Afterward,

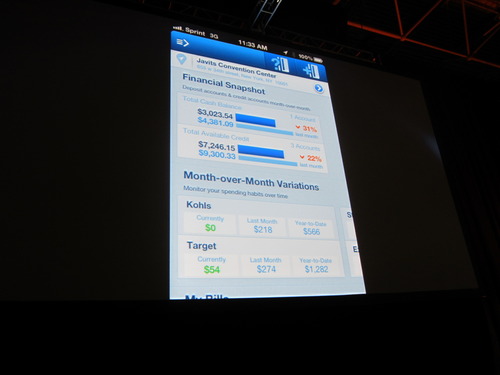

Backbase demonstrated

Launchpad, a solution that minimizes time-to-market for mobile projects:

“Backbase Launchpad is a new and unique banking experience, based on Backbase Portal technology. Launchpad offers the latest innovations and best practices in user experience design and cross device customer journeys. The goal of Launchpad is to drastically bring down time-to-market for online and mobile projects.

Launchpad is immediately optimized for use on regular browsers, tablets and smartphones and is entirely manageable by the e-business and digital teams using the Backbase Portal Manager. Launchpad is seamlessly integrated with the Backbase App Center and includes apps such as: Accounts Overview, Payments, PFM, Stock Portfolio Manager, Message Center, etc. Other apps (either developed by the bank, by Backbase or by third party vendors) can be easily added to Launchpad.

Launchpad and its apps come with a universal integration architecture to hook up existing core banking systems with the new Bank 2.0 front-end.”

Product Launched: 2012

HQ Location: New York, NY

Company Founded: April 2003

Metrics: Privately funded, 150+ employees with offices in New York, Amsterdam, London, Singapore and Moscow

Twitter: @backbase

Introducing Greg Turman (VP Sales North America) and Jelmer de Jong (Global Head of Marketing)