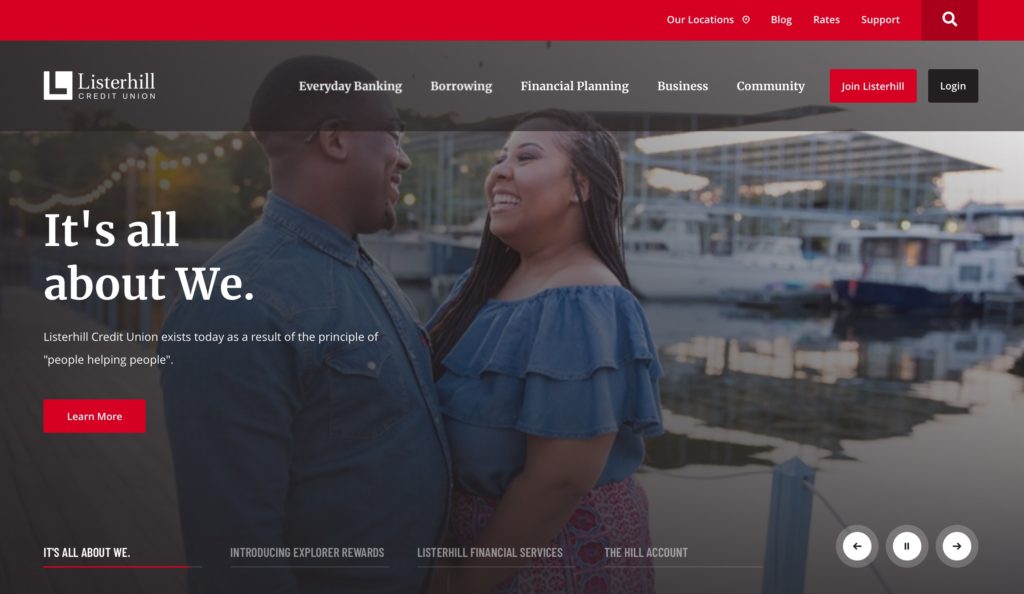

Turns out that President Trump isn’t the only one with Alabama on his mind these days. Cloud-based omnichannel sales solution provider Terafina announced this week that it is teaming up with Alabama-based Listerhill CU to power the 90,000+ member FI’s sales strategy as it continues its digital transformation.

“Terafina’s partnership allows us to deepen our existing member relationships and develop new ones, while also helping us to be proactive in meeting our members’ diverse financial needs,” Listerhill CEO Brad Green said. “Moreover, as we continue to expand our reach into new markets, we are excited about this partnership helping us meet and exceed our growth objectives for 2020 and beyond.”

With more than $841 million in assets, Listerhill Credit Union has embarked upon an effort to boost member engagement with a new, omnichannel experience. The goal is to make it easier for members to learn about, choose, and deploy new products and services to meet their financial needs. Named one of America’s Best Credit Unions in Alabama by Forbes and market research company Statista, Listerhill Credit Union was founded in 1952 and serves members in 13 counties in northwestern Alabama and Tennessee.

“Our entire team is delighted to help Listerhill grow organically and provide top notch services to its membership,” Terafina CEO Meheriar Hasan said. “We believe in the great value that Listerhill provides its communities and feel privileged to be a part of its rising story.”

Terafina demonstrated its omnichannel sales platform at FinovateSpring 2019. The technology delivers a seamless experience that aligns branches, call centers, and digital channels to help banks and credit unions improve customer engagement and increase sales. The company notes that its platform is core-agnostic and that it has built more than 30 connectors to core banking, loan origination, KYC, and CRM systems, as well as to data aggregation and data prefill providers.

Earlier this year, Terafina announced that it was partnering with PlainsCapital Bank to help the Texas-based institution fast track small business onboarding. PlainsCapital Bank is the fifth largest bank in Texas with $9.7 billion in total assets. In April, Terafina teamed up with Washington state’s Gesa Credit Union ($2+ billion in assets and more than 150,000 members), and in March, the company announced its collaboration with Silicon Valley-area credit union KeyPoint CU ($1.3 billion in assets; 63,000 members).

Founded in 2014, Terafina is headquartered in Fremont, California.