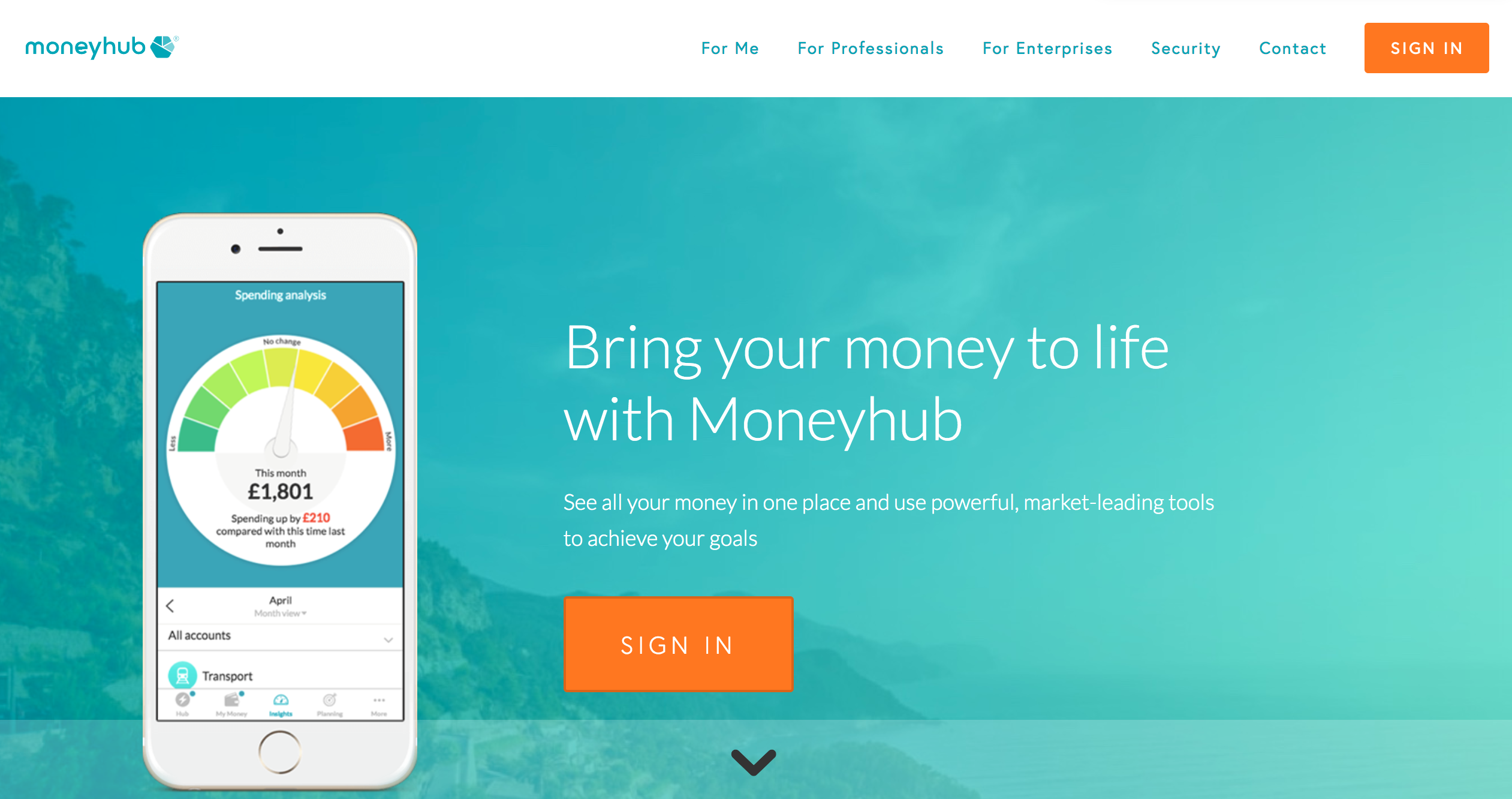

Financial tools company MoneyHub announced today it received an undisclosed amount of funding from the venture arm of financial services giant Nationwide, which used a portion of its $64.5 million fund to take a minority stake in the U.K.-based fintech.

Tony Prestedge, deputy chief executive at Nationwide Building Society, said, ‚ÄúIt‚Äôs important that the Society invests for the future to ensure we remain at the forefront of innovation. Investing in start-ups like Moneyhub helps us identify, learn about, and explore new capabilities and technologies that will help deliver our technology strategy both now and in the future.‚ÄĚ

Interestingly, this isn’t MoneyHub’s first tie-up with the insurance industry. The company was acquired by South African insurance company MMI Holdings in 2014.

Founded in 2009, MoneyHub offers direct-to-consumer, direct-to-advisor, and enterprise versions of its personal financial management technology. The company aggregates consumers’ financial data onto a single platform to offer a holistic view of their overall financial health. In August, MoneyHub received¬†authorization as a payment initiation services provider from the U.K.’s Financial Conduct Authority. This certification enables the firm to allow users to initiate payments across accounts from within its platform.

In April, MoneyHub solidified its commitment to open banking by partnering with challenger banks Monzo and Starling in an integration that enables the banks’ clients to¬†use the Moneyhub app to link their checking and savings accounts, credit cards, pensions, loans, mortgages, SIPPs, ISAs, and investments. “While we have years of experience in innovating and unlocking the benefits of new technology, we aren‚Äôt complacent. We know that by working together with start-ups we can learn from each other and ensure we are best placed to help our members get the most out of new technology in the future,‚ÄĚ said¬†Prestedge.

MoneyHub most recently presented at FinovateEurope 2017, where it debuted the SmartAssist tool for the enterprise version of its software. SmartAssist is an intelligent messaging feature that leverages AI to help consumers manage their finances and plan for the future.

Presenter

Presenter

Joel Niwogaba, Software Developer

Joel Niwogaba, Software Developer

Presenters

Presenters Paris Valakelis, Co-founder

Paris Valakelis, Co-founder

Seven months after

Seven months after