August 21, 2015

Dear Ms/Mr CEO:

Congratulations on making it through the most trying time in banking since the 1930s! That was some ride, wasn’t it? And now that you are on the other side, what’s your reward? Alienated customers. Massive new regulations. Escalating costs. Technology obsolescence from deferred development. And now, new competition! Both from less-regulated fintech players with fancy APIs, and aggressive digital marketers at the mega-brands.

So, I can understand your reluctance to avoid anything that smacks of a price increase. Why risk losing another household? And your customers are already testy over interest rates so low they look like a typo. It’s a lot easier to keep checking accounts free of monthly fees and make it up on the back-end with low-balance and OD/NSF fees.

But we all know that’s not sustainable. The $35 dollar overdraft will soon go the way of 1.5% interchange on debit cards. If there is anything we’ve learned in the internet era, it’s that hidden fees are eventually uncovered. And even if you don’t buy that, the CFPB will make you a believer sooner or later, especially if the issue rears its head in the 2016 election cycle.

I know this is going to hurt, but I’d like you to seriously consider getting rid of consumer OD/NSF fees altogether. Or at least roll them back to the $10 range where they’d be much more defensible. I know this is not going to be good for the short-term stock price and/or compensation. But it’s a logical consequence of becoming too reliant on fees that hit hardest to those with lower balances.

But weaning off of OD/NSF revenues doesn’t have to decimate your P&L. And it could even prove better in the long run. Here’s my (admittedly over simplified) 4-point plan to make up the fee income shortfall:

1. Move customers into subscription-based “overdraft protection”

The best thing that ever happened to me, in terms of my own banking usage, is when I found US Bank’s overdraft protection, a line of credit with automatic, unlimited and fee-free overdraft transfers to checking. I never had to worry about my checking balance as cash flow ebbed and flowed over the course of the month. I paid a $35 annual fee for the credit line, but I gladly would have paid much more ($7 to $10/mo?) for the peace of mind. In addition, I happily paid 12% APR on my credit balances each year. That varied, but I’m sure I racked up at least $100 in finance charges every year. It was a huge win for the bank, and I was very happy. Sadly, the bank no longer offers fee-free transfers, but I hope they bring it back.

2. Introduce subscription fees for premium services

If you offer a good product, you have to be upfront and charge for it. And it doesn’t have to be an across-the-board fee increase. Let customers self-select into higher-priced options. Want to talk to CSR at 2:00 a.m.? That comes with our $5/mo gold package. Like more security? Yep, we’ll guarantee you’ll never lose a dime with our $7/mo Fort Knox upgrade.

3. Charge for faster access to remote deposits

Region Bank’s pricing for remote deposits is one of the smartest moves I’ve seen in my 25 years in banking. Unless they hold a patent on this, I don’t understand why everyone hasn’t adopted it. Granted, there’s some technical, service and operational issues, but there’s also the startup InGo Money, who can do much of the heavy lifting and even take on the risk exposure if that’s an issue. InGo Money is already powering mobile deposits for a pile of prepaid issuers including BB&T Bank and Moven.

4. Get into the insurance business

This may seem like a random suggestion, but think how much better it would be for your brand to replace negative penalty fees with products that increase peace of mind. There are many ways to enter the insurance business, but one of the fastest ways to jump-start an online program is through the Insuritas white-label program (see last year’s Finovate demo).

I apologize for sending this letter just when you were enjoying the end-of-summer holidays. But with the 2016 planning season just around the corner, there is no better time to diversify your fee-income stream.

Sincerely,

Jim Bruene

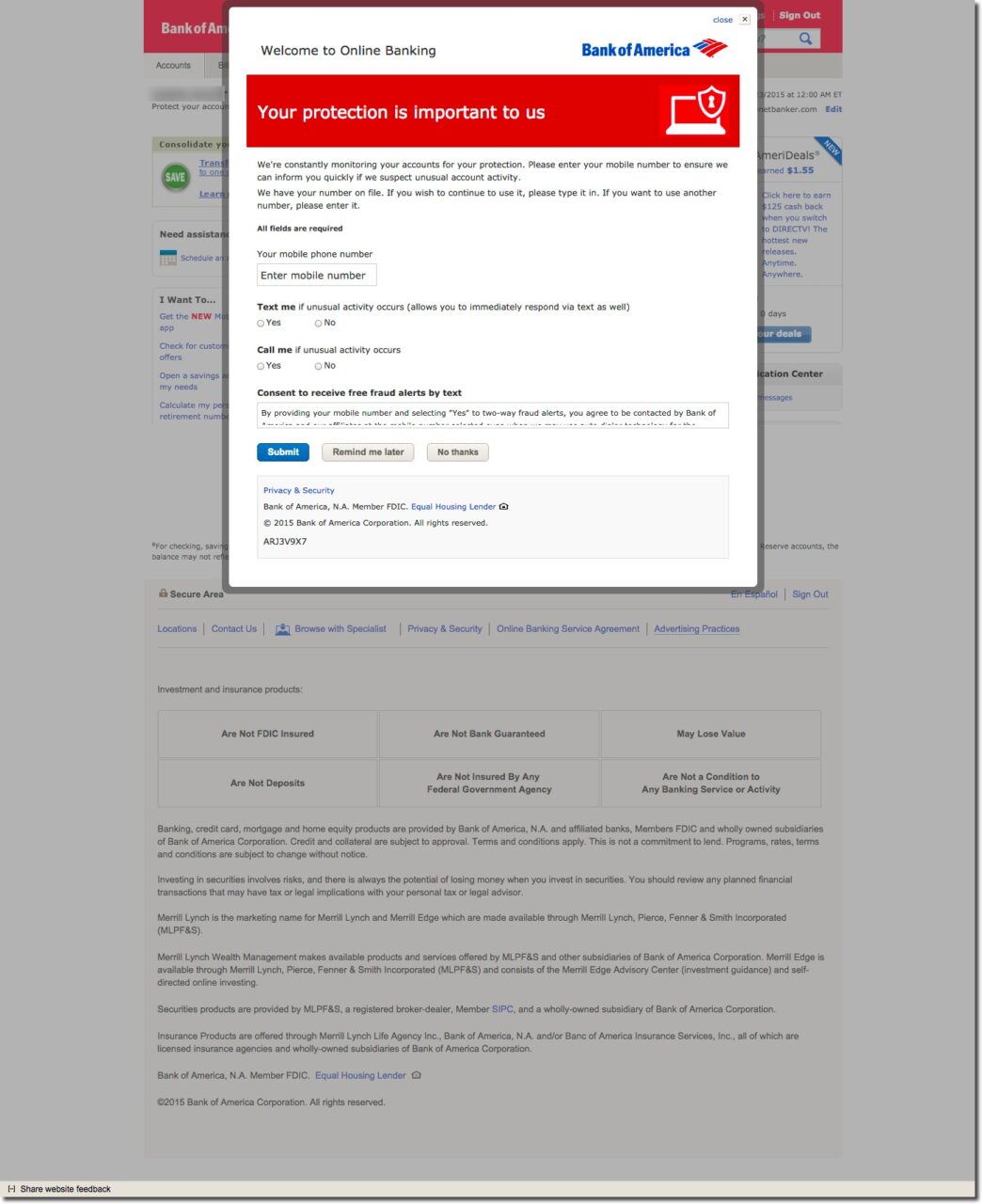

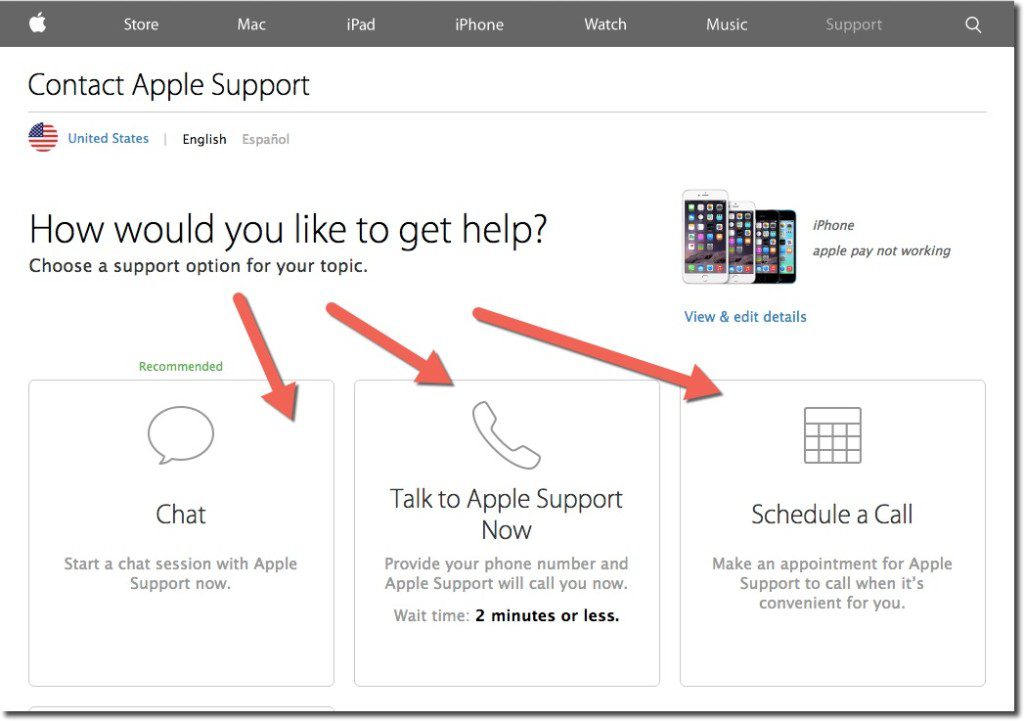

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

During my Google search, I stumbled into the correct area to get to Apple Care support (see A above). While I had to go through a few screens in the self-service area, it took only about 30 seconds to get to the one that offered a choice of online chat, call center (with 2-minute estimated wait time), or alternatively, I could schedule a call (see inset).

Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).

Following one of the biggest weeks ever ($580 million), new fundings to the fintech sector cooled to under $100 million this week. More than half (55%) of the funds went to companies outside the United States including India’s mPOS provider Ezetap ($23.5 million) and Germany’s deposit brokerage SavingsGlobal ($21.8 million).