Update 5/24/2016: SigFig has raised $40 million in the round we first reported last week (see story below). The funding included a $7 million credit facility from Comerica Bank. Also participating alongside UBS were:

- Bain Capital Ventures

- DCM Ventures

- Eaton Vance Corp.

- InnoVentures Fund (Banco Santander SA)

- New York Life Insurance Co.

- Nyca Partners

- Union Square Ventures

The round takes SigFig’s total capital to more than $70 million. “Today’s announcement signals a major vote of confidence by some of the world’s most respected financial institutions in the quality of SigFig’s enterprise wealth management solutions,” SigFig CEO Mike Sha said.

——-

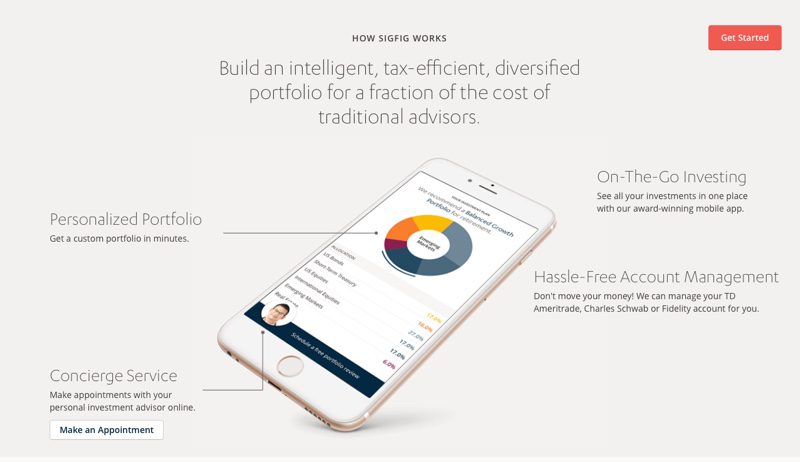

The new strategic partnership between UBS Wealth Management Americas (WMA) and SigFig announced this week is “strategic” in more ways than one. The deal features both an equity investment in the automated investment platform and new software solutions for UBS wealth mangers. While the amount of the investment was undisclosed, SigFig has raised more than $16 million in funding to date, with its last round a $1 million Series B in April 2015.

Tom Naratil, president of UBS Americas, said investment in technology like SigFig’s is “vital” for the wealth management business to better align “service, advice, and access … with how clients live their lives today.” The investment comes as UBS continues its shift in focus toward wealth management, and includes the building of a joint Advisor Technology Research and Innovation Lab to facilitate collaboration between UBS financial professionals and SigFig’s technologists.

SigFig CEO Mike Sha emphasized the importance of technology in helping wealth managers customize investing solutions for their clients. He added that partnerships with major FIs like UBS will be key in growing the reach of the platform. “We are excited to work with UBS WMA,” Sha said.

According to Reuters, UBS Wealth Management Americas began looking for partnerships with fintech firms under the leadership of the former president, now Chairman Bob McCann. Picking up the trail, Naratil and his team met in 2015 with a variety of robo-advisers in Silicon Valley in 2015, but eventually opted to invest rather than acquire. According to Naratil, the decision was based at least in part to avoid stifling innovation: “Our fear was that we would turn a technology firm like SigFig into us,” Naratil said.

The UBS announcement comes just a few days after news that Pershing Advisor Solutions had selected SigFig as one of three new roboadvisers available via its platform (fellow Finovate alum Jemstep was among them). Founded in 2007 (as Wikinvest) and headquartered in San Francisco, SigFig demoed its technology at FinovateFall 2011. For an annual fee of 0.25% and with the first $10,000 invested managed for free, the company’s wealth management platform helps 800,000 users manage $350 billion in investments. SigFig provides free portfolio monitoring and analysis, access to investment advisers, automatic dividend reinvestment and portfolio rebalancing. The account minimum is $2,000.

From expressing in real-time the “wow effect” of live fintech demos to the way a 140-character limit sharpens the wit of some of our industry’s most clever and insightful, our showtime Twitter feed #Finovate was certainly one of the stars of

From expressing in real-time the “wow effect” of live fintech demos to the way a 140-character limit sharpens the wit of some of our industry’s most clever and insightful, our showtime Twitter feed #Finovate was certainly one of the stars of

Currency Cloud CEO Mike Laven praised Tee’s “deep understanding of the payments industry” which he credited to the diveristy of her executive background. Prior to Intelligent Environments, Tee worked as CFO at Omnico Group, and has held executive positions at MasterCard, Anite, and Mondex International. She is a graduate of the Imperial College London and has an ACA certification from the Institute of Chartered Accountants England and Wales.

Currency Cloud CEO Mike Laven praised Tee’s “deep understanding of the payments industry” which he credited to the diveristy of her executive background. Prior to Intelligent Environments, Tee worked as CFO at Omnico Group, and has held executive positions at MasterCard, Anite, and Mondex International. She is a graduate of the Imperial College London and has an ACA certification from the Institute of Chartered Accountants England and Wales.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.