Open banking platform TrueLayer recently landed $70 million in Series D funding.

The investment, which brings the London-based company’s total funding to $142 million, was led by Addition, with contributions from all major existing investors, as well as new investors including Visionaries Club, Surojit Chatterjee, Zack Kanter, Daniel Graf, and David Avgi.

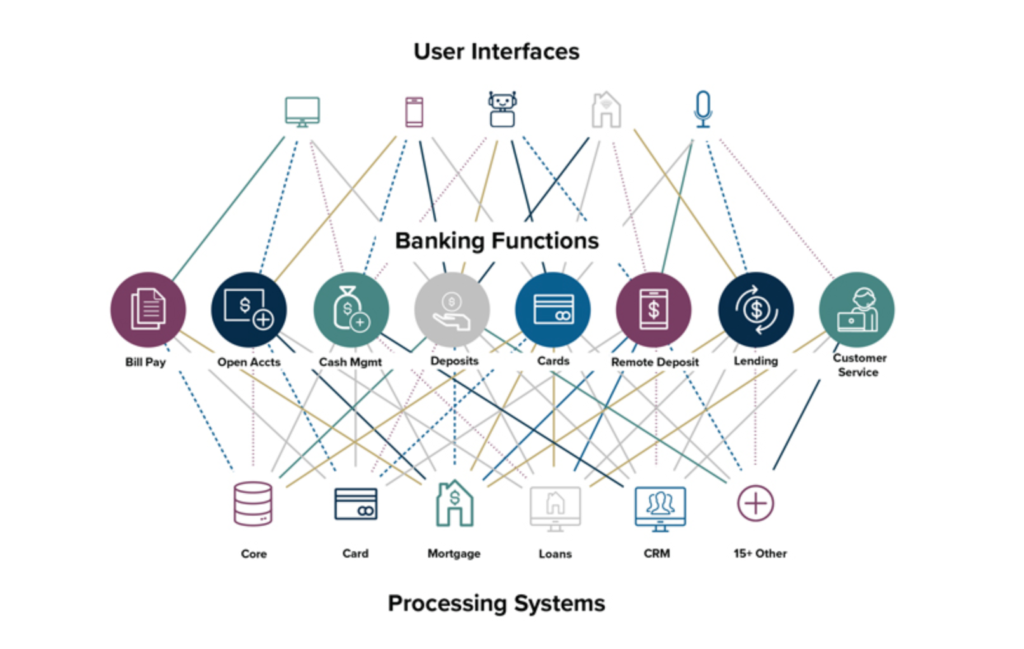

TrueLayer’s mission is to open up finance with its open banking network that connects payments, data, and identity to help people spend, save, and transact more freely online.

The funding comes at a time of major growth in the open banking scene in the U.K. The nation has seen more than three million open banking users and if the growth curve continues, 60% of the U.K.’s population will be using open banking by the end of 2023.

Founded in 2016, TrueLayer now processes more than half of the open banking volume in the U.K., Ireland, and Spain. Much of this growth has come over the course of the past year during which time the company has grown by 600x and expanded across 12 markets.

As for what’s next, TrueLayer will launch new open banking capabilities this year. The company will also expand its network, which will in turn add more account connectivity for consumers.

“We believe that open banking is reaching maturity in several markets and the next phase is about solving bigger, more complex problems for our customers – layering value on top of the raw infrastructure,” said TrueLayer CEO and Co-Founder Francesco Simoneschi. “You’ll see us building more and more in this direction.”

TrueLayer’s clients number in the hundreds and include fintechs such as Revolut, Nutmeg, Trading 212, Stake, and Payoneer.