“BrightScope, which provides background on 450,000 advisors based on reports from the Securities and Exchange Commission and FINRA, is adding a section to its Advisor Pages that will let consumers write reviews about advisors – a concept akin to popular consumer websites like Yelp or Tripadvisor.com.”

Finovate Alumni News– October 3, 2011

- Rebirth Financial introduces its new platform.

- FreeCreditScore.net profiles PayNearMe.

- Pittsburgh’s Smart Business looks at how Dynamics CEO Jeff Mullen has founded and grown the company.

- James Varga from miiCard reflects on FinovateFall.

- BlueRidgeNow.com recommends using findabetterbank.com to avoid banking fees.

- New Zealand Herald discusses Rod Drury’s success with taking Xero public.

- Entrepreneur looks at how Dwolla’s services compare to big bank’s small business services.

- Bobber Interactive and Bundle are making finance interesting with social engagement.

- The San Francisco Chronicle reports LearnVest is 1 of 30 most valuable startups in New York.

- Bank Technology News cites that Citi is the first bank to publicly launch a site designed using Yodlee’s FinApp platform.

- Mint.com discusses the value of CreditSesame’s Credit Badge.

- The Spokesman-Review discusses the popularity of P2P lending sites Prosper and Lending Club.

- The Paypers features Samurai from FeeFighters, an online payment gateway.

- Loren’s World blog lists Expensify as 1 of 5 best apps for business women.

- USA Today lists BillFloat as a good alternative to a payday loan.

- DeadlineNews.com names FamZoo as a “site to see.”

- Balance Financial launches version 1.2 of its mobile app in the Apple app store.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Bobber Interactive and Bundle Are Making Finance Interesting with Social Engagement

Earlier this week, Bank Technology News wrote about the gamification of finance. The article describes Capital One’s promos in Zynga’s CityVille (a FarmVille-like game), then looks at Seattle-based Bobber Interactive’s new GoalCard:

Earlier this week, Bank Technology News wrote about the gamification of finance. The article describes Capital One’s promos in Zynga’s CityVille (a FarmVille-like game), then looks at Seattle-based Bobber Interactive’s new GoalCard:

“Users set up their accounts and access funds with a Visa debit card issued by Meta Financial Group Inc.’s MetaBank Inc. and offered by Plastyc Inc. They are encouraged to share their financial goals with their Facebook friends, and they get points and rewards for transacting and sharing the application with others.”

![]() New York-based Bundle is also highlighted in the article for its spending tracker and comparison platform:

New York-based Bundle is also highlighted in the article for its spending tracker and comparison platform:

“Bundle, which is backed by Citigroup Inc., analyzes card transaction data to help customers track their spending. It also compares their spending to various demographic groups based on aggregated data provided by Citi and other sources.”

Both Bobber Interactive and Bundle demonstrated their platforms at FinovateFall last week. Full-length videos will be posted within the next two weeks. In the meantime, check out Bobber Interactive’s FinovateSpring 2010 demo and Bundle’s FinovateSpring2011 demo.

Out of the Inbox: ING Direct Provides Free Digital Magazine Subscription with Birthday Greeting

I like it when businesses I frequent remember a milestone. Typically, it’s the anniversary of our first transaction or my birthday. I prefer the former, because it’s unique to the business relationship and less cliche.

I like it when businesses I frequent remember a milestone. Typically, it’s the anniversary of our first transaction or my birthday. I prefer the former, because it’s unique to the business relationship and less cliche.

Even though I know it’s just a bit of programming back at the home office, it still says something about an organization that they prioritized it over other pressing needs (like a new debit card fee, see note 1).

Unlike retailers or eateries, who can give customers a free desert and more than make up the cost with profit from the dinner, it’s hard for banks to deliver a freebie that has actual value. Last month, I wrote about Discover’s month-long double points birthday bonus. That was a winner.

This week, ING Direct came through with birthday present that has some perceived value. Delivered via email (see opposite) was a complimentary four-issue subscription to ODE Magazine plus a special issue devoted to savings. Granted, it’s only the digital edition (note 2), but it’s still better than nothing.

The bank also throws in a 15% discount at its online store. A nice touch, but not a huge value for most customers.

Landing page to redeem magazine subscription

Note: Here you can choose digital or printed version (note 2)

———

Notes:

1. Actually, I’m pro debit-card fee. Why shouldn’t you charge for an optional-yet-super-convenient service that people use every day? I might have started out at $3/mo and bundled it with more value-adds, but even at $5 it’s about 17 cents per day for unlimited usage. So what’s the big uproar? Sure, it probably made more sense to have the merchants pick up the tab, but that got Durbined down the drain.

2. The landing page offers a choice between printed and digital. However, it’s not clear whether that applies to the 4-issue subscription or just the special savers issue.

eToro Wins 3 World Finance Awards

At the beginning of this month, eToro won three World Finance Awards:

At the beginning of this month, eToro won three World Finance Awards:

“(eToro) was selected as the Best Social Trading Network, Best Mobile Trading Platform, and Best Trading Software Provider by the World Finance Awards. eToro was selected following an email poll of 40,000 industry decision-makers due to its innovation, originality and quality of product, as well as proof of market development and excellence in client representation.”

The goal of the World Finance Awards is to identify organizations that implement best practices in the financial and business world.

Finovate Alumni News– September 30, 2011

Reuters advises opening a BankSimple to avoid bank fees.

Reuters advises opening a BankSimple to avoid bank fees.

- Fox Business News interviews Bill Harris, CEO of Personal Capital, on the startup’s services.

- Digital Stock Market recommends using Yodlee or Mint to help control your spending.

- eToro makes its blog available as a WebTrader widget.

- SmartMoney discusses Personal Capital’s advisor video chat feature.

- Q2ebanking adds its mobile app to the Android marketplace.

- Xero wins K2 Quality award for SaaS.

- SecondMarket puts itself up for sale using its own site, SecondMarket.

- Wall Street Survivor announces the winners of the August Stock Game Giveaway.

- Lifehacker advises using BrightScope to analyze your 401(k) during a “financial bootcamp day.”

- eToro wins 3 World Finance Awards.

Capital One Pays to Play in Zynga’s Virtual Worlds

Like most, I’ve been amazed at how fast Zynga was able to build a 250+ million user base for its social games. But I’d never actually played one.

Like most, I’ve been amazed at how fast Zynga was able to build a 250+ million user base for its social games. But I’d never actually played one.

Until now. So make that 250 million and one users, because I couldn’t resist checking up on Capital One’s new product placement in three Zynga games (more on what players could do). The bank’s Facebook page, which has grown to 2.3 million likes, has details on the promotions (screenshot 1).

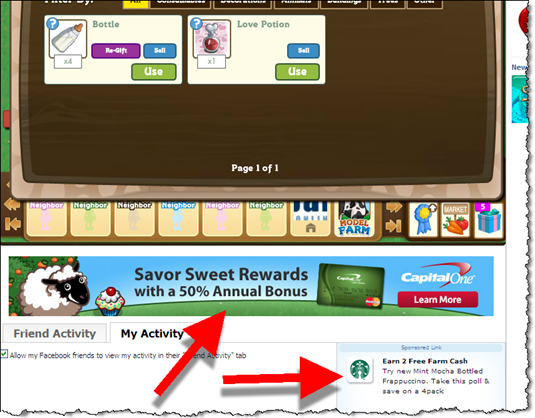

Although, it appears I may have missed my chance to interact with the CapOne goat, Visigoth statute or a virtual branch (the promo only ran one week), there are still credit card ads and mystery gifts available, at least in Farmville, the only game I tested.

Although, it appears I may have missed my chance to interact with the CapOne goat, Visigoth statute or a virtual branch (the promo only ran one week), there are still credit card ads and mystery gifts available, at least in Farmville, the only game I tested.

Capital One viral gift & banner ads

Capital One may have ended the in-game elements for now, but they still have a presence in the game. Starting Farmville for the first time, I was greeted by a number of social elements, one of which is sending a Capital One gift (screenshot 2). There is no indication of what the gift actually is. Maybe that’s part of the fun, but it seems like a weakness to me. Am I sending someone a virtual goat or a solicitation for a CapOne card (mystery solved)?

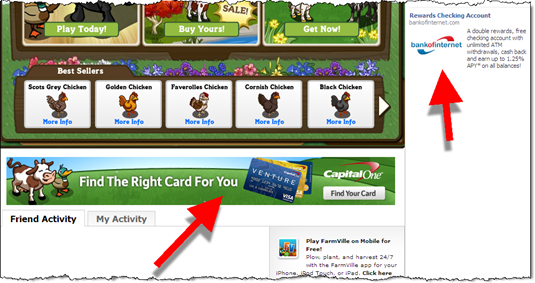

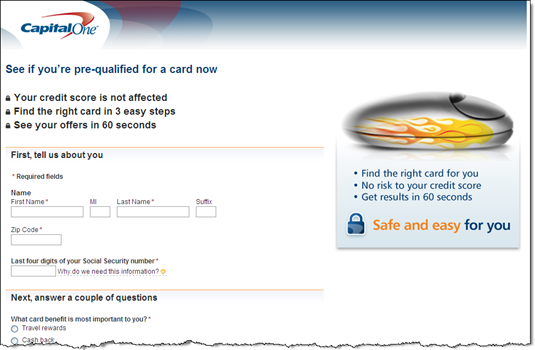

The company is also running banner ads within the game (screenshots 5 & 6). Clicking on them takes users to the usual Capital One pre-approval page within a separate browser window (screenshot 7). Once you land on the CapOne site there is no mention of Farmville.

Discover Card & Citibank bonus offers

Game players are encouraged to buy all kinds of virtual goods. They can earn virtual currency in a number of ways, including using real world cash to buy credits. But users can also earn currency by participating in sponsored activities.

Both Citi and Discover are offering users virtual cash to apply, and be approved, for a credit card. Discover is offering virtual currency worth about $75 and Citi is handing out about $50.

My take: With 250 million users, the large brands owe it to their shareholders to see if they can make hay in Farmville and any other popular virtual world. And I suspect there will be a positive ROI for the right mix of promotion/offer. I have no idea what the magic formula is, but you know the direct marketing wizards at CapOne, Citi and the others will figure it out sooner rather than later (note 1).

———————————————

1. Capital One Facebook page (27 Sep 2011)

2. Capital One "free gift" in Farmville (27 Sep 2011)

3. Choose friends you want to receive the gift

4. Before you send the gift, you have the opportunity to see what the notice looks like to the recipient, and you can add a personal note

5. When I got back to the game, there was a large Capital One banner

Note: Starbucks promotion in lower right

6. Another Capital One banner ad served while playing Farmville

Note: Bank of Internet ad on right

7. The banner ad in Farmville, led to Capital One’s usual pre-qualification form

8. Discover Card and Citibank have powerful offers in the "earn cash" area.

Note: Discover offers 475 Farm Cash (worth about $75) for card approval, Citibank 300 (about $50).

9. The first screen after choosing Discover’s offer

10. Clicking Continue above leads to standard Discover Card app (in new browser window)

———————-

Note: If you are interested in a fictional look at where the commercialization of Internet gaming is headed, I highly recommend Cory Doctorow’s For the Win.

FinovateFall 2011 Live Twitter Transcript

- Here we go, Finovate number 10 starts in 10 minutes. Lots of cool tech coming! Follow the #finovate hashtag for next 2 days.

- Weemba is launching a “reverse lending” system that puts borrowers in control. Only lenders they authorize can contact them. Link

- Demyst.Data is launching a lender predictive analytics system to grow portfolios through better segmentation. Link

- Google is showing its new Advisor that is designed to improve the search experience for mortgages, credit cards, etc. Link

- Google is showing how you can easily compare terms and conditions. It is inviting banks to talk to them to participate.

- Betterment is launching goal-based investing to its simple investing platform. Link

- Betterment is showing how to create multiple goals with different asset allocations. This is a great, understandable investment UI.

- Segmint is launching SegmintSocial, a platform for financial institutions to interact with customers on Facebook. Link

- Segmint is demoing a bank dashboard and live chat-like user interface to engage customers in Facebook.

- Kabbage is debuting its SocialKlimbing system that uses social activity as part of the credit evaluation process. Link

- Kabbage is demoing the social and sales analytics around an eBay merchant’s store in order to assess the merchant’s risk and increase credit.

- RobotDough is launching an “antivirus for your portfolio” that monitors a brokerage account for accounting red flags. Link

- RobotDough has massive coverage: it is worldwide on 130 stock exchanges, has 45,000 companies worldwide, and has options coverage coming soon.

- RebirthFinancial is showing a new way for lenders to analyze small businesses. JAS (pronounced jazz) is a neural network rating system. Link

- Rebirth Financial is looking to popularize a small business predictive model– there is a big need for that.

- CreditSesame is launching its “badges of financial responsibility” to “certify credit worthiness” to the world. Link

- TandemMoney is launching a system for users to “borrow” from themselves, then repay. This helps to minimize interest. Link

- TandemMoney is demoing the “loan” process that uses a “plain talk promise” to disclose exactly what’s going on.

- Equifax is demoing a freemium service that shows “Places” on its mobile app and has real-time access to your credit file. Link

- Equifax is showing how you can use its mobile app to determine “neighborhood safety” based on credit scores. It also has a “credit report” lock toggle.

- Transecq is showing its ENTERSECT out-of-band transaction authentication system using a mobile phone. Link

- Transecq is using push-based notifications rather than an SMS message for the 2nd-factor authentication.

- Balance Financial is demoing a bill upload process using an iPhone camera. It also launches a FaceTime chat with the personal bookkeeper. Link

- Balance Financial’s app has receipt uploads that are managed with help of a personal bookkeeper at $40 per month.

- Micronotes is showing its new KulaX cross-sell engine 1st Advantage Credit Union on stage demoing it Link

- 1st Advantage FCU says it gets three times the number of leads using Micronotes compared to the traditional method of direct marketing.

- PersonalCapital is launching its company today at Finovate, calling itself an “investment management for the Internet age.” Link

- Personal Capital is demoing an investment management UI which really pops, showing an “investment checkup” with fee projections.

- Personal Capital demonstrates its free service using an iPad app with FaceTime connection to your financial advisor. It ends its demo with an iPad giveaway.

- Kony is showing its new mobile commercial banking application that streamlines approvals and transactions. Link

- MyCyberTwin is debuting an “emotionally responsive AI virtual agent” that is able to use emotion, smile, frown, etc. Link

- MyCyberTwin is demoing a fully automated avatar deployed on Australia’s NAB. It captures customer mood and responds to what they really want.

- CashStar is launching its Digital Gifting platform where the iPhone app turns card points into mobile gift cards. Link

- Authentify is launching 2CHK for a secure, 2-way window into user accounts for review, approval, or cancelation of transactions. Link

- Backbase debuts its Retail Bank of the Future, and suggests products that “other peo

ple like you use” (Similar to Amazon.com’s recommendations). Link

- Andera is showing its new FortiFI system that scans new account applications submitted to over 500 financial institutions. The system discovers fraud patterns. Link

- Andera is demoing a fraud app made on BankSimple app. Side note: this is the first Finovate company with masked man driving the laptop!

- eToro is launching “Copy.Me,” a store where you can find the top traders to follow and copy their trades. Link

- The best jokes delivered at Finovate so far: eToro’s Yoni Assia (high school copying) and Kabbage’s Marc Gorlin (naked tweeting).

- Yodlee is showing its new “Dynamic Consumer Experience” with a large “deals” section in the upper-right. Link

- Yodlee is showing a goal-oriented profiling tool, Smart Credit, in its FinApp Store. Real-time PayPal payments can be used to pay bills.

- BillGuard is demoing its new “Antivirus for Bills,” a crowd-sourced database with information on bad charges to inform all users of the fraud. Link

- BillGuard is demoing a Yodlee-powered daily scan on credit card transactions across all your cards. It flags potential issues and likely fraud.

- BillGuard today is launching “BillGuard browser extension,” so far it has found fraudulent charges on 20% of cards– this adds up to $350,000 in savings.

- BillGuard is launching a collaborative industry working group to track fraudulent charges.

- modoPAYMENTS is showing its full-service mobile payments service using a live helmet cam at a local bar. Link

- So glad that modoPAYMENTS the helmet cam demo worked!

- cbanc Network is showing a “social network-like” system for bankers to work with each other to tackle issues. Link

- cBanc uses a virtual currency to incent bankers to upload answers and solutions to the network so that others can “buy” the solutions.

- cBank has 2,900 participating financial institutions and 3,000 solutions and answers in the system, including exam sharing. It even has a method to NOT share the information with competitors.

- cBank Network is launching vendor opportunities today such as advertising, review responses, surveys, etc.

- SigFig is a “second set of eyes for your portfolio.” It can set up a meeting with your adviser within the system.

- SigFig is showing its system for avoiding trading fees, showing a real example where the user could save $150k per year. Link

- Mootwin is showing its new mobile investment management and trading system with real-time updates. Link

- Experian is demoing its new myID privacy and identity monitoring system. Link

- Experian myID will help you opt out from tracking services. This helps get your name and mobile phone number removed from data aggregation services.

- Experian myID can be white-labeled for financial institutions.

- Plastyc is showing its new savings account attached to Upside prepaid account. It includes goals and achievements. Link

- Plastyc is showing its systematic savings tools and cash-back rewards to incent savings (currently 6% rate).

- Dynamics is launching Chip & Choice, enabling advanced EMV applications without the need to update point of sale terminals. Link

- Dynamics drops its card into a glass of water to show that it can go through the washer, nice.

- FinovateFall 2011 day 2 starts off with T8 Webware.

- T8 Webware is launching Grip, a mobile banking app with aggregation to monitor all accounts. It also includes receipt upload. Link

- T8 Webware built its own aggregation engine. The app carries a fee of $0.99 for each month used.

- Swipely is launching a “loyalty for main street,” platform that is linked to customer credit and debit cards. Link

- CREALOGIX is launching CLX.SentinelDisplay, a USB device with keypad, display, and a hardened browser for out-of-band authorizations. Link

- CREALOGIX also includes complete data confidentiality: when the USB device is disconnected, nothing about the session remains on the PC.

- ACI Worldwide and MShift are unveiling their Mobile Enterprise Banker,” a business banking app for tablets. Link

- ACI and MShift are demoing on the iPad, showing how an urgent push notification from a bank overrides an “Angry Birds” session– nice visual.

- FuzeNetwork is launching Swipe2Pay to make a cash payment or deposit to a bank by swiping a card at a retailer’s point of sale. Link

- Fuze Network is demoing actual point of sale transactions where “any card” works. The system is live at ACE now.

- FreeMonee is showing its new card-linked offers system to provide simple cash back rewards. Link

- MitekSystems is debuting “Mobile Balance Transfer” for banks to acquire new credit card customers. Link

- Mitek is demoing “point.shoot.transfer.save.” Users take a photo of a credit card statement, the tool extracts the APR/balance, then uploads the information to the issuer for an offer.

- Mitek is showing what happens in the back office when an image is received and how it is evaluated.

- Truaxis (formerly BillShrink) is demoing its new platform that delivers personalized discounts via web, mobile, and email. Link

- Truaxis says that the majority of its users want “Netflix-like” recommendations for purchases. There is great potential for banks to showcase this information.

- LearnVest is creating the 1st online ‘financial fitness center’. Its goal is to make financial planning more accessible to women. Link

- LearnVest has put 250,000 users through its “financial boot camp” in past 3 months. It is showing a PFM with a “Gmail look and feel.”

- LearnVest is demoing a “financial advice center” with costs $130/yr or $4.99 for 1-day.

2, Session 2

- Cartera Commerce unveils its Local Offers solution, part of its card-linked offers service. Link

- Cartera Commerce is demoing its merchant self-service interface.

- FamZoo is showing its system for teaching kids good money habits via co-branded FamZoo Virtual Family Bank. Link

- FamZoo is demoing how kids and parents interact through its online interface, manage spending, incent savings/giving, and create rewards.

- FamZoo is launching a “partnership edition” today, a private branded version for banks, credit unions, and advisors.

- oFlows is launching a broad-based paperwork solution; allowing for the digitization of all types of paper-based transactions. Link

- oFlows is demoing the upload of a voided check to handle account verification on-the-go.

- InComm and CorFire are showing a new mobile platform for retailers to personalize the consumer payment experience. Link

- InComm and CorFire are demoing an offer delivered in-store on a mobile device. It then uses a mobile barcode to pay at the point of sale.

- planwise is debuting its company at Finovate today. It is designed to help consumers understand their financial plans. Link

- planwise offers “Secure Share” to provide the ability to share parts of your financial plans with others– this is a much-needed online finance feature.

- Jingit is launching a transactional ad platform where consumers can earn cash for engaging with brands. Link

- Jingit is demoing how it works with an online music store: “instant earn/instant spend.” It is working with US Bank for cash-back rewards.

- LighterCapital showing its new Revenue Loan that offers “debt-like risk with equity-like returns.” Link

- Ligher Capital is showing its two-question loan application–that should raise eyes. It is also discussing real “Tomato Battle” funding.

- Lighter Capital is launching “social security” with partners. It combines “light-weight lending platform” with social media-based decisioning.

- MasterCard is showing its new Small Business Controller, part of the inControl suite to create unique payment products. Link

- MasterCard is demoing virtual card creation by small businesses with real-time alerts to employees.

- BankSimple is showing its user interface publicly for the first time today, focusing on speed and simplicity. Link

- BankSimple features a “Safe-to-spend” balance that is “red flagged” in the upper left corner of the main page. It is also demoing a “Goggle-fast” natural-language search.

- BankSimple is “helping users learn from their transactions”. It is demoing fast bill-pay with real-time processing.

- BankSimple is demoing a goal setup. Users can pause, lock, resume, or manually add to it. It is also showing a mobile interface that was “designed before online UI.”

- PayNearMe is launching its new automobile-loan payment service using cash at local stores such a 7-Eleven. Link

- PayNearMe is demoing with a Monopoly board and a toy cash register–a Finovate first.

- PayNearMe demos making payments for rent and utilities with a mobile bar code scanned at a 7-Eleven.

- CarryQuote is showing its Intellicast system to quickly publish investment research to mobile and tablet apps. Link

- CarryQuote is launching a “conference feature” to connect with customers before, during, and after investment events. It also has real-time updates.

- FeeFighters is launching the Samurai payment gateway, the “simplest way to accept payments online.” Link

- FeeFighters is demoing how to add its gateway to a webpage. It uses “intelligent routing” of payments to ensure the lowest cost.

- Wall Street Survivor is launching a new interface catering to investing beginners. It uses missions to educate the learning investors. Link

- Wall Street Survivor is the “largest fantasy stock market online,” with 350,000 registered users.

- Wall Street Survivor is demoing a stock trading “mission” with virtual cash and points to reward users. It also includes Facebook integration.

- miiCard is showing “Assured Identities” to serve as “drivers license/passport checks” for the online world. Link

- miiCard is designed to reduce high levels of “financial cart” abandonment, showing how it can be integrated into a banking site.

- DoughMain is launching a family financial management platform and three age-relevant financial game sites. Link

- DoughMain is showing a financial homepage for pre-teens with a service that includes a prepaid card. It also has a gift card purchase cart.

- DoughMain is looking to offer versions for banks.

- Bundle is using actual spending data to help “cut through the noise” of user-review sites like Yelp. Link

- Bundle is demoing its advanced “search results filtering” to hone in on restaurants that attract repeat customers.

- Transparency Labs is working on the transparency genome to decode and explain financial “fine print.” Link

- Transparency Labs is demoing how it can break down the “fine print” and uncover fees and important conditions, showing it in a dashboard.

- Transparency Labs also monitors existing agreements and sends alerts when the “fine print” changes.

- ActivePath and Cardlytics are teaming up to deliver in-statement offers delivered directly to clients via email. Link

- Cardlytics and ActivePath are showing “active mail” within Gmail. It includes an “offers” tab within the emailed bank E-Statement.

- The Cool House of Financial Media is launching eyeOpen, a financial matching service that provides the best-fit in financial products. Link

- The Cool House of Financial Media is demoing a consumer profiling session with eyeOpen, and recommends products based on what other people liked.

- IN

D Group is launching IND Innovation, a new online and mobile platform that includes a “bank feed.” Link

- IND Group is demoing mobile P2P payment with a QR code. It supports “mobile first” banking.

- Offermatic is reinventing “daily deals” by making them relevant and easy to redeem through bank card linkage. Link

- Offermatic is offering “guaranteed net new profitable customers.” It is demoing a dashboard of metrics for merchants with zero cost to the merchant.

- Offermatic is launching Dynamic Offers, the first system that pegs the value of a discount to the value of the customer. It also track repeat purchases.

- ReadyForZero is showing a new system with loan repayment automation and data sharing. Link

- ReadyForZero found that its users pay down debt twice as fast as non-users; its designed to reduce credit losses for banks/card issuers.

- Bobber Interactive is launching its GoalCard app on Facebook. Link

- Bobber Interactive’s social-game-based system is geared towards GenY; asks “who would you rather loan $50 to?” using Facebook tools.

- Bobber Interactive “is helping Gen-Y win at money” ($200 billion market).

- That’s it– FinovateFall is a wrap…see you in the networking hall!

FinovateFall 2011 in the Press

PG&E’s Convenient Mobile Bill Payment App

Skimming my news feeds in the post-Finovate logjam, I flagged a news release about a new app that just landed in the Android Market (the iPhone version rolled out last December). The app allows Californians to easily pay their PG&E power bills from their mobile phone using a credit/debit card or checking/savings account. It’s powered by Tio Networks.

Skimming my news feeds in the post-Finovate logjam, I flagged a news release about a new app that just landed in the Android Market (the iPhone version rolled out last December). The app allows Californians to easily pay their PG&E power bills from their mobile phone using a credit/debit card or checking/savings account. It’s powered by Tio Networks.

And while you’d think that three years into mobile app era, there’d be hundreds, if not thousands of similar apps, a quick search of the Apple App Store came up empty (see note 1).

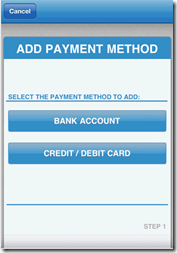

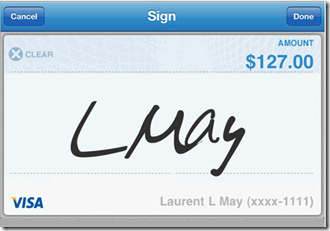

The app is drop-dead simple to use, as it should be (see screenshots below). The amount owed (across multiple PG&E accounts if necessary) is shown. Then, users select payment method, "sign" the screen with their finger, and submit. An email confirms the transaction.

TIO levies a $1.45 transaction fee per payment (well disclosed, see second screenshot below), which is a buck more than a stamp, but it also gives customers the option of paying by card, something that can’t be done in the mail, online or in person. And payments received by 5pm are posted the same day, an important benefit for the large segment of the population that prefers to pay bills at the last minute.

Summary: Company specific same-day billpay apps are a great convenience for the majority of customers who pay their bill upon receipt (rather than relying on automated options). We expect to see many more like this. FIs and payment processors that serve billers would be wise to help them mobilize their payments.

——————————————–

PG&E mobile billpay screenshots (iPhone version)

——–

Notes:

1. There are likely at least a few others that I didn’t find. The app search tools are not super sophisticated.

2. As of 7 July 2011, there are more than 425,000 available apps and more than 15 billion cumulative downloads.

FinovateFall 2011 Best of Show Winners Named

Wow, what a brilliant two days! Lots of new technology, creative twists on the state-of-the-art, and things that will someday be mainstream. As usual, at the end of each day the audience voted on their three favorite demos. Nine shiners were crowned Best of Show (see note for methodology).

FinovateFall 2011 Best of Show winners (in alphabetical order):

We’ll have videos of all 63 demos posted at Finovate as fast as possible (probably 2 weeks out).

Thanks to everyone who participated. I know it’s a cliche, but we couldn’t have done it without you!

——————————

Notes on methodology:

1. Only audience members NOT associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites as the day progressed and to choose just three favorites from the demos of that day. Ballots were turned in at the end of the last demo session each day.

3. The exact written instructions given to attendees: “Please rate (the companies) on the basis of demo quality and potential impact of the innovation demoed. Note: Ballots with more than three companies circled will not be counted.”

4. The nine companies (see #5) appearing on the highest percentage of submitted ballots were named Best of Show.

5. In general, we aim to highlight the top 10% of demos as Best of Show. In this case, we had a three-way tie for 7th place, so we ended up awarding 9.

Finovate Fall 2011 Best of Show Winners Named

Wow, what a two days! Lot’s of brilliant new technology, creative twists on the state-of-the-art, and things that will someday be mainstream. As usual, at the end of each day the audience voted on their three favorite demos and nine ended up being crowned Best of Show (see note for methodology).

FinovateFall 2011 Best of Show winners (in alphabetical order):

We’ll have videos of all 63 demos posted at Finovate as fast as possible (probably 2 weeks out).

Thanks to everyone who participated. I know it’s a cliche, but we couldn’t have done it without you!

——————————

Notes on methodology:

1. Only audience members NOT associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites as the day went on and choose 3 favorites from just the demos of that day. Ballots were turned in at the end of the last demo session each day.

3. The exact written instructions given to attendees: “Please rate (the companies) on the basis of demo quality and potential impact of the innovation demoed. Note: Ballots with more than three companies circled will not be counted.”

4. The nine companies appearing on the highest percentage of submitted ballots were named Best of Show.