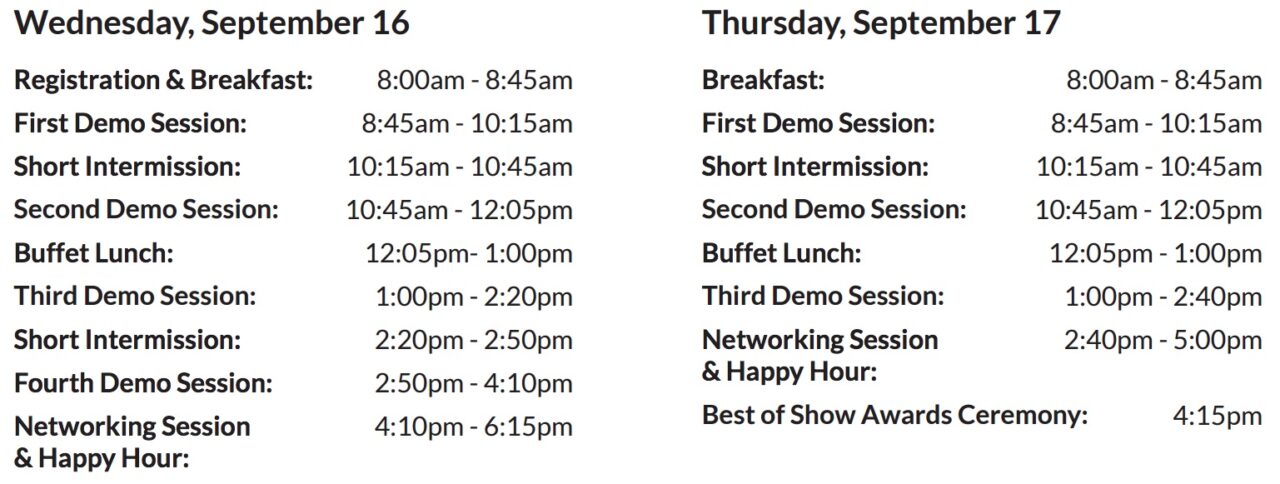

The Sneak Peek series looks at the innovators demoing live onstage in front of 1,500 execs at FinovateFall. Get your tickets today and we’ll see you in New York, 16/17 September!

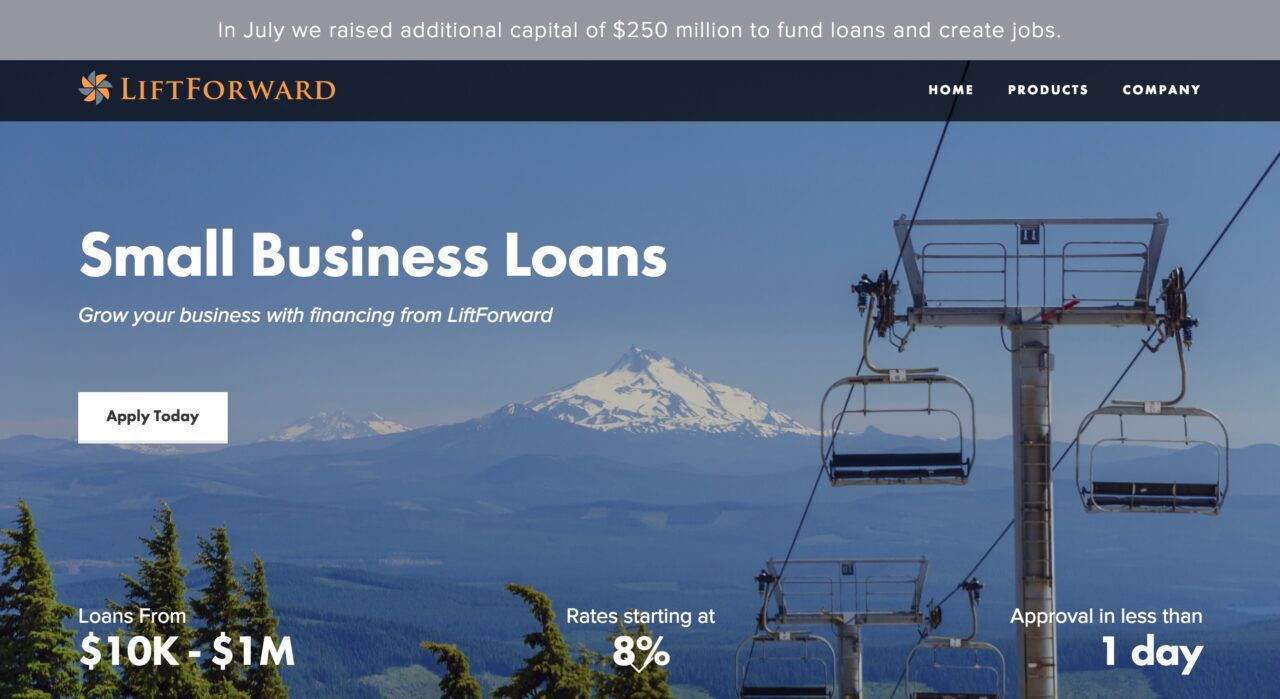

LiftForward will show its technology-as-a-service financing platform for manufacturers, suppliers, and retailers. TaaSLift provides a plug-and-play method for businesses to offer their small-business customers products-as-a-service.

will show its technology-as-a-service financing platform for manufacturers, suppliers, and retailers. TaaSLift provides a plug-and-play method for businesses to offer their small-business customers products-as-a-service.

Features:

- Turns a one-time purchase into a subscription service

- Increases sales and repeat purchases

- Increases customer loyalty

Why it’s great

By replacing expensive, one-time purchases with affordable subscriptions, TaaSLift helps companies increase sales while strengthening customer relationships.

Presenters

Presenters

Jeffrey Rogers, CEO

Rogers has more than 20 years of experience in building companies. His disciplines include technology, e-commerce, finance and operations.

LinkedIn

Michael Grassotti, CTO

Michael Grassotti, CTO

Grassotti has more than 20 years of experience as a technology-focused entrepreneur with experience recruiting and leading tech teams, and taking products from idea to market.

LinkedIn

HelloWallet

HelloWallet Presenters

Presenters Andrew Vincent, Senior Product Manager

Andrew Vincent, Senior Product Manager

Cameron Jacox, Co-founder

Cameron Jacox, Co-founder

Presenter

Presenter

Additiv

Additiv Presenter

Presenter

Presenter

Presenter

Why it’s great

Why it’s great Kate Miroslaw, Key Account Manager

Kate Miroslaw, Key Account Manager