Digital customer acquisition specialist and multiple Best of Show winner Avoka has picked up $12 million in new investment. The venture round featured participation from a variety of institutions and professional fintech investors in Australia and is the first major funding for the company since 2013. Avoka CEO Phil Copeland said the new investment will be used to “accelerate our already strong organic growth prospects, expand our product capabilities … and explore new markets.”

With regard to products, Copeland highlighted Avoka Transact, saying that the investment will help the company continue to build and develop the technology, which he called “the leading single platform for driving customer-centric digital transformation.” He added that part of further developing his company’s solutions will be to integrate fraud, identity management, fund transfer, and core banking functionality into the platform.

Avoka’s Kevin Mortimer, technical director, and Derek Corcoran, chief experience officer, demonstrated Avoka Transaction Effort Score at FinovateEurope 2016 in London.

Underscoring the importance of growth and expansion to the company’s past and future, Copeland noted that not only did 65% of Avoka’s revenue come from North American and European markets, but also that the percentage “is expected to grow substantially” in the wake of this latest funding round. Advising on the deal was Moelis & Company whose managing director, Ben Wong, called the company “a great example of an Australian technology company with a global footprint based on best-of-breed technology being adopted by global corporate customers.”

Recent headlines for Avoka include a new partnership with fellow Finovate alum Mitek to build a new mobile onboarding solution in May. In April, Beyond Bank won the Celent model bank award with a customer-engagement platform from Avoka, the same month Avoka partnered with Finovate alum eSignLive to enable 100% digital customer acquisition. Avoka was named to the Top Ten FinTech Worldwide by KPMG in March.

Founded in 2002 in Sydney, Australia, and co-headquartered in Denver, Colorado, Avoka demonstrated its Transaction Effort Score (TES) at FinovateEurope 2016. The company has more than 95 working in offices in Sydney, Denver, and London and includes 2 global banks; 5 of the top-50 banks in the U.S.; and 4 of the top-10 banks in Australia among its more than 80 customers.

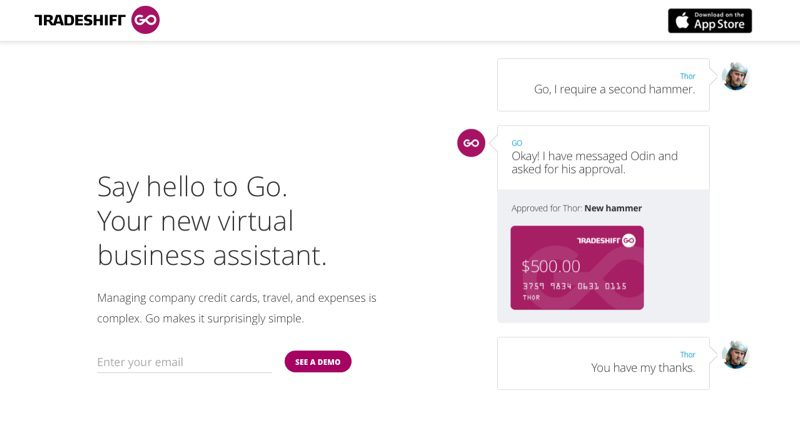

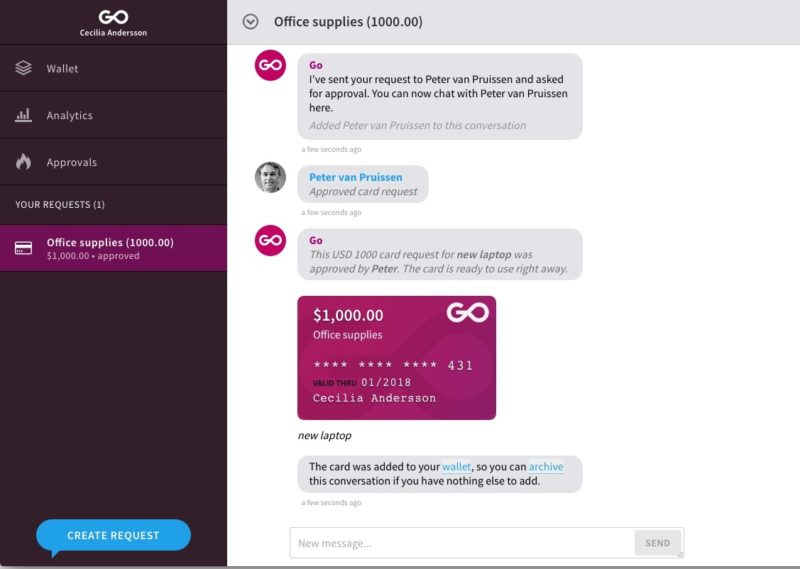

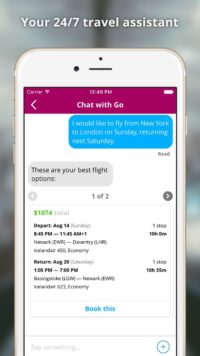

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.

workers the ability to make business purchases via a pre-approved, single-use virtual credit card that is billed to a corporate card. The employee never sees the corporate card number, and the employer has 100% visibility in real-time on how much and what is being purchased. Compare this, Eng suggested, to the typical situation of the financial officer who doesn’t learn what company funds were actually spent until after they are spent.