To start off the second session this morning,

Cartera Commerce demonstrated

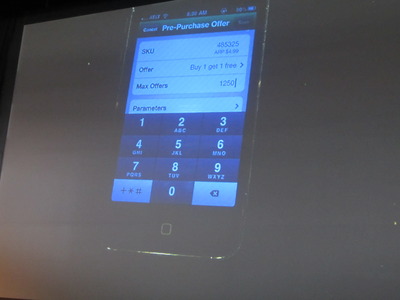

Local Offers, a solution that enables banks to offer daily deals:

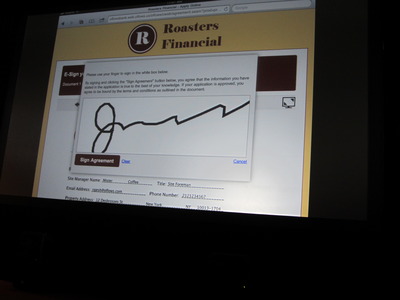

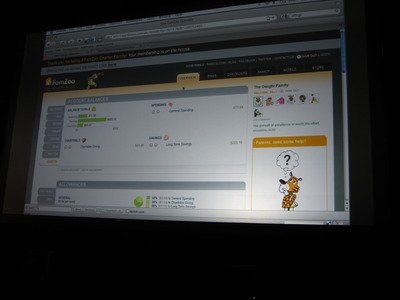

“Cartera will unveil its Local Offers solution enabling banks to tap the explosive growth of the local deals market popularized by Daily Deal sites. Cartera Local Offers allows Banks to market local, card-linked offers to their customers to increase engagement, drive new revenue and maximize card spend.

Cartera executives will demonstrate how merchants advertise local offers, how banks target and market offers, how consumers accept and redeem offers in local stores, and how banks and merchants track sales and results- all with maximum consumer privacy protection and minimal impact on bank or retail systems.”

Product Launched: September 2011

HQ Location: Lexington, MA

Company Founded: August 2005

Metrics: Founded in 2005, headquartered in Lexington, MA, 165+ employees; raised over $30M in venture capital; triple-digit revenue growth each of last four years; merged with Vesdia in Jan 2011, powering card-linked offers for 150 million consumers across programs in financial services, travel, retail, media, and loyalty programs; clients include 4 of the top 5 banks, 3 of top 4 airlines and 60,000+ in-store, local and online merchant advertisers.

Presenting Tom Beecher (President & CEO) & Marc Caltabiano (VP Marketing & Product)

(2)-thumb-200x75-4033.jpg)