Mobile-first financial platform Stash closed $37.5 million in funding today to help Americans rethink how they invest and save. Union Square Ventures led the Series D round, with contributions also coming from existing investors Breyer Capital, Coatue Management, Entree Capital, Goodwater Capital, and Valar Ventures.

“Through customer focus and a data-driven mindset, Stash has been able to create a powerful consumer brand, with unprecedented growth, on its journey to fix the inequities plaguing financial opportunity across the U.S. We’re excited to join them on this mission to shake up the status quo,” said Rebecca Kaden, Partner at Union Square Ventures.

Today’s round brings Stash’s total funding received in its three-year history to $116.3 million. After last October’s $40 million round, Business Insider estimated the company’s value at $240 million. The New York-based company will use the funds to support the launch of its newest batch of products, including Custodial Accounts, which will be rolling out this week. Custodial Accounts will allow Stash clients to open new accounts for minors to give them a head start on their finances.

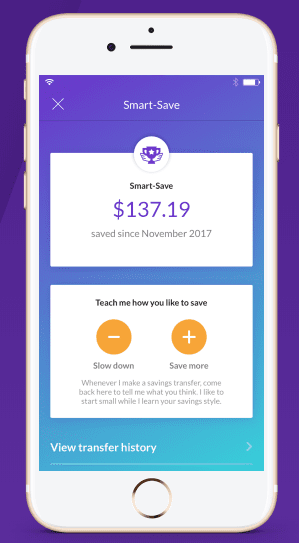

Additional new features include Smart-Save (pictured right) and Stash Coach. Smart-Save studies a user’s spending habits and uses an algorithm to determine where they have spare cash, then moves a portion of that amount into a savings account, from which clients can withdraw at any time for free. Stash Coach provides financial recommendations and challenges, while providing guidance and support for accomplishments.

“Stash’s goal since day one has been to help the masses of underserved Americans jump start their journey towards building a healthy and prosperous future,” said Brandon Krieg, co-founder and CEO of Stash. “Through intelligent products and an emphasis on education, we’ve been able to meaningfully improve the financial lives of nearly two million clients. We’re proud of what our customers have accomplished, but we’re even more excited for what’s ahead.”

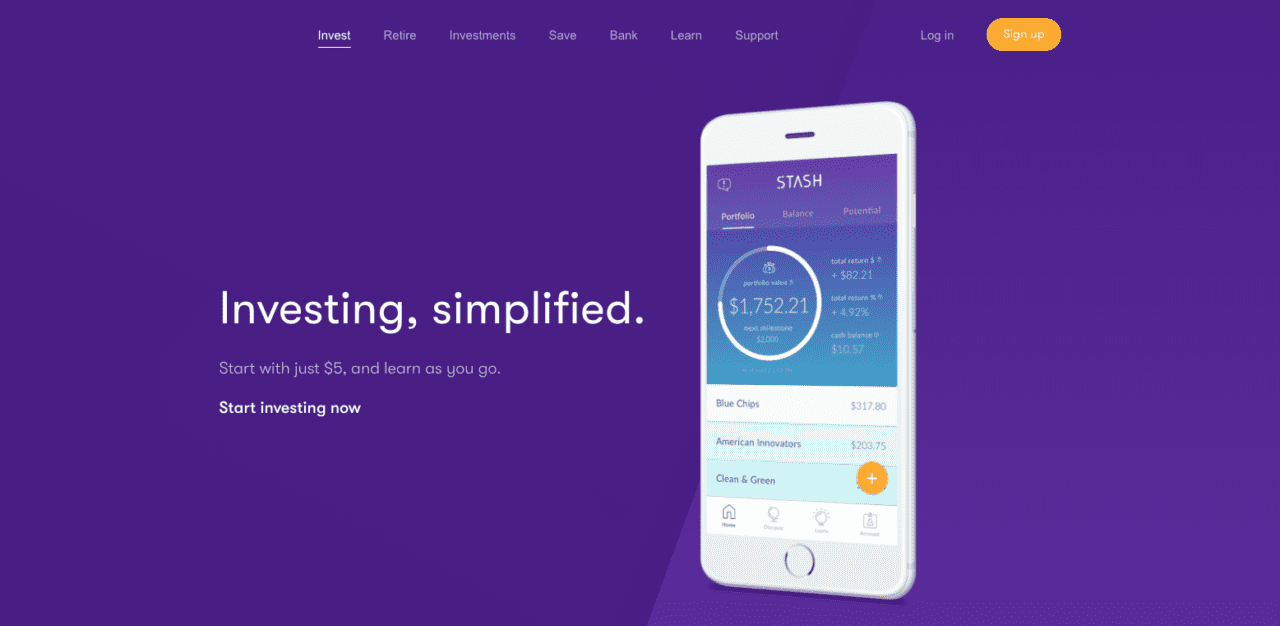

Stash currently serves over 1.7 million clients on its investing platform, which allows users to choose from a selection of over 40 curated ETFs, and is showing strong growth– approximately 40,000 new clients join its investing platform weekly. The company counts 5 million subscribers to Stash Learn, a financial education content newsletter.

The company’s mobile investing platform doesn’t collect add-on commissions or trading fees, and charges $1 per month for accounts under $5,000. Users with portfolios over that threshold pay 0.25% per year. For all accounts, Stash has lowered the overdraft fee to $0.50 for returned deposits. This is significantly lower than the $35 average overdraft fee that traditional banks charge.

Krieg debuted Stash Retire at FinovateFall 2017. In November of last year, KPMG and H2 Ventures named the company on its 2017 Fintech 100 list. The month prior, Stash announced plans to expand its platform from investing to a more robust banking service. This is part of the rebundling of fintech trend that many analysts predicted would dominate 2018.