- Bold Commerce will offer its merchant clients a pay by bank solution, thanks to a partnership with open banking innovator Link Money.

- When consumers pay using their bank account, merchants avoid credit card processing fees and experience reduced fraud.

- There has been an uptick in pay by bank activity in fintech in recent months, with J.P. Morgan and Adyen both announcing plans to offer the new payment method.

Ecommerce checkout innovator Bold Commerce announced recently it is offering its merchant clients a new way to pay. The Canada-based company has tapped open banking technology company Link Money to help its merchant clients offer more payment options in the checkout experience for their end customers.

Specifically, merchants using Bold Commerce’s checkout tools can take advantage of Link Money’s Pay by Bank solution, which offers consumers an alternative to credit card payments and helps businesses reduce payment processing fees, credit card fraud, and provides guaranteed funds at checkout.

“Every shopper has their preferred payment method among the wide range of options available to them—from Buy Now, Pay Later to digital wallets, credit cards, and account-to-account payments—and they won’t hesitate to leave a product behind if their preferred method isn’t available,” said Bold Commerce CEO Peter Karpas. “It’s why we’re hyperfocused on diversifying the payment options we offer to brands, so they can personalize checkout for individual shoppers down to payment. Adding Link Money’s Pay by Bank solution to our repertoire rounds out these offerings.”

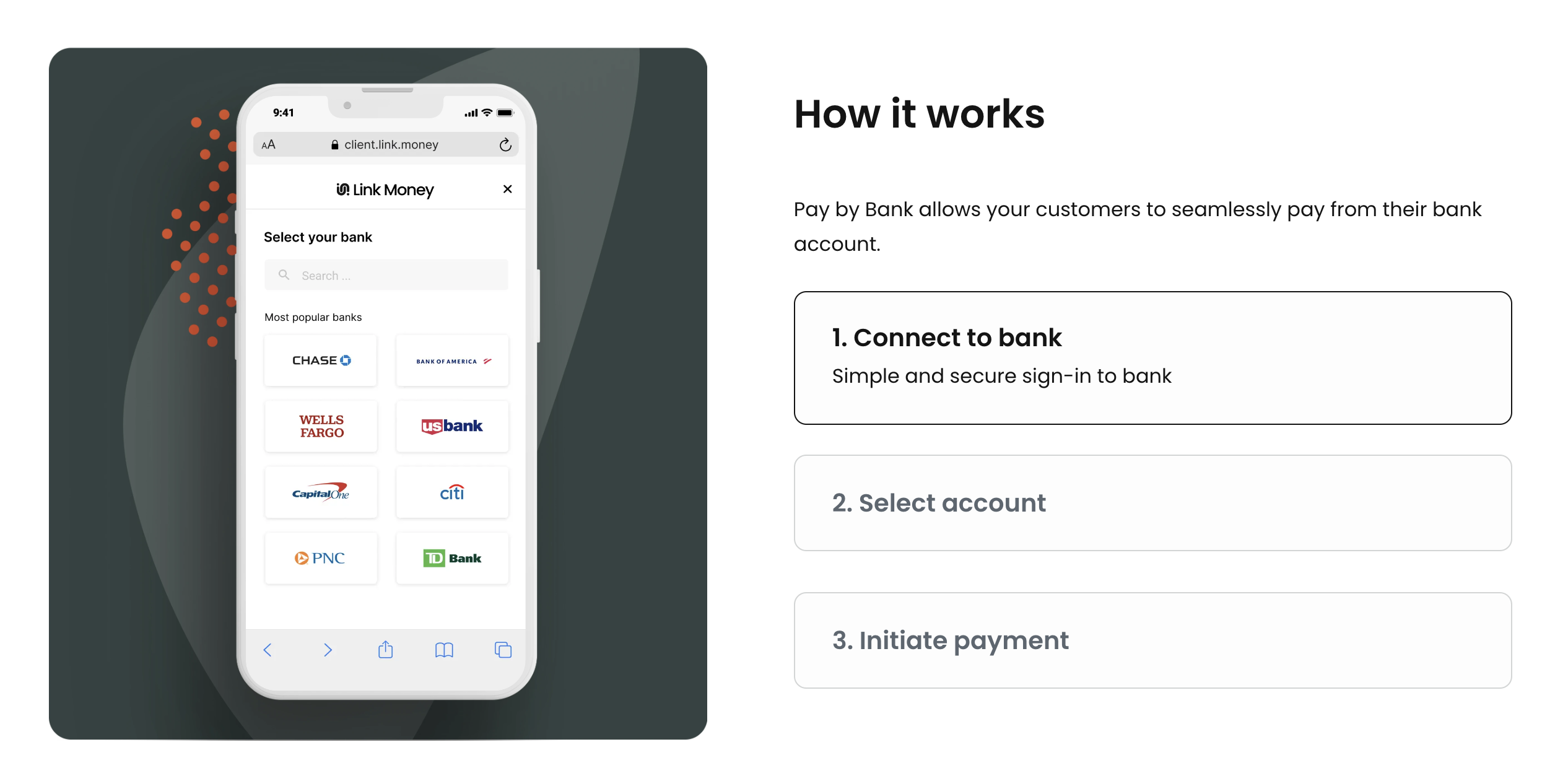

To keep the user experience simple, Link Money’s Pay by Bank leverages open banking, connecting to 3,400 banks across the U.S. Once the shopper selects and signs into their bank, they choose the account they’d like to use for the purchase and initiate the payment.

Link Money, also known as Link Financial Technologies, was founded in 2021. In addition to offering Pay by Bank, the California-based company also offers AccountVerify a verification solution to help merchants ensure that their customers are connecting real bank accounts. The company has raised $30 million and recently named Eric Shoykhet CEO.

With its potential to negate the fees and fraud that come with credit card payments, pay by bank has seen an uptick in popularity lately. Last month, J.P. Morgan disclosed it was leveraging Mastercard to provide billers with the ability to allow their customers to pay bills directly from their bank account. Days after that announcement, Adyen unveiled that it is teaming up with Plaid to launch its pay by bank services in North America early next year.