This post is part of our live coverage of FinovateSpring 2015.

![]() Finaeos debuted its compliance automation:

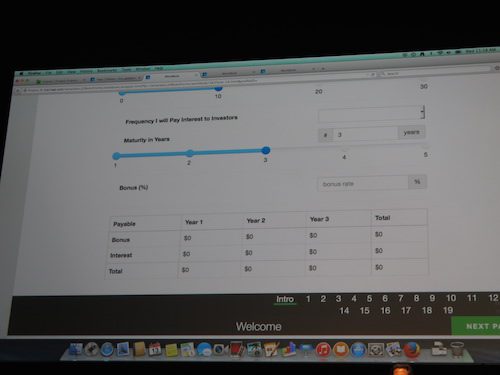

Finaeos debuted its compliance automation:

Finaeos Automates the Back-Office and Capital Raise Compliance.

• Private placement memorandums (full version control for legal and disclosure updates)

• Automated/fillable forms and workbooks

• Subscription documents and, when required, promissory note in debt offerings

• KYC “Know Your Customer”

• KYP “Know your Product” (tests for agents)

• AML “Anti Money Laundering” with specific considerations to BSA and the U.S. Patriot Act

• Digital signatures upon EDGAR termination with heightened consideration of website filing and modernization

• Mobile access with consideration of OCIE Cyber Security Initiative April 15, 2014: National Exam Program

Presenter: Tim Vasko, CEO and founder

Metrics: 42 employees between Canada, our self-owned India Corporation, and the United States; self-funded

HQ: Victoria, British Columbia, Canada

Founded: January 2015