- Fiserv and Akoya announced a partnership this week.

- Fiserv will have API access to consumer data from Akoya’s network of financial organizations.

- Akoya will utilize Fiserv’s AllData Connect to access consumer data held at financial institutions.

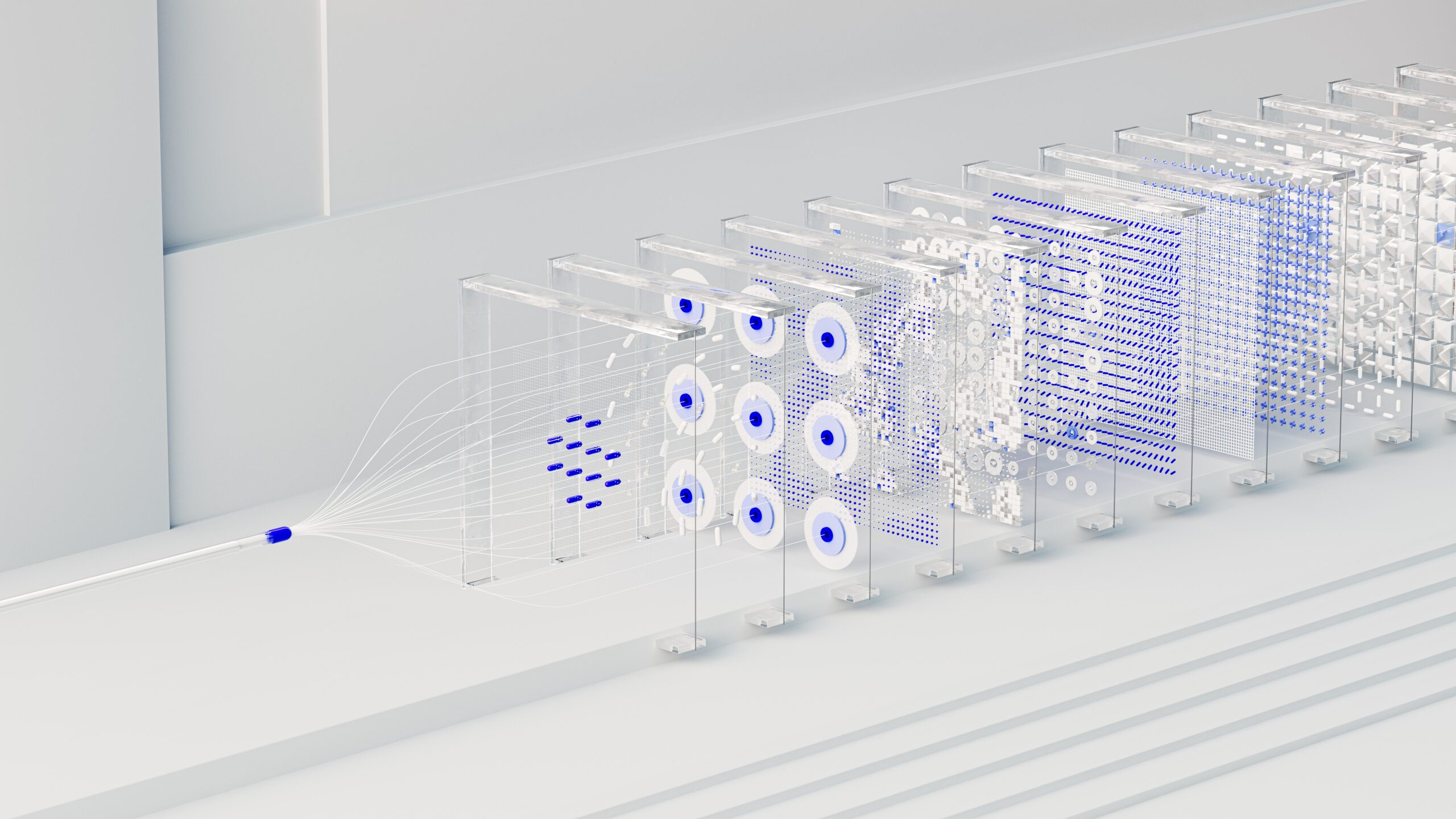

Digital banking and payments solutions company Fiserv has partnered with consumer-permissioned data company Akoya this week. Under the agreement, the two will facilitate financial data sharing among banks, their end customers, and the third party apps the customers engage with.

Fiserv will have API access to consumer data from Akoya’s network of financial institutions and brokerage firms, while Akoya will utilize Fiserv’s AllData Connect to access consumer data from more than 2,800 financial institutions.

“Fiserv and Akoya are empowering consumers to share their data by creating a broader and more secure data access network,” said Fiserv President of Digital Payments Matt Wilcox. “Direct access to data facilitates more integrated digital experiences for consumers and improves the security of the financial ecosystem.”

Akoya’s APIs can create secure, permissioned access to consumers’ account data across Fiserv’s client base of banks, fintechs, and merchants. This free flow of information across the network can help reduce risk related to account opening, funding, and account-to-account transfers. On the merchant side, consumers can opt to transact using a Pay by Bank option in which consumers link their bank account to the merchant’s wallet or app to make direct payments to the merchant.

Ultimately, the partnership will help consumers choose what financial data from their bank they want to share with third party providers.

“This will help consumers manage exactly who they give their data to and understand how their data will be accessed and used,” said Akoya CEO Paul LaRusso. “100% of Akoya’s traffic to financial institutions goes through APIs. Akoya doesn’t ask for consumers’ passwords, and it doesn’t screen-scrape. All consumers deserve this protection and control.”

In the U.S., where open banking regulations do not exist, partnerships like these are key to empowering consumers with control over their financial data. In addition to helping end customers, this open structure also creates efficiencies by empowering organizations with more data, reduces fraud by eliminating screen scraping, and reduces errors that come with manual data entry.

Founded in 1984, Fiserv’s solutions are used in nearly six million merchant locations and almost 10,000 financial insitution clients. The company powers 12,000 financial transactions each second. Fiserv is listed on the NASDAQ under the ticker FI and has a market capitalization of $73.6 billion.