One benefit of running a financial services publication is that my own financial mistakes can be used for editorial material. My latest faux pas resulted in learning first-hand about U.S. Bank’s self-service collection module integrated into online banking.

One benefit of running a financial services publication is that my own financial mistakes can be used for editorial material. My latest faux pas resulted in learning first-hand about U.S. Bank’s self-service collection module integrated into online banking.

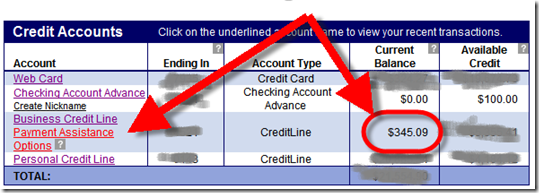

The details: Apparently, last month I hit negative $300 in my business checking account during some intra-day moment. The daily closing balances never fell below a healthy balance, so I didn’t realize an automatic “overdraft” transfer from our credit line had occurred (note 1).

Since I assumed it was unused, I never looked at the credit line statement, and therefore neglected to pay it off or make the minimum payment. Then yesterday, when I went online to pay a bill, I noticed a new line item on my account ledger, Payment Assistance Options (see first screenshot below). I know that if my bank is offering to assist me with my payment, I’m in deep trouble.

I followed the link to where a well laid-out module took me through my options to pay back the delinquent loan (see screenshots 2 and 3). I paid off the $300 plus an extra $39 for the late fee, $3 for the overdraft fee, and a $2.79 finance charge. That’s $44.79 in penalty fees, pretty expensive for a 42-day $300 loan (note 1), but low cost for a blog entry.

Bottom line: The self-service collection module is a good addition to online banking and should save the bank costs in routine collection efforts where the user simply forgot to make a payment. Even though I hated the $39 late fee, I’m glad the delinquency didn’t progress further until it landed on my credit report.

1. US Bank main account management page showing collection function (29 July 2009)

2. Landing page outlining collection options

3. Promise to pay page

Note: Can pay by Web, mail, express mail,

Note:

1. Yes, closer monitoring of our checking account transaction register would have identified the transfer. But like many business owners, I prefer to spend time in other areas of the business.

The new GUI attempts to make bill payment more understandable. With paper and electronic delivery to merchants, person-to-person payments (also paper or electronic), and expedited payments thrown in the mix, it was hard for users to know exactly which option to select (see second screenshot for old user interface).

The new GUI attempts to make bill payment more understandable. With paper and electronic delivery to merchants, person-to-person payments (also paper or electronic), and expedited payments thrown in the mix, it was hard for users to know exactly which option to select (see second screenshot for old user interface).