Healthy credit card circulation is an underestimated aspect of what makes e-commerce work. In a world in which the average consumer carries more than three credit cards and a growing number of consumers are using those cards to shop online, it is critical that the infrastructure that delivers these cards works as seamlessly as possible – as well as for the benefit of all participants in the process.

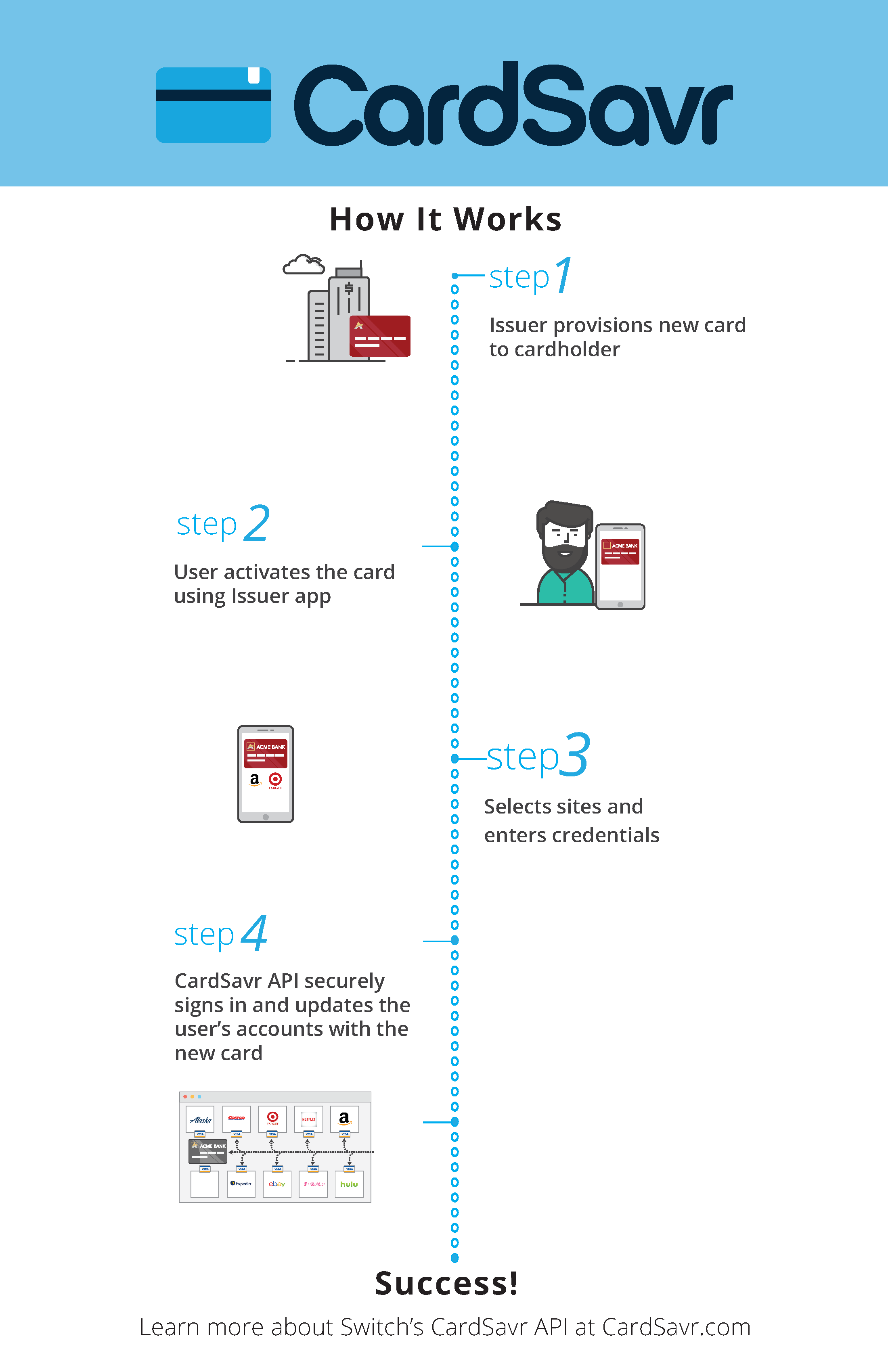

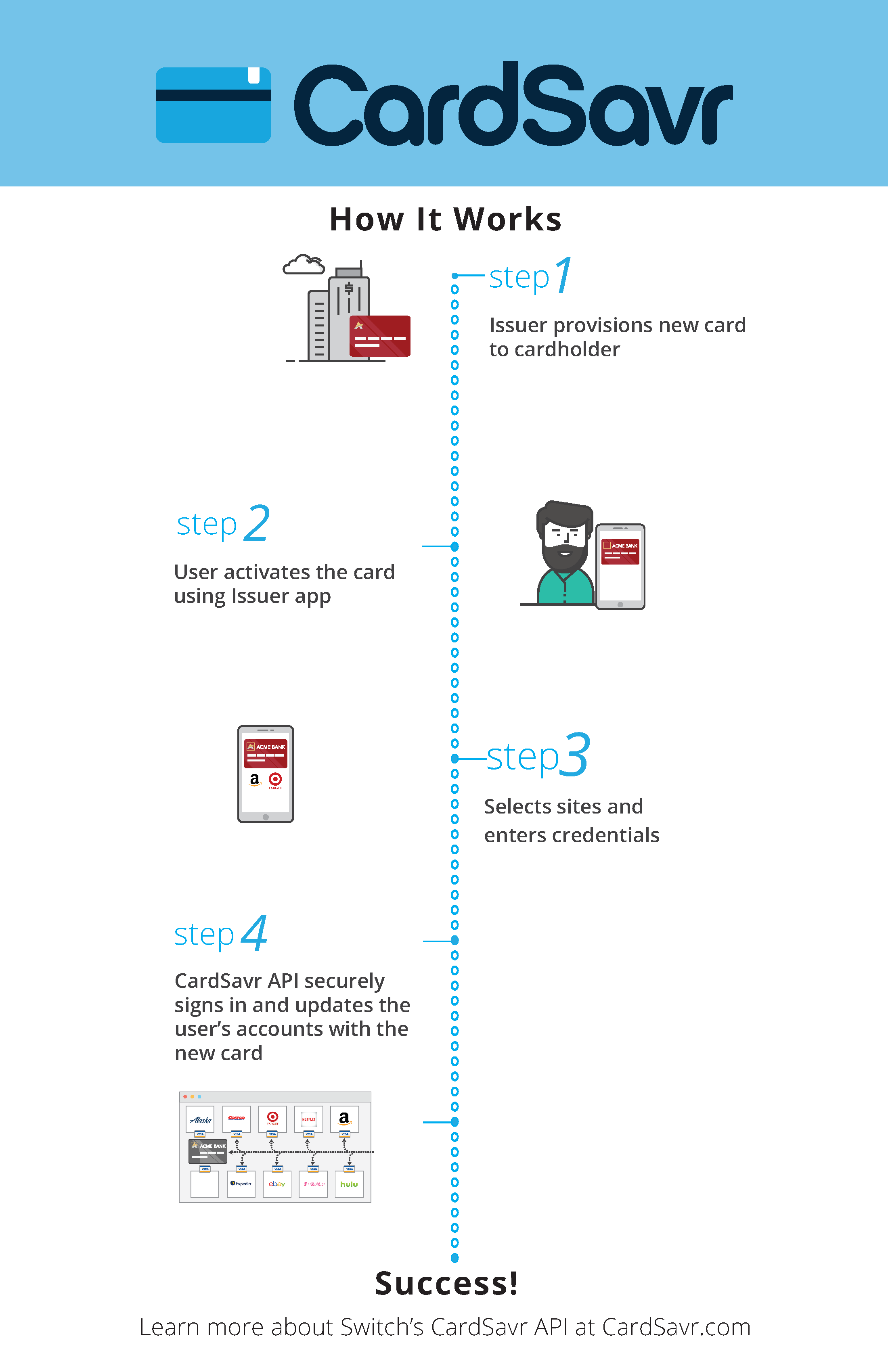

This is what makes the new technology from Switch so compelling. The Seattle-based company unveiled Cardsavr today, the first API of its kind to give card issuers the ability to get new and re-issued cards into circulation with thousands of online merchants immediately after activation.

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

Switch made its name as a platform that enables consumers to easily manage their credit card accounts. With Cardsavr, the company is leveraging its core platform to help issuers and merchants increase or recapture revenues lost through the current, inefficient process.

“Our platform increases both their bottom line around credit card circulation issues and enhances cardholders’ online purchasing experiences. All parties of the e-commerce ecosystem benefit,” Hopen said. He added that Cardsavr API currently supports thousands of e-commerce sites and leverages machine learning to add more merchants daily. This enables faster card updates, Hopen explained, which was a feature merchant issuers especially liked because of the way getting cards into circulation drives outside spend, as well.

A standard REST API with support for basic CRUD (“create, read, update, and delete”) operations for cards on-file, the Cardsavr API makes it easy for card issuers to integrate Switch’s technology into their online and mobile banking apps. Mark Morrison, President and CEO of MountainCrest Credit Union and a member of the focus group that explored the Switch app, underscored this point in the statement accompanying the Cardsavr launch. “The Switch application is extremely easy to use and provides a much faster way to pay and shop at card-on-file sites,” Morrison said.

Founded in 2014 and with $1.6 million in funding, Switch demonstrated its platform at FinovateSpring 2016. The company anticipates naming a “significant list” of partners for its new Cardsavr API soon.

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

“Until Cardsavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” Switch CEO Chris Hopen explained. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

Presenters

Presenters Esther Kaufmann, Senior Product Manager

Esther Kaufmann, Senior Product Manager

Presenters

Presenters

Presenters

Presenters Lisa Terziman-Gutu, Business Development EMEA

Lisa Terziman-Gutu, Business Development EMEA

Presenters

Presenters James Gin, Chief Scientist

James Gin, Chief Scientist

Presenters

Presenters

Jan-Lukas Wolf, Senior Manager

Jan-Lukas Wolf, Senior Manager

Presenters

Presenters Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

Mark Hetenyi, Deputy CEO, Retail and Digital, MKB Bank

Presenters

Presenters Javier Puga, Product Marketing Manager

Javier Puga, Product Marketing Manager