Yesterday, U.S. Bank became the fifth top-10 United States bank to release an iPad app and only the second to include remote check deposit (Chase was first). The new app is not listed on the bank’s website yet, but became available in the Apple App Store on May 1.

Yesterday, U.S. Bank became the fifth top-10 United States bank to release an iPad app and only the second to include remote check deposit (Chase was first). The new app is not listed on the bank’s website yet, but became available in the Apple App Store on May 1.

I’ve been testing it for a day now and find it attractive, well laid out, and practical. It’s a genuine native tablet app, and not an enlarged version of its iPhone app.

Here’s what I liked:

- Remote deposit: A cool feature that creates a nice point of differentiation for now.

- Person-to-person payments (which I didn’t test because I needed to first enroll online)

- Different portrait vs. landscape mode looks: The layout changes slightly depending on what position you use the app.

- Built-in calculator and calendar: The lower-right corner contains a calculator/calendar widget.

- Pinned account summary: Account balances are displayed in the upper-right corner on all pages.

- Offers section: The bank has created an offers area in the middle of the page. Presumably this is where the bank will display card-linked offers from its partnership with FreeMonee, along with bank-product specials. Unfortunately, it’s empty, at least for my account (note 1). Unless, the box can be hidden, there should be at least one offer in it at all times (especially at app launch).

- Contact info: The bank’s phone number and email address are prominently displayed.

- Integrated location map: In landscape mode, the nearest US Bank branch and ATM locations are always displayed in the upper right corner (note 2).

- Branding/advertising in front of login: Not everyone who downloads your app, is ready and/or able to login. Talk to them. Service them.

- Full site access via button in right-hand column.

What’s missing:

- Simplified login: U.S. Bank’s table login is 25% harder than its desktop banking login. It uses full username and password. There’s no option to remember username. And unlike the desktop, where the curser is automatically positioned in the fields, tablet users must touch the empty box before typing.

- Financial management/PFM: There is no ability to sort, annotate, or interact with the data in any way.

- Chat: There is no way to interact in real time online.

- Search: There is no way to search transactions or any other info.

- Security assurances: No security section to assure users that it’s safe to bank via tablet.

- Content (other than account info): There is little content outside bank account info and the ATM/branch locator.

- Visual interest: The app is attractive and functional. However, it’s fairly bland by iPad standards. Within the secure site, there are no photos, no interesting graphics, along with the aforementioned empty offers box.

Final grade: The app supports the brand, is easy to navigate and does a great job covering the important basics. Plus it has a few advanced features: offers, P2P payments, and remote deposit. Overall, I’ll give it an A-. Nice work.

———————

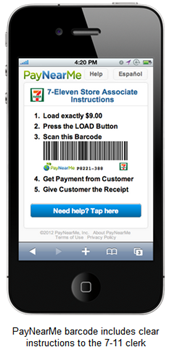

U.S. Bank iPad app pre-login (2 May 2012)

Note: Graphical images promoting the bank and its remote deposit service

U.S. Bank iPad main "Accounts" page in landscape mode

Note: Empty "offers" box; link to full site; calculator in lower right

U.S. Bank iPad main "Accounts" page in landscape mode

Note: Empty "offers" box

———————

Notes:

1. I’m a long-time customer with six current accounts plus a closed home equity line.

2. While the map makes a nice visual, it doesn’t have much use for the 97% of the time the user is logging in to mobile banking from their home or work. So it might be too prominent. This is only an issue in landscape mode. In portrait mode, the map is not displayed.