Helping banks and other financial institutions manage the myriad third party fintech solutions available to them will only become more necessary as the open banking revolution takes hold. And that’s where companies like FI.SPAN come in. The firm, which made its Finovate debut earlier this year at FinovateFall, provides a cloud-based, API services management platform for FIs that allows them to rapidly deploy a wide variety of business banking solutions to their corporate customers.

Based in Vancouver, British Columbia, Canada, FI.SPAN lowers the time and cost to innovation for banks, as well as increases transactional revenues. The solution helps banks open up a new business banking channel via accounting and ERP apps which, in the words of FI.SPAN CEO Lisa Shields, “embed(s) your brand and your products into your client’s daily workflow.” FI.SPAN also enables banks to leverage any third-party fintech “under your brand and under your control and with no IT projects required.”

FI.SPAN co-founder and CEO Lisa Shields demonstrating her company’s cloud-based bank API services management platform at FinovateFall 2017.

A full, API banking system in its own right, FI.SPAN gives banks the ability to automatically control and specify which products and services are delivered and which channel is used. The company curates and pre-integrates third party apps technologies that FIs can use alone or in combination with their own solutions, and provides pre-built connectivity to major mid-market and enterprise ERP platforms. FI.SPAN currently has plug-ins for QuickBooks, NetSuite, SAP, and has many more under development.

“We believe banks can extend their brand into their customer sites,” Shields said. “(Banks) can as easily leverage fintechs as be leveraged by them, and have an opportunity to exchange rich data with their customers and become the trusted custodians of that data.”

Company facts

- Founded in 2016

- Headquartered in Vancouver, British Columbia, Canada

- Has 15 employees

Recent headlines for FI.SPAN include earning recognition as a CIX Top 20 company, and being chosen to participate in the start-up pitch contest sponsored by the Canada FinTech Forum – both in October.

We met Lisa Shields (pictured) and company Chief Strategy Officer and co-founder Clayton Weir at FinovateFall 2017. We followed up with a few questions by email. Below are our questions and Ms. Shields’ responses.

We met Lisa Shields (pictured) and company Chief Strategy Officer and co-founder Clayton Weir at FinovateFall 2017. We followed up with a few questions by email. Below are our questions and Ms. Shields’ responses.

Finovate: What problem does your technology solve?

Lisa Shields: FI.SPAN is reimagining the business banking experience. We provide banks the ability to deliver any service directly to its business customers via accounting and ERP applications.

Finovate: Who are your primary customers?

Shields: FI.SPAN’s primary customers are regional and middle-market banks. These banks have outdated online banking interfaces and are struggling to provide the value-added services that their business customers are demanding. While fintech startups are well positioned to create compelling payment, lending, and analytic user experiences, banks are best positioned to deliver them. FI.SPAN enables banks to leverage any fintech service and deliver all of its services through the customer’s preferred application environment.

Finovate: How does FI.SPAN solve the problem better?

Shields: FI.SPAN powers true collaboration between banks and fintech companies. It’s an API marketplace for banks to select and offer the solutions their customers have come to expect, without requiring any IT projects since FI.SPAN pre-integrates all fintech components. Also, our platform centralizes all aspects of third-party service management, including transaction monitoring, limits and risk policy adherence and exception handling.

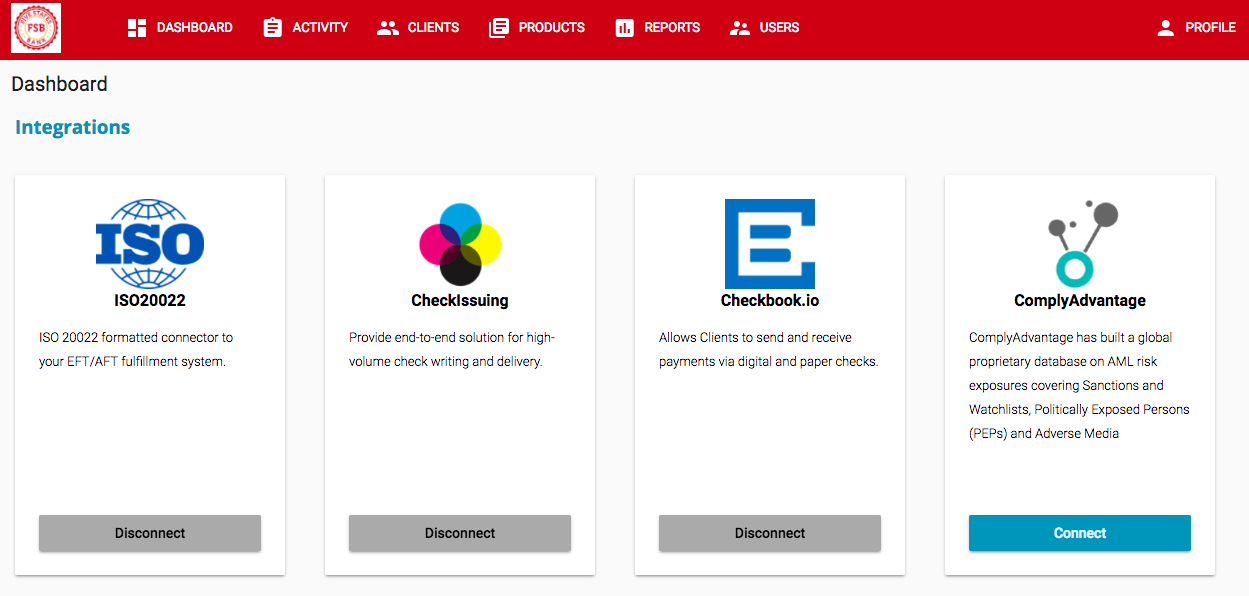

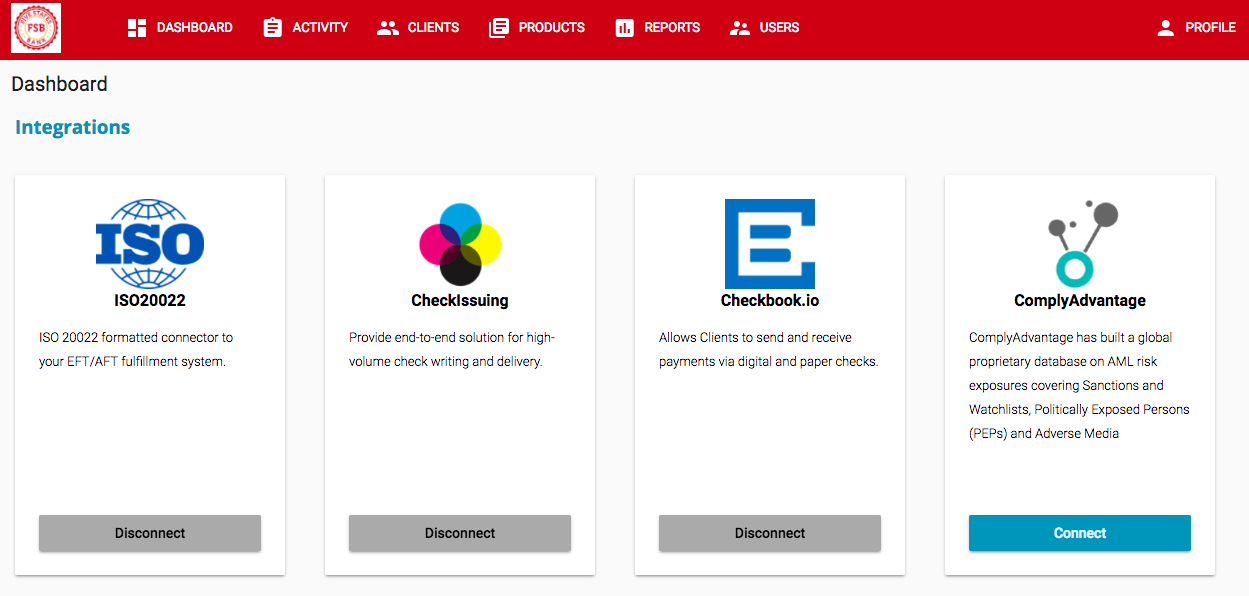

A look at the FI.SPAN dashboard which features pre-integrated, best of breed fintechs for services such as lending and analytics.

Finovate: What in your background gave you the confidence to tackle this challenge?

Shields: Prior to starting FI.SPAN, I founded and built a global payouts company over 15 years. That experience provided me with an appreciation of what operating a regulated business entails and what treasurers and CFOs are looking for from their transactional services providers. As a veteran of the fintech industry, I was able to identify the opportunity emerging between fintech companies and banks. I also saw the hurdles banks were facing when it came to providing their customers with the services they needed, and I knew that FI.SPAN could be the solution.

Finovate: What are some upcoming initiatives from FI.SPAN that we can look forward to over the next few months?

Shields: We have gone live with our first customer this fall and are working on some very exciting bank pilots with both large and small financial institutions across the continent. Our product capability and partner catalog are both rapidly growing, and you will start to see announcements of multiple new product lines including lending, onboarding and accounts receivable.

Finovate: Where do you see FI.SPAN a year or two from now?

Shields: Selling to banks has a long sales cycle, and we expect to reap the rewards of seeds we have been sowing with our bank partners over the last year. I expect that FI.SPAN will become a very important part of the banking API ecosystem as it continues to become more robust over time.

CEO Lisa Shields and CSO Clayton Weir demonstrating FI.SPAN at FinovateFall 2017.

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.

In addition to his experience with Hewlett-Packard and Andreessen Horowitz, Asiff Hirji (pictured) has served as a senior advisor at Bain Capital, founded private investment and operating company Inflekxion, and is a director at number of technology firms including Eze Software Group, TES Global Limited, RentPath, and Saxo Bank. With a BSc in Computer Science from University of Calgary, he earned an MBA from the Ivey Business School at Western University in London, Ontario, Canada.

We met Lisa Shields (pictured) and company Chief Strategy Officer and co-founder Clayton Weir at FinovateFall 2017. We followed up with a few questions by email. Below are our questions and Ms. Shields’ responses.

We met Lisa Shields (pictured) and company Chief Strategy Officer and co-founder Clayton Weir at FinovateFall 2017. We followed up with a few questions by email. Below are our questions and Ms. Shields’ responses.