

- TickSmith adds fintech veteran Mark Rodrigues to its board of directors.

- Texas-based Amplify Credit Union ($870 million in assets) to deploy Fiserv’s DNA platform.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Fenergo Helps Santander Enhance Customer Onboarding Experience

Client lifecycle management (CLM) software vendor Fenergo has landed a deal with Santander Global Corporate Banking to revamp its client onboarding process, reports Tanya Andreasyan of Banking Technology (Finovate’s sister publication).

Fenergo CLM will be rolled out to Santander’s operations in Europe, Asia, and the Americas, across multiple business lines. The first site will be in the UK, the vendor said.

“We selected Fenergo CLM as part of a global internal transformation and re-organisation programme,” explained José Muñoz, global head of operations at Santander Global Corporate Banking.

The programme, he said, is “designed to streamline processes and integrate once disparate systems to create a single source of client data and a seamless and well-orchestrated client onboarding journey”.

Fenergo CEO Marc Murphy demonstrating new customer onboarding and account opening technology at FinovateEurope 2012.

Fenergo said its “enterprise platform” can do just that as it supports “the end-to-end client lifecycle journey from initial client onboarding to KYC/AML and regulatory compliance, to client data/documentation management and regular and event-driven KYC reviews & remediation, all the way through to client off boarding”. It is suitable for corporate, investment, and private banks.

“For us, it’s about making the technology work to generate greater ROI (return on investment) and improved TCO (total cost of ownership),” stated Fenergo CEO Marc Murphy.

The company showcased some stats to support this statement, saying that by automating the CLM process, its technology enables banks to:

- onboard clients up to 82% faster than a manual process and improve time to revenue by up to 40%;

- reduce the cost of onboarding by up to 93% and enable banks to onboard double the number of clients;

- reduce TCO for compliance and KYC reviews by up to 60%.

Founded in 2009 and headquartered in Dublin, Ireland, Fenergo demonstrated its Deal Manager onboarding and account opening solution at FinovateEurope 2012. The company has raised more than $80 million in funding, and includes Ulster Bank Diageo Venture Fund, Investec, Insight Venture Partners, and Aquiline Capital Partners among its investors.

Finovate Alumni News

On Finovate.com

- Fenergo Helps Santander Enhance Customer Onboarding Experience.

Around the web

- Juvo partners with Malaysian mobile virtual network operator (MVNO), Tune Talk. Join Finovate as we return to the Far East for FinovateAsia in November.

- Alpha Payments Cloud accentuates its end-to-end middleware technology in rebrand to Alpha Fintech.

- Xero announces integration with Santander.

- Klarna completes acquisition of German online payment specialist, BillPay.

- ID.me adds support for FIDO U2F (Universal Second Factor) Security Keys.

- DefenseStorm wins 2017 IDC FinTech Rankings Real Results Award for Digital Trust and Stewardship.

- Alpha FinTech (formerly Alpha Payments Cloud) and Market IQ shortlisted for inaugural FinTech Abu Dhabi Innovation Challenge in October. Join our first foray to the Middle East as Finovate comes to Dubai in December.

- Hip Pocket founder Mark Zmarzly to help promote innovation and provide mentorship to fintech startups in Australia as part of new Queensland-sponsored initiative.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Finovate Talks: The Conversation Continues

Today at FinovateFall, we continued to speak to some of our key speakers about the hottest topics that we have been discussing over this year’s event. Here, Nathan Snell, Chief Innovation Officer at nCino stresses the importance of customer experience and how the “innovation journey” can be improved when he spoke to Julie Muhn, Finovate Research Analyst at the conference.

Watch more interviews here:

Finovate Talks: Creating the Foundations for Financial Literacy

Ederick Lokpez, Director Engagement Strategy, Customer Experience Office, U.S. Bank

Finovate Talks: RegTech – Innovation vs. the Regulation Regime

Joanne Barefoot, CEO at Barefoot Innovation Group

Finovate Talks: RegTech – Tech or Die

Pascal Bouvier, Fintech Venture Investor & Thought Leader

How Can Banks with Older Core Systems Take Advantage of Fintech Innovation?

Oded Shoshany, CEO at CelerityFinTech

Investing with a Difference: How To Stand Out From the Crowd

Ross Baird, CEO, Village Capital

Top Tips for Startups To Stand Out Within Incubators

Matt Armstead, Executive Director, Fintech71

Top Fintech Innovations To Look Out For in 2018

Fintech innovation is experiencing its highest-ever interest levels, and 2017 has seen some revolutionary new ways of doing business emerge. With the stage set for an explosive 2018, what are some of the top innovations to watch out for next year? Hear what global industry leaders predict for the future of fintech.

Fintech innovation is experiencing its highest-ever interest levels, and 2017 has seen some revolutionary new ways of doing business emerge. With the stage set for an explosive 2018, what are some of the top innovations to watch out for next year? Hear what global industry leaders predict for the future of fintech.

Nick Ogden – founder and Executive Chairman, ClearBank

The number one thing that’s going to occur in 2018 is fragmentation of the marketplace as we know it today. The days of big banks delivering everything and being specialists in everything are over. Some of them might still not accept that but the reality is that it’s happened.

You’ve got ringfencing in the UK occurring, and it will be in place by January 2019. Where you’ll get to is a situation whereby there’ll be transactional banking, which everybody needs – it’s how we pay bills and how we receive our salary. And it’s the same structure for businesses.

Then there’ll be different ways in which we consume financial services – things that we use occasionally like a car loan, a house loan, or a holiday loan. And the market will change to encourage customers to seek alternative choices as opposed to feeling reliant on one choice.

Ajay Bhalla – President of Global Enterprise Risk and Security, MasterCard

These technologies are now reaching a point where they can really change consumer experience, and that’s one of the reasons for our investments in this artificial intelligence space. These algorithms and the way they make decisions are becoming so good that we as consumers will increasingly leave our devices to start making decisions for us.

And it’s cool and it’s sometimes worrying, but in the bigger picture it’s going to change the way we live. And I think that’s not very far away now.

Karen Kerrigan – Chief Legal Officer, Seedrs

Rather than looking at a specific technology, have a look at a particular sector. There are a lot of challenger banks out there at the moment – Starling Bank, ClearBank, Monzo, Tandem – and they’re all vying for the same space. They’re all doing things slightly differently, but ultimately are taking on the banks.

How they do that, what technologies they use, and how they embrace user experience will be a fascinating journey, and I’d urge everyone to keep their eyes on it.

Want to learn more about the future of finance from these and other global industry leaders, including Professors Nir Vulkan and Alex Pentland, and David Shrier?

Saïd Business School, University of Oxford is collaborating with online education provider GetSmarter to present the Oxford Fintech Programme, a 10-week online programme designed to equip you with the skills, tools, knowledge, and network you need to take a fintech startup from concept to execution.

Finovate Talks: How To Make it as a Small Business in Fintech – Kathryn Petralia, Kabbage

This year at FinovateFall, we spoke to some of our key speakers about the hottest topics that we have been discussing over this year’s event. Watch the interviews here:

Finovate Talks: Meet the Fintech Observer

Dave Birch, Global Ambassador, Consult Hyperion

Finovate Talks: Financial Inclusion for Latin American Communities

Ramona Ortega, CEO & Founder, My Money My Future

Finovate Talks: How BankMobile Has Turned Digital Banking on its Head

Luvleen Sidhu, Co-Founder, Chief Strategy Officer and President of BankMobile

Does the US Have a Savings Problem?

Mimi Chan, CEO & Founder, Littlefund

How Will AI Change the World of Underwriting?

Mike Armstrong, President, ZestFinance

How Can Fintech Facilitate Stability in a Gig Economy?

Rachel Schneider, Senior Vice President, CFSI

FinovateFall 2017 Best of Show Winners Announced

Join us in a hearty congratulations for the seven companies that earned not just the admiration of our FinovateFall 2017 attendees, but their votes for Best of Show, as well.

With more than 70 companies demonstrating their technologies live on stage over the course of two days, some diversity in theme and topic is to be expected. What is especially interesting about our Best of Show winners this time around is that, while numbering only seven, these innovators still reflect a wide variety of approaches toward solving some of the most vexing challenges in our financial lives. These are the technologies that we increasingly turn to for help when it comes to saving and investing for the future, working better and more efficiently with our banks and credit unions, and safeguarding our property, our financial transactions, and even our identities against fraudsters, hackers, and other malevolent actors.

So hats off to the Best of Show winners of FinovateFall 2017. From Finovate veterans that have been honored by our attendees with Best of Show trophies in the past to newcomers who made huge, positive impressions in their Finovate debuts this week, these are the companies that help define our industry and show us the direction of fintech innovation to come.

Envestnet | Yodlee for its Financial Health Check that leverages account and transaction-level data to measure and score overall financial health across multiple dimensions including spending, savings, borrowing, and planning.

Envestnet | Yodlee for its Financial Health Check that leverages account and transaction-level data to measure and score overall financial health across multiple dimensions including spending, savings, borrowing, and planning.

Finn.ai for its Virtual Banking Assistant, powered by artificial intelligence and available via channels ranging from Facebook Messenger to Amazon Alexa, which makes everyday banking simple and easy for customers.

Finn.ai for its Virtual Banking Assistant, powered by artificial intelligence and available via channels ranging from Facebook Messenger to Amazon Alexa, which makes everyday banking simple and easy for customers.

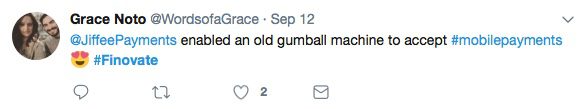

Jiffee for its tap & pay mobile technology that turns any device into a payment terminal, enabling consumers to pay anywhere and everywhere without relying on plastic credit and debit cards.

Jiffee for its tap & pay mobile technology that turns any device into a payment terminal, enabling consumers to pay anywhere and everywhere without relying on plastic credit and debit cards.

![]() Sensibill for its +Pulse solution that helps spot revenue opportunities from on- and off-card purchase data, providing a targeted prospect list for personalized, in-app campaigns.

Sensibill for its +Pulse solution that helps spot revenue opportunities from on- and off-card purchase data, providing a targeted prospect list for personalized, in-app campaigns.

SpyCloud for its monitoring and alert service that helps organizations better understand their employee and customer digital footprints by giving them visibility into their exposed credentials actively being traded in the underground.

SpyCloud for its monitoring and alert service that helps organizations better understand their employee and customer digital footprints by giving them visibility into their exposed credentials actively being traded in the underground.

![]() Sustainably for its social good platform for consumers and businesses that turns the spare change from shopping into micro-donations to philanthropic causes.

Sustainably for its social good platform for consumers and businesses that turns the spare change from shopping into micro-donations to philanthropic causes.

Voleo for its social trading app that makes it easy for people to invest together, saving time and money, while simultaneously leveraging the collective wisdom of networked investors to pursue market-beating returns.

Voleo for its social trading app that makes it easy for people to invest together, saving time and money, while simultaneously leveraging the collective wisdom of networked investors to pursue market-beating returns.

We want to thank all of the companies that demonstrated their technologies live on stage this year for FinovateFall 2017. From AI, the blockchain, and chatbot technology to mortgagetech, payments, and voice-enabled banking, the breadth of solutions and services shown over the past two days of our conference bodes well for the future of fintech. And be sure to join us Wednesday morning at 9:15 a.m. as we host our first-ever roundtable discussion featuring representatives from each of our Best of Show winning companies.