After the final fintech demo at FinovateSpring next month, the next highlight to take the stage will be a committee of six fintech experts. Each analyst will have seven minutes to make their case for what they see as the hottest trend and opportunity in financial services.

The pressure is on for this group. Here’s who will be in the hot seat at FinovateSpring next month:

Jacob Jegher

Jacob Jegher

Jegher is an experienced fintech executive and digital banking thought leader. He advises clients on emerging technologies and business strategies related to retail, small business, and corporate digital banking. Jegher provides strategic consulting to financial institutions and solution providers on issues ranging from digital strategy to vendor selection. In addition to his client-facing responsibilities, Jacob leads Javelin’s overall strategy, marketing, and product development efforts.

Most recently, Jegher was Vice President of Global Solution Marketing and Head of Analyst Relations at FIS, where he was responsible for marketing strategy efforts across all business units and solutions. He also brings extensive expertise in the banking research and consulting field, having spent over 10 years as a Research Director at Celent.

Tiffani Montez

Montez is a Retail Banking senior analyst at Aite Group covering card issuance for prepaid, credit, and debit cards. She has deep experience in global financial services with more than 20 years of experience in strategic planning, strategic execution, and consumer experience design. Montez has the unique ability to not only build strategies but also provide the strategic guidelines for executing complex strategic plans to deliver results.

Prior to joining Aite Group, Montez held executive-level positions at Wells Fargo, building digital experiences for various product groups such as home lending, personal credit, wealth, brokerage, and retirement, and was a principal analyst at Forrester Research, covering topics such as mobile banking, digital financial management, multichannel banking, and next-generation sales strategies. Most recently, she was the VP of operations at Terafina, helping banks and credit unions transform their customer experience through an omnichannel strategy. Her unique blend of experience as a practitioner, analyst, and vendor solution provider gives her the foundation to be able to provide thought leadership to clients through all lenses of the financial services ecosystem.

Ron Shevlin

Ron Shevlin

Shevlin is the Director of Research at Cornerstone Advisors where he heads up the firm’s strategic research efforts, including the Insight Vault service. Shevlin is the author of the book, Smarter Bank, and is the purveyor of fine snark on his Snarketing blog and the Fintech Snark Tank podcast. Shevlin’s experience includes research and consulting for Aite Group, Forrester Research, and KPMG.

Shane Hubbell

Shane Hubbell

Hubbell is a Vice President at Arbor Advisors and has more than 10 years of experience as an investment banker, business operations manager, and entrepreneur. In his role at Arbor, Hubbell is responsible for driving the firm’s business development efforts to source new clients as well as helping clients execute successful transactions. He has executed over $600 million of M&A and capital raising transactions over his career.

Prior to joining Arbor, Hubbell helped drive the strategic development of Goldman Sachs’ derivative trading systems. Previous to this, he was co-founder and CFO of a biotechnology company that developed a safer device for a cricothyrotomy.

Daniel Latimore

Daniel Latimore

Latimore, CFA, is the Senior Vice President of Celent’s Banking group and is based in the firm’s Boston office. Latimore’s areas of focus include the banking ecosystem, digital and omnichannel banking, and innovation. Underlying each is a keen interest in consumer behavior and technology-enabled strategy. Latimore is a frequent speaker at industry conferences and client gatherings, having addressed audiences ranging from intimate meetings of CEOs and central banks to conference keynotes in more than a dozen countries. He led research groups at Deloitte and IBM, worked in industry Liberty Mutual and Merrill Lynch (where he lived in New York, Tokyo and London), and was a consultant at McKinsey & Co.

Jerry Silva

Jerry Silva

Jerry Silva is research director for IDC Financial Insights responsible for the global retail banking practice. Jerry’s research focuses on technology trends and customer expectations and behaviors in retail banking worldwide. Jerry draws upon over 25 years experience in the financial services industry to cover a variety of topics, from the back office, to customer channels, to governance in the technology shops at financial institutions. His work for both institutions and vendors gives Jerry a broad perspective in technology strategies.

Join us on May 8 through 11 at the Santa Clara convention center to hear the experts talk about the latest in fintech. Register by April 27 and save.

Jacob Jegher

Jacob Jegher Ron Shevlin

Ron Shevlin Shane Hubbell

Shane Hubbell Daniel Latimore

Daniel Latimore Jerry Silva

Jerry Silva

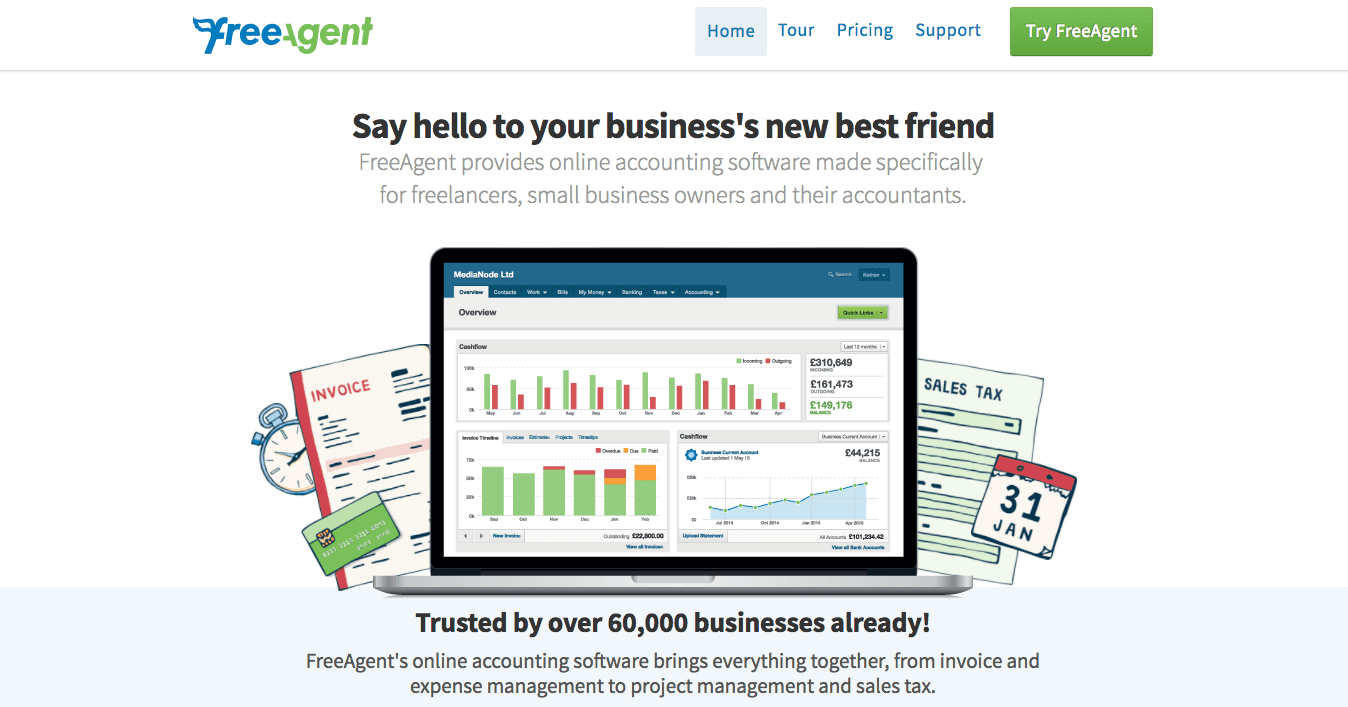

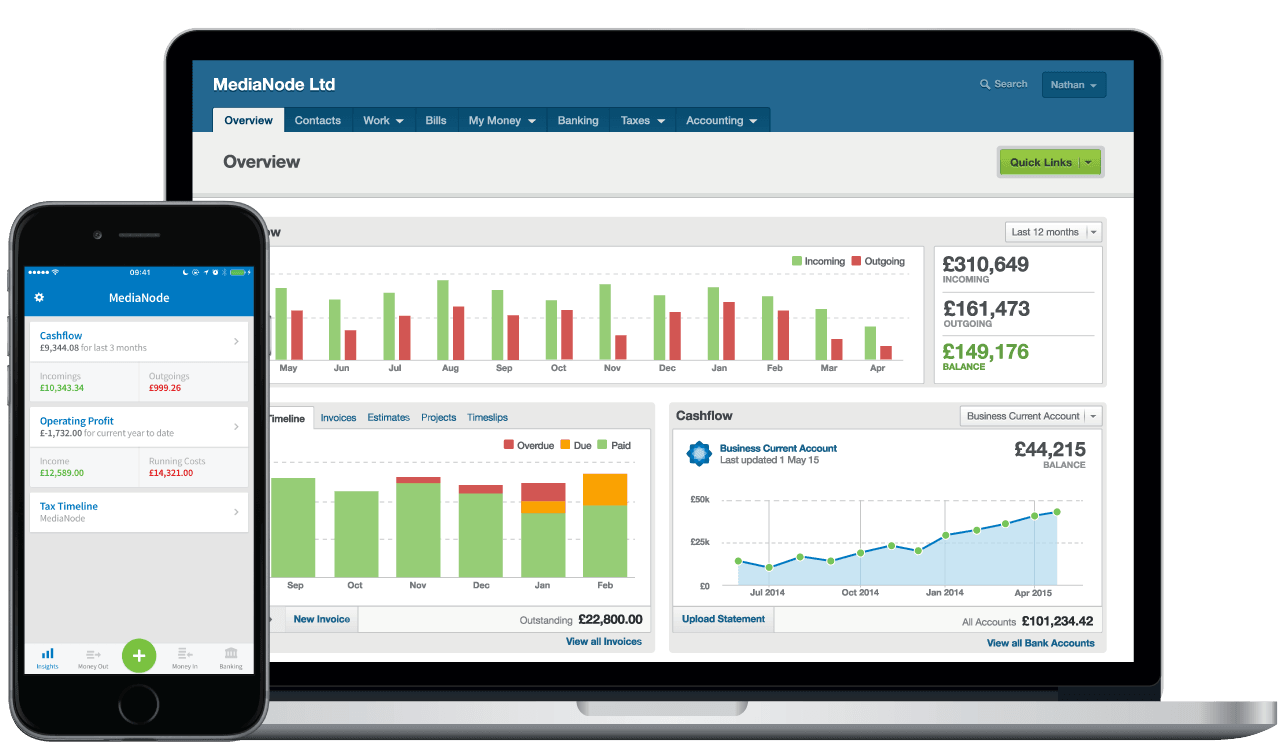

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”