Challenges, Successes and Opportunities of Financial Inclusion in MENA

Financial inclusion has been identified as a key topic for the MENA region. Technology on its own will help us connect with the digitized financial world but it will not be the only factor. We need to build technologies that expand the horizons of electronic payments and work with partners across industries and segments. We need to create deeper, inclusive and intelligent experiences to enhance how people live and businesses grow. The webinar will cover the challenges, successes and opportunities of financial inclusion in MENA.

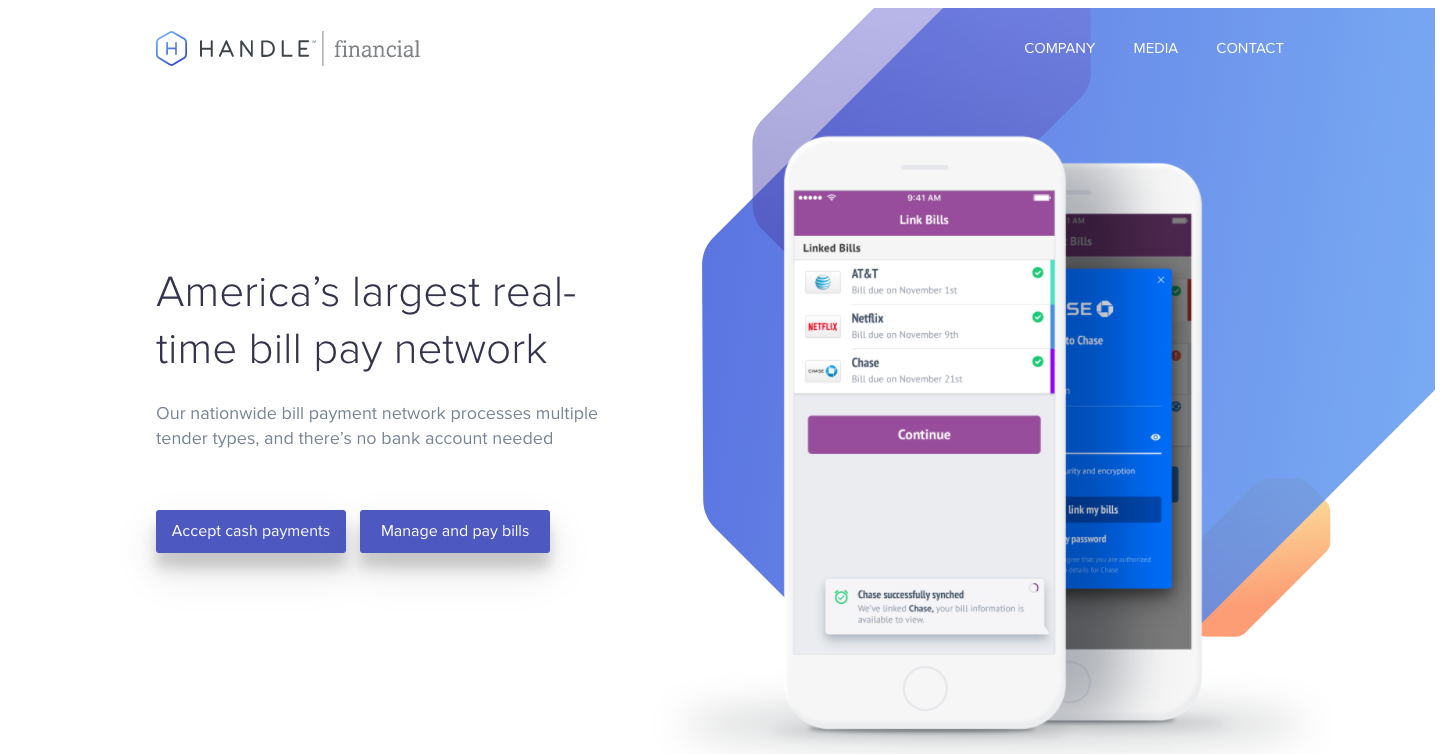

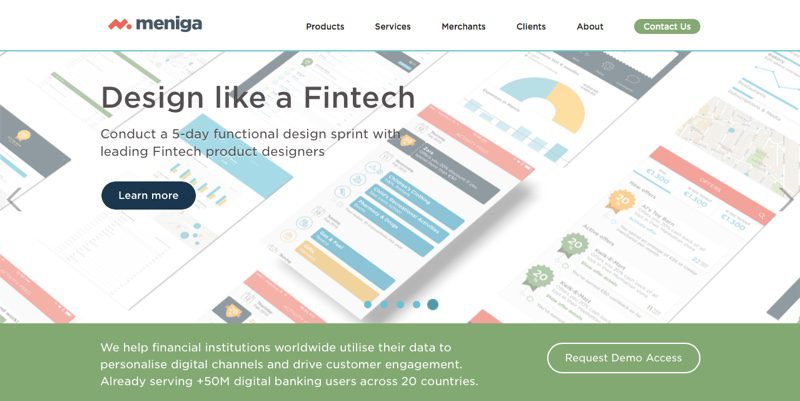

Digital technologies have spread rapidly in much of the world, yet, there is potential to boost digital dividends but also to simply enhance efficiencies, reduce costs and expand access to financial services.

The webinar is expected to draw on the global fintech landscape and how better data collection and analytics can inform customer choice better. It will cover the opportunities, challenge and successes in financial inclusion around the world and how best to serve the digital customer.

Speakers

Hjh Rosmah Ismail

Hjh Rosmah Ismail

Member, Board of Director, Arab Malaysian Chamber of Commerce and Board Member, AmBank Islamic

Hjh Rosmah is an international banker with a total of more than 25 years of comprehensive experience in the Banking and Financial sector, covering Conventional and Islamic Finance across both corporate and consumer client segments across all banking products, and 3 years in the Financial Consultancy sector. During her career, she has been commended by top international Sharia Advisors for having authored among the best Shariah Compliance, Risk and Business Operational Policy & Procedures Manual for Islamic Banking and Finance. She has set up Islamic Banking entities in the Middle East and Malaysia, and the businesses under her leadership had also won corporate awards during her tenure.

Devie Mohan is an influential writer, speaker and commentator on fintech, and has been listed as a top 10 global fintech influencer by several groups. Devie is the co-founder and CEO of Burnmark, a fintech research company, that supplies research and data to all players of the fintech ecosystem.

Devie has helped several banks, fintech startups, innovation groups and investors understand the trends in the fintech industry, helping them set their corporate, marketing and investment strategies. She is also a proponent of a fintech ecosystem where banks and startups collaborate to drive innovation.