Our expanded FinovateFall conference is coming up on September 11 through 14, and we’re taking a look at each of the six summit discussions that will take place after the demos. In the final segment of this series, we’re examining future technologies.

Summit #6: Future technology

The year was 2000. AOL and Timer Warner merged, Tate Modern and the London Eye both opened in London, Blink-182 and Oasis ruled the air waves, and the movie Meet the Parents premiered in theaters. Seventeen years later, we’re living in the future, and while payments and mortgage technology sometimes still hark back to the 1990’s, there are a handful of enabling technologies that remind us of our progress.

Blockchain

Blockchain has come a long way since Bitcoin became available in 2008 and spiked in value in 2014. The blockchain, the technology behind the digital currency, has not only opened doors to a range of other cryptocurrencies, it is now used by companies to track and manage personal identities, transmit data, send and receive international payments, and more.

Notable alums leveraging the blockchain:

- Ripple, the technology behind the XRP cryptocurrency. Ripple demoed at FinovateSpring 2013 as OpenCoin.

- Caxton, a multi-currency, cross-border payments platform. The company’s CEO, Rupert Lee-Browne debuted Caxton’s Firebird Payment Engine at FinovateEurope 2017.

- Bitbond, an international marketplace lending platform for small business loans that leverages the blockchain for global payments. At FinovateFall 2016, the company’s founder and CEO, Radko Albrecht, showcased Bitbond’s automated SME credit scoring methodology.

- BanQu leverages the blockchain to provide global economic identities. The company won Best of Show for its demo at FinovateSpring 2016.

- MarketX’s online investment platform leverages the blockchain to prove ownership and integrity of private, pre-IPO shares. The company’s CEO and founder, Cathryn Chen, showcased MarketX at FinovateFall 2016.

AI

Elon Musk has bolstered the public’s interest in artificial intelligence recently, after he publicized a doomsday warning that software and machines may leverage AI to take over the world. Despite this, the use of AI in fintech has been growing over the past couple of years and we have yet to see its peak.

Notable alums leveraging AI:

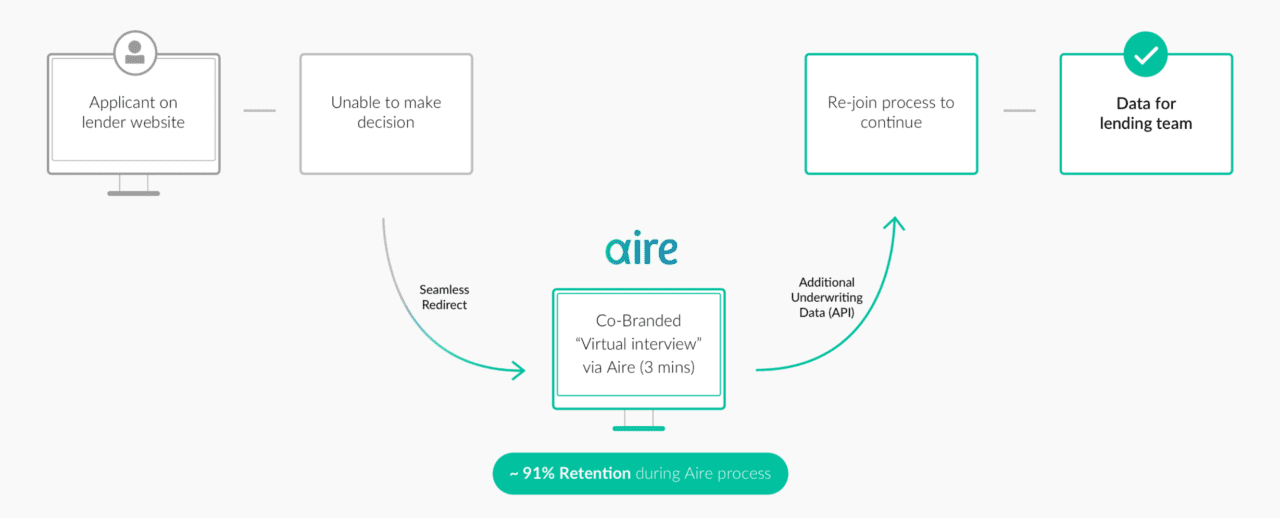

- Aire offers an API that generates an alternative credit score for potential borrowers with thin-to-no credit files. The company, which recently raised $5 million, demoed at FinovateEurope 2015.

- LendingRobot is an automated investment service that enables lenders to invest in alternative, P2P investments. The company won Best of Show for demoing its dashboard at FinovateSpring 2016.

- Kensho is an interactive, user-friendly research assistant. The company’s CEO Daniel Nadler debuted Kensho’s Warren assistant at FinovateEurope 2014.

- Personetics uses AI-powered predictive analytics to help banks fulfill their clients’ needs by predicting their situation. The Israel-based company showcased its chatbot at FinovateFall 2016.

- Feedzai’s fraud prevention software uses big data and AI to block payment fraud in real time. The company’s CEO, Nuno Sebastiao, demoed Feedzai at FinovateEurope 2014.

Augmented Reality

Augmented reality (AR) isn’t new to banking, but its potential has increased since technologies such as ATM location tools came on the scene in 2010. In the seven years since, there has been little development across all sectors.

The most notable application of augmented reality has been Pokemon Go, a game launched in 2016. While Pokemon Go is still one step removed from the banking world, it has shown us that the way in which we interact with our devices is changing. This change is still in its infancy but a handful of companies have created viable products for banks, mostly in the way of marketing solutions.

Notable alums leveraging AR:

- ebankIT provides omni-channel digital solutions that break the mold of traditional online banking. The company most recently demoed at FinovateEurope 2017 and will showcase its newest technology at FinovateFall in September.

- ITSector is a software development company (and parent company of ebankIT) that offers banks marketing products powered by augmented reality. The company debuted its Express Credit solution at FinovateEurope 2017.

- Fiserv, a global financial services technology provider, offers augmented reality solutions for banks seeking a unique way to advertise to their customers. The company’s most recent Finovate demo was at FinovateFall 2016.

Virtual Reality

Similar to AR, virtual reality (VR) is also on the fringe. While there’s a lot of excitement about technology’s potential to make communications more efficient, harness new client segments, and improve the customer experience; there has been limited application in its use for financial services.

Notable alums leveraging VR:

- NCR is an omni-channel solutions company. At FinovateSpring 2017, the company showed off its fully immersive VR ATM experience that leverages real-time collaboration to train employees to fix ATMs with hands-on experience.

- CREALOGIX, a digital banking company, launched a VR solution for personal financial management at FinovateEurope 2017. The solution uses imagery and an inspiring user experience to engage users and encourage them to mange their finances.

- Comarch is an international software company. At FinovateSpring 2016, the company showed how advisors and relationship managers can deliver investment advice in VR for a more personal touch.

- Worldpay, a global payments company, is developing a VR-based payments system. The company gave a presentation about the payment journey at FinDEVr Silicon Valley 2016.

The upcoming Future Technology Summit at FinovateFall will offer a day of discussions from industry thought leaders, top fintechs, and banks. Be a part of these live panel discussions at FinovateFall; register and save your spot at the show. A few summit highlights include:

- Blockchain

- AI

- Open Banking

- AR/VR

This is our final post in the FinovateFall Summit Series. Review all six topics and be sure to drop by the discussions taking place at FinovateFall this September 11 through 14 in New York.

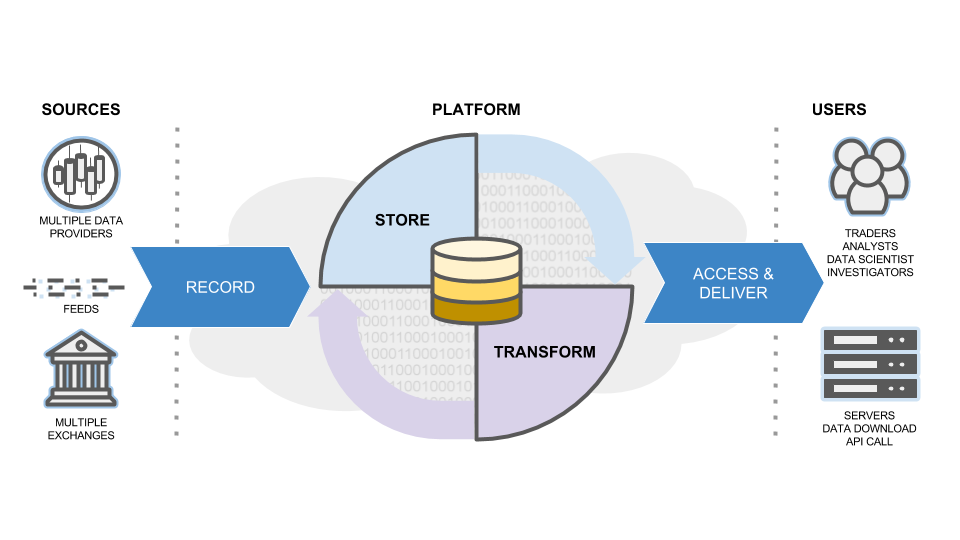

TickSmith’s TickVault data flow diagram

TickSmith’s TickVault data flow diagram