Switzerland-based Avaloq has cut a deal today with KASIKORNBANK (KBank). The Thailand-based bank has selected the Avaloq Banking Suite to grow its private banking and wealth management offerings.

With $85.8 billion assets under management, KBank is Thailand’s leading provider of banking and wealth services to High Net Worth Individuals (HNWIs). In today’s deal, the bank has tapped Avaloq to upgrade its customer service infrastructure and improve internal processes such as client relationship management and risk management.

Jirawat Supornpaibul, KBank Private Banking Business Group Head, said, “While we have a very strong market position, we do not rest on our laurels. It is very important to invest for growth and partner with best-in-class suppliers that can give us a real competitive edge not just in terms of the customer interface but also fundamentals such as a strong internal risk management framework. This is why we have selected Avaloq to take our private banking business forward.”

This marks Avaloq’s first move into Thailand and is expected to strengthen its ties to the Asia Pacific region. Chris Beukers, head of Asia Pacific at Avaloq said, “With a well-established footprint and multiple customers in Singapore, Hong Kong and Australia, we are very pleased to be expanding to Thailand. As the Thai market continues to both expand and mature, we believe that KBank, which already has a significant market share of the domestic private banking market, will be able to strengthen its position as a market leader.”

Founded in 1985, Avaloq offers a full range of flexible banking software that boasts rapid deployment. The company’s software is currently used to manage $4.30 trillion. The company employs 2,000 people from 66 countries. Jürg Hunziker is CEO.

Avaloq will demo its newest technology at FinovateEurope next month in London. Register by the end of this week to save.

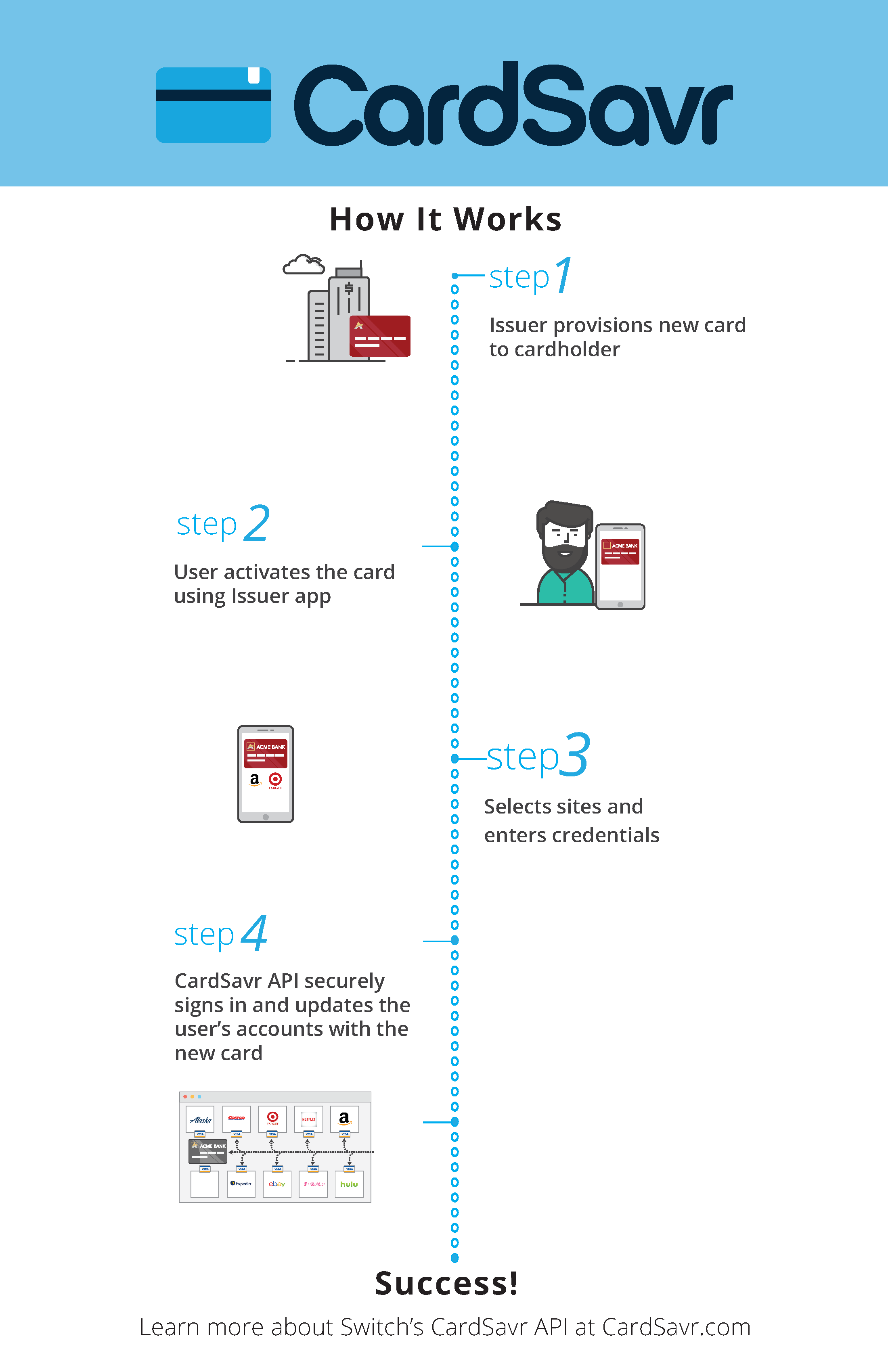

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

Presenters

Presenters Esther Kaufmann, Senior Product Manager

Esther Kaufmann, Senior Product Manager

Presenters

Presenters

Presenters

Presenters Lisa Terziman-Gutu, Business Development EMEA

Lisa Terziman-Gutu, Business Development EMEA

Presenters

Presenters James Gin, Chief Scientist

James Gin, Chief Scientist

Presenters

Presenters

Jan-Lukas Wolf, Senior Manager

Jan-Lukas Wolf, Senior Manager

Presenters

Presenters Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

Presenters

Presenters Javier Puga, Product Marketing Manager

Javier Puga, Product Marketing Manager

Presenter

Presenter