What happens after the newest cutting-edge banking technologies become table stakes? Banks move on to tackle another new technology.

In fact, in the past decade or so, banks have been constantly moving from one new technology to the next– from remote deposit capture to merchant-funded rewards, roboadvisory services, AI-informed marketing strategies, and finally on to complete digital transformation.

So now that 2020 served as the year of digital transformation, what’s next? How will banks use their limited resources to get ahead of the curve? Below are a few areas in which banks are focusing their attention to gain competitive advantage:

Communication

Last year we saw multiple financial services organizations update their communication technologies in tandem with digital transformation. But the game of facilitating customer communication is far from over. As Ron Shevlin pointed out in his piece, Every Bank Needs A Chatbot (Or Two) For Its Digital Transformation, chatbots are no longer simply a novelty. Instead, these tools offer fast turnaround for customer inquiries, provide additional data about consumers, and help firms hold personalized conversations with clients.

Another communication enhancement comes in the form of leveraging popular third party apps to communicate with customers. Axis Bank, for example, India’s third-largest private sector bank, recently announced a partnership with WhatsApp. Customers can now use WhatsApp to inquire about their account balance, recent transactions, credit card payments, deposit details, and block their credit or debit card.

Cryptocurrencies

Ready or not, crypto is here! In January, the U.S. Office of the Comptroller of the Currency (OCC) published an interpretive letter detailing that banks can transfer stablecoins to other banks. While banks haven’t been rushing to leverage this functionality, there have been a few moves that indicate financial services are slowly entering the cryptocurrency game.

First off, marketing services company Kasasa unveiled plans to help its bank and credit union clients provide bitcoin wallets to their consumers. Additionally, Mastercard recently announced it will allow merchants to accept payments in cryptocurrencies, and BNY Mellon agreed to begin custody of cryptocurrencies.

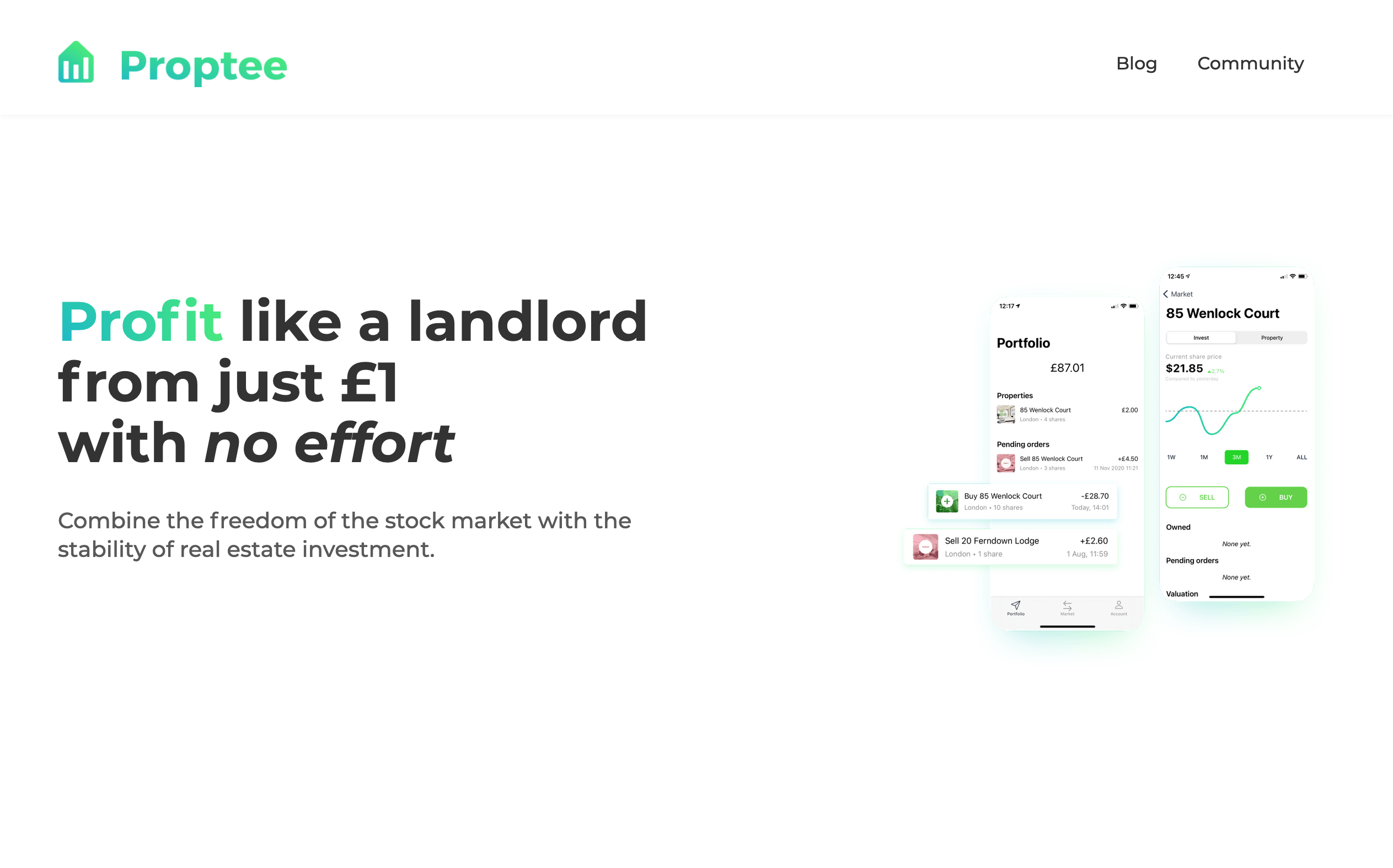

Payment tools

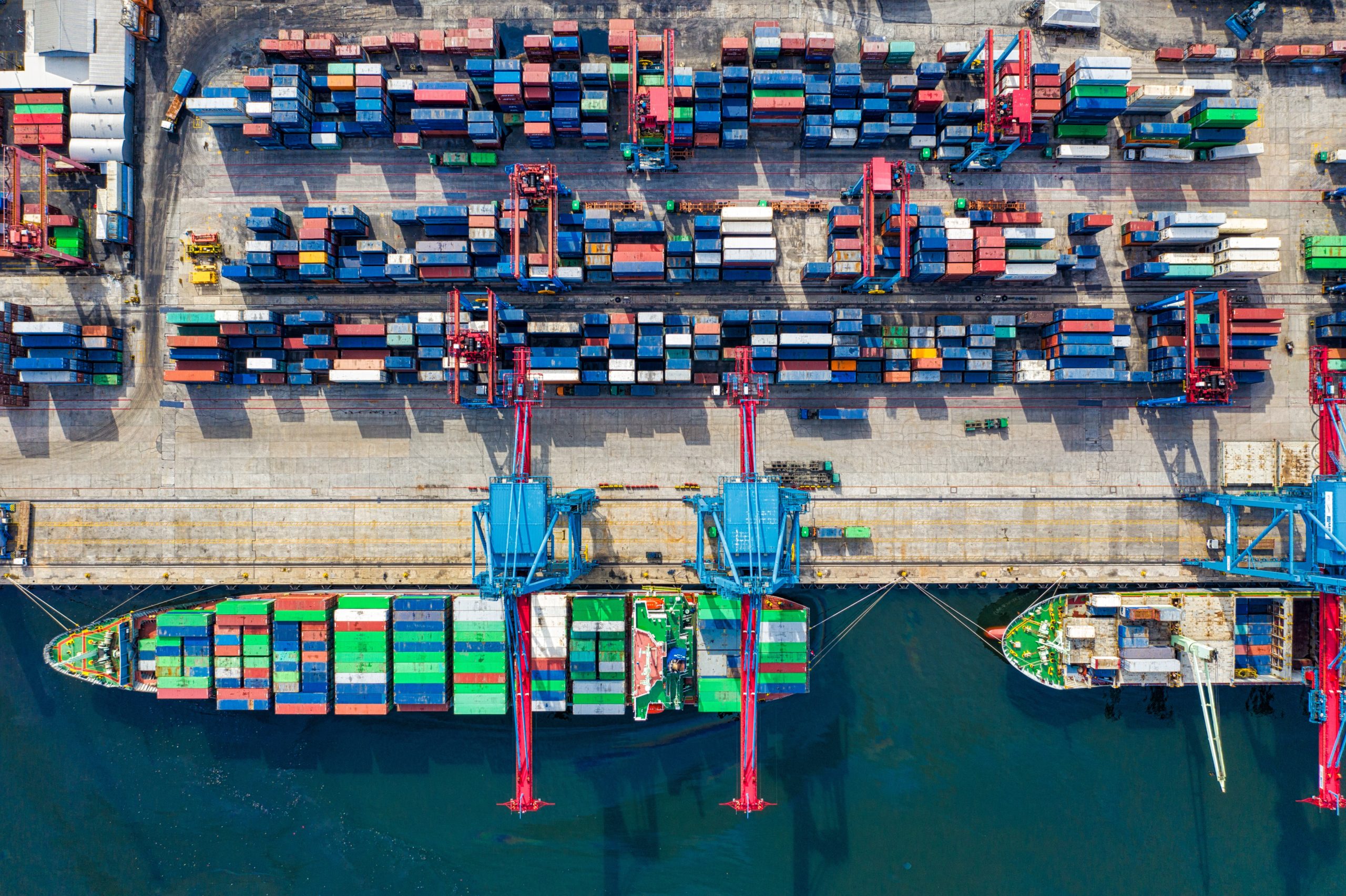

With so many payments moving online in the past year, banks need to be even more aware of their role in the online payments flow. In fact, the recent rise in embedded payments poses a risk to banks as third party apps such as Uber and DoorDash make the payment element of a transaction almost disappear.

There’s also been a lot of competition in the booming buy now, pay later (BNPL) space, and not just from third party fintechs like Klarna and Afterpay. Last year, Citi announced Citi Flex Pay, a product that enables cardholders to pay for select purchases over time at a lower interest rate than their card’s purchase rate. And in 2019, JPMorgan Chase launched My Chase Plan, an offering that allows cardholders to make equal monthly payments on purchases of $100 or more with no interest, just a fixed monthly fee.

Offering another tool to make payments more flexible, is U.K.-based fintech Curve. The fintech connects with consumers’ existing payment cards to offer rewards as well as a Go Back in Time feature that lets users switch payments from one card to another for up to 14 days after the purchase was made.

Sustainability

If you’re not green, you’re gone! O.K., maybe not quite, but in the past few months we’ve seen an increase in fintechs working toward a more sustainable future. In fact, just this month there have been multiple headlines that highlight fintech’s green future. First, U.K.-based digital bank Starling Bank launched recycled plastic debit cards. Second, Citi began restricting financing for companies expanding coal power. And finally, Meniga partnered with Iceland’s Íslandsbanki to integrate Meniga’s Carbon Insight into its digital banking solution.

Fintechs are also helping consumers do their part to minimize their impact on the environment. Aspiration, for example, ensures accountholders that their deposits won’t fund fossil fuel projects like pipelines, oil drilling and coal mines. The startup also works with reforestation partners to plant a tree when users roundup their purchase to the nearest dollar. And speaking of trees, Treecard offers a wooden Mastercard and donates 80% of its profits to reforestation efforts.