Dear Mr. Cox:

I don’t have to tell you that the Madoff mess has dominated the Wall Street Journal headlines for the past few days. You probably saw Jane Kim’s recap today tallying the $25 billion in known losses so far in a wide-reaching, long-running fraud perpetrated by a firm overseen by your agency.

I don’t have to tell you that the Madoff mess has dominated the Wall Street Journal headlines for the past few days. You probably saw Jane Kim’s recap today tallying the $25 billion in known losses so far in a wide-reaching, long-running fraud perpetrated by a firm overseen by your agency.

It’s not that I blame you for the Madoff fraud. The cops can’t catch every crook. But now that you have your hands full with this matter, I have an idea as to how you can free up some staff resources to sort out the mess Mr. Madoff left.

You’ve probably been too busy to read Netbanker (see note 1), but if you had, you’d know that I haven’t been very happy with the way the U.S. peer-to-peer lending industry has been treated by the SEC this year. Thanks to your agency’s efforts, the three major providers have all been shut down for extended periods and several others have been dissuaded from opening at all.

Currently, just a single company, Lending Club, remains in operation, but they were crippled much of the year by a dark period as they spent hundreds of thousands of dollars meeting SEC registration requirements. Thankfully you approved their registration statement and they are now open for business, albeit weighed down by massive ongoing reporting requirements.

As recently as last year, we had as many as a dozen companies in various stages of launching companies in this space. The goal is to connect people with excess funds to those in need of money with a fair rate of interest established via open bidding in a transparent market. What more can you ask for?

And even before the SEC became involved, it’s not like these companies were skating by with no regulation. They spent considerable time and money obtaining lending licenses in individual states and/or working with existing regulated financial institutions to originate loans. In addition, the startups all had to comply with a myriad of federal consumer protection statutes. In fact, you could say they were already operating as highly regulated companies.

The biggest of the group, Prosper, even made all its data available to the world including the good, the bad, and the very, very ugly. They could very well be considered the first open source financial institution in the world. Their unique transparency gave us all a ringside seat to watch the ebb and flow of a new market gaining traction.

No, Mr. Cox, it has not been a smooth ride for Prosper. More than 20% of the loans made the first year have already gone bad, and ultimately the losses may end up above 30%. But with an average interest rate of 17% on the 70% of the balances ultimately repaid, most lenders will get most, if not all, their principal back from their speculative bets. That’s a better return than blue chip stocks over the same period. And I’m sure the investors in Madoff Securities would be happy with to have 98% of their principal returned.

But even before the SEC got involved in P2P lending, things were improving for lenders. The open market fostered quick learning as lenders learned from both from their own mistakes and those of others in the community.

And the exchange operators were learning even faster. Prosper now makes much more borrower info available and began verifying certain applicant statements. As a result, returns appear to be improving. Although, against the backdrop of a severe recession, it’s hard to make good comparisons.

Had these companies been left alone, journalists would be writing stories about how P2P companies were stepping into the lending void left by the turmoil in the banking sector. And how wise the U.S. regulators were in letting this new area thrive amidst the collapse of HIGHLY REGULATED financial companies around the world.

But instead, the SEC decided it needed to keep closer tabs on the tiny $100 million annual volume originated in these markets (that’s just a single day’s worth of fraud by Mr. Madoff). Your agency came to the surprising conclusion that loans, made between individuals in a regulated peer-to-peer market, are securities and needed SEC oversight. And based on recent events, what exactly does that even mean? Besides requiring a flood of documents uploaded to your servers, are you really going to assign an agent to watch over these $3,500 loans. I don’t know what your 2009 staffing plans are, but I’m guessing everyone will still be pretty busy.

The decision to classify these loans as securities will ultimately cost Prosper as much as $10 million, a potentially fatal blow. Prosper has been shut down as it goes through the SEC-registration process. The SEC ruling has already cost the company at least $2 million in cash: $700,000 just to create the documentation for your agency to review, $1 million to pay-off state securities regulators, and an undisclosed amount to settle with your agency. And the company must still settle or fight the class-action suit, where lenders, who knew perfectly well the risks they were taking (Hello… they were lending to strangers on the Internet!), will try to win back their loan losses by asserting that Prosper was selling unregistered securities.

Furthermore, you are driving innovation and competitors out of the market. The original pioneer in the industry, Zopa, withdrew from the U.S. market, despite a thriving business in the United Kingdom because of the threat of SEC registration. End result: There is just a single U.S. P2P loan exchange operating today. Had you stayed out of it, we’d have at least five, probably more.

I have this to say to the SEC:

- Rethink your oversight model: We’ve seen hundreds of billions lost by SEC-regulated companies this year. You weren’t even able to sniff out a $50-billion Ponzi scheme in your own backyard. Maybe you don’t have enough resources. I buy that. Even mammoth funds with virtually unlimited resources were duped by Madoff. So let me ask the obvious question. If you are short on staff, why are you wasting them on controlling the $100-million P2P market where every bid, loan, and repayment are open to scrutiny by the community.

- Embrace openness: Instead of stomping on a new, open and self-regulating market, maybe you could learn from it. As Don Tapscott proposed in his BAI Retail Delivery keynote last month, let’s open source financial holdings. If Madoff had made his trading data public, his customers could have monitored the flow themselves, and figured out about $49.9 billion dollars ago that he was fabricating his results.

Bottom line: Leave the P2P lenders alone. Their open approach reflects an order of magnitude far better than the broken regulatory model employed on Wall St.

Regards,

Jim Bruene, Editor & Founder

Online Banking Report & Netbanker.com

<whew!…stepping off soapbox>

Note:

1. In the spirit of openness, Prosper, Lending Club, Zopa, Loanio, Pertuity Direct and other P2P startups are customers of ours, buying research reports and admission to our events. But the total gross revenues from the sector amounted to less than 2% of our total revenues. We do not invest in any companies we cover, nor do they pay us for consulting, or influence our editorial coverage in any material way.

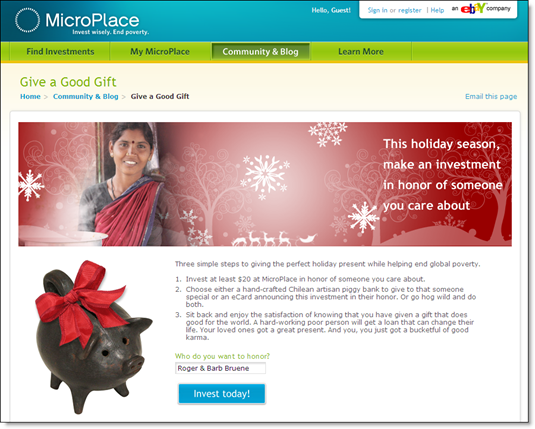

SmartyPig, which launched its social savings program in March 2008 (previous post) and debuted at Finovate Startup (video here), hit the world stage Dec. 16.

SmartyPig, which launched its social savings program in March 2008 (previous post) and debuted at Finovate Startup (video here), hit the world stage Dec. 16.